The Apple (AAPL) stock price crashed hard in the extended session on Thursday after the company published weak results. The stock declined to a low of $144.5, which was substantially lower than Thursday’s high of $153.

Apple earnings review

Apple is the biggest company in the world with a market capitalization of more than $2.5 trillion. In a statement on Thursday, Apple revealed that its business was going through significant challenges as the chip shortage continued to worsen.

For the first time since 2017, Apple managed to miss the lofty expectations by Wall Street analysts. The company said that its total revenue rose to a record high of $83.4 billion. This was $19 billion from what the company made in the same quarter in 2020.

This performance was mostly because of the company’s product and services growth. Product revenue rose to more than $65.1 billion whole its services revenue rose to $18.3 billion. Services like Apple Music, Apple TV+, and iCloud have become a pivotal part of Apple’s ecosystem in the past few years. In total, the company’s net income was more than $20.6 billion.

However, the company’s revenue and guidance was significantly lower than what analysts were expecting. For one, the supply shortages impacted the company’s results by about $6 billion. This trend will likely continue in the coming few months because the supply challenges are continuing.

The company expects that its operation expenditure will be between $12.4 billion and $12.6 billion. It also expects that its revenue growth will be a bit slower than expected.

Buy the dip?

The Apple stock price crashed sharply on Thursday after hours after it released its quarterly results. This price action was expected because of the big miss and weak guidance. However, this does not mean that the company’s stock price is starting a new bearish trend.

Indeed, there is a likelihood that investors will move to buy the dip on the stock for several reasons. First, the company’s service business is doing relatively well. Its revenue has moved from less than $5 billion a few years ago to more than $18.3 billion in a single quarter.

This happened even as the segment continues facing challenges in the United States. For example, Apple has been compelled by court to change its policies on its app store charges. Still, there is more room for the business to grow.

Second, demand for Apple’s products continues to rise as the company boosts its lineup with its self-made chips. These products have superior performance than those with Intel’s chips. Therefore, I expect that the demand for iPads, Macbooks, and iMacs with the new chips will keep rising.

Third, Apple is an exciting free cash flow machine that has excellent margins. For example, the company managed to return about $24 billion to shareholders in the third quarter. These returns were mostly in the form of share repurchases. This trend will continue since Apple has strong cash in its balance sheet. It has about $66 billion in its balance sheet. Therefore, the Apple stock price will likely rebound in the coming months.

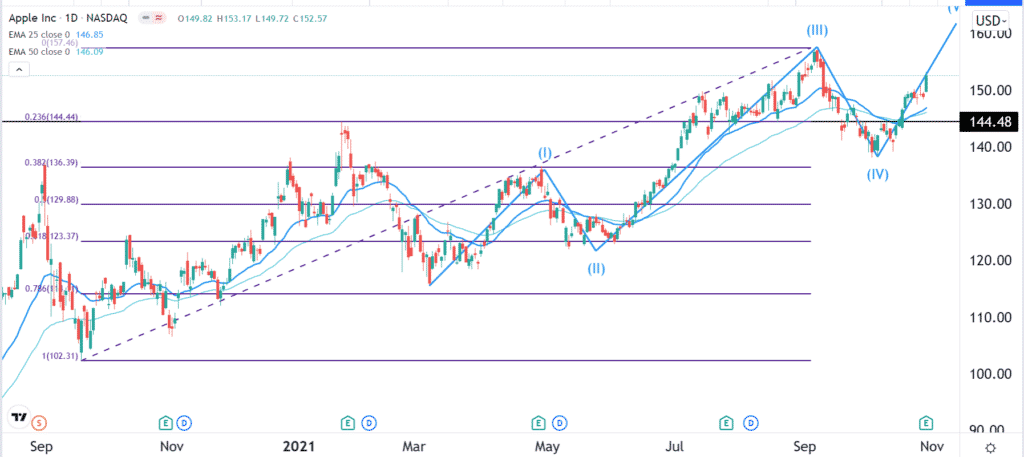

Apple stock price forecast

The daily chart shows that the Apple stock price rose by more than 2.5% in the regular session. The stock then erased most of these gains and declined to the important support level at $144.48. This was an important level since it was the highest point in January this year. It was also along the 23.6% Fibonacci retracement level. The price is also along the fourth wave of the Elliot Wave pattern. Therefore, I am optimistic that the stock will soon rebound and rise to its YTD high of $146.