Free Automated Trading Journal – Streamlining Your Trading Activities

You’re likely already found a lot of useful stuff here on fxaudit.com. Whether you’re a newbie or a seasoned professional, you’ll benefit from numerous education materials, thoughtful market analysis ideas, and up-to-date news. The resource will ease your burden in choosing the right broker, EA, signal provider, or even a crypto exchange!

Besides providing quality financial content, we strive to give you the practical tools to grow as a trader. As such, we’re excited to offer our free online trading journal that will show you what’s happening under the hood of your trading, saving you time and money.

To get access to the service, create an account by clicking register free account and completing the registration form.

After you’re done, sign in to your account and go to “tools,” where you’ll find how to setup trading journal for your MT4/5.

Below are the features you’ll find in the fxaudit trading journal.

- Data visualization charts

- Advanced statistics of your account

- Works for forex, crypto, stocks, and futures

- Unlimited number of connected accounts

- Automated update: install once and never deal with statement uploads

- The trading journal is 100% free

Finally, you can see the performances of other trading systems and reveal yours, if you wish.

Why use a trading journal

For many industries, whether it’s sport or business, record keeping is vital. Trading is not an exception. Professional traders keep a trading journal for several fundamental reasons below.

- Find your strengths and weaknesses

The trading journey is a lot about self-discovery. The trading journal will help you to discover your behavioral patterns and notice what works and what doesn’t. You’ll struggle to stand against competition if you can’t leverage your strengths and mitigate your weaknesses; that’s where the journal comes in handy.

- Take a full responsibility

It’s not a big deal to place a trade nowadays. Newbies often perceive trading deceptively simple, to the point of opening FOMO positions, getting random results, and never figuring out what this business is all about.

To build a character suitable for a long-term trading career, you must learn to stay accountable for your decisions. The very fact of the obligation to keep records will help you to stay disciplined.

- Hone your strategy

You can’t improve something you don’t measure. Creating a successful trading system with its ins and outs requires vast data, extensive observations, and objective conclusions. It’s not possible to cope with such a complex task without a trading journal.

- Gain consistency

Consistent profits should be your ultimate goal as a trader. After you’ve built a suitable character, discovered your competitive advantage, and perfected the strategy, trading wins are just a matter of time. Notice, each part of the way to consistency includes a trading journal.

Is it important to journal your every trade?

Every trade has a story to tell. The more “stories” you know, the faster you’ll grow and improve your trading performance. Some trades might feel unnecessary to journal, tempting you to make an exception.

However, to get to the point when you’re able to stick to your trading plan and control the risk even in the most enticing circumstances (and there will be plenty!), you must take every single trading decision seriously, assuming full responsibility for it. Sometimes a journal may reveal something about your hidden motives; once you start digging into the reasons for taking those trades, you are tempted to shrug off.

What is a forex trading journal?

Traders use journals to document details about positions, market observations, mental state, or any other thoughts helpful for professional growth.

There are two kinds of forex trading journals: manual and automated.

The manual journal can be physical, such as a simple notebook, or digital – keeping records in Excel file, or a note-taking app, like Evernote or OneNote.

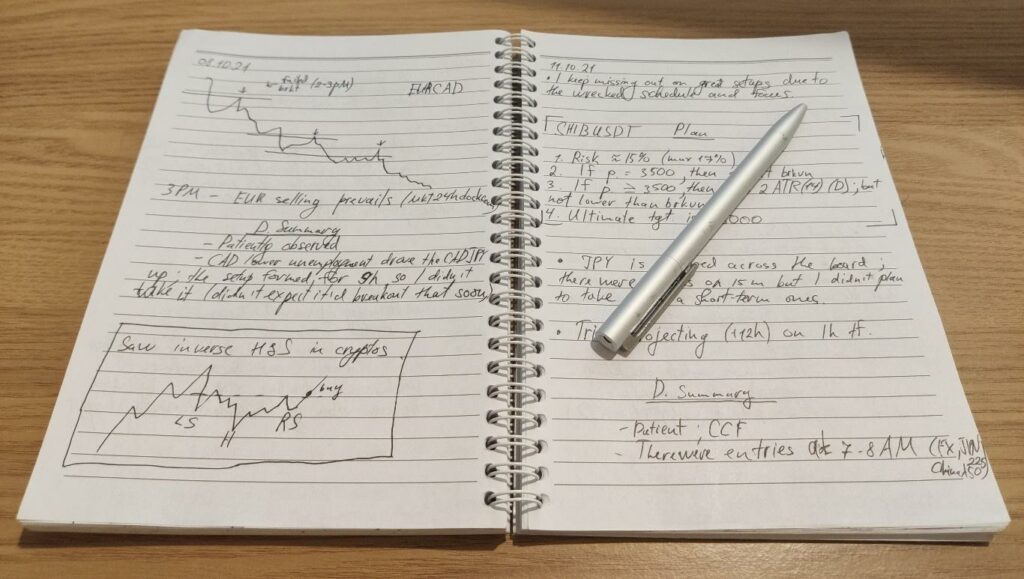

Below is an example of a manual physical journal.

Often kinesthetic people love journaling in the physical notebook, though the rest may also benefit from the absence of distractions and ways to lay out thoughts in a creative way.

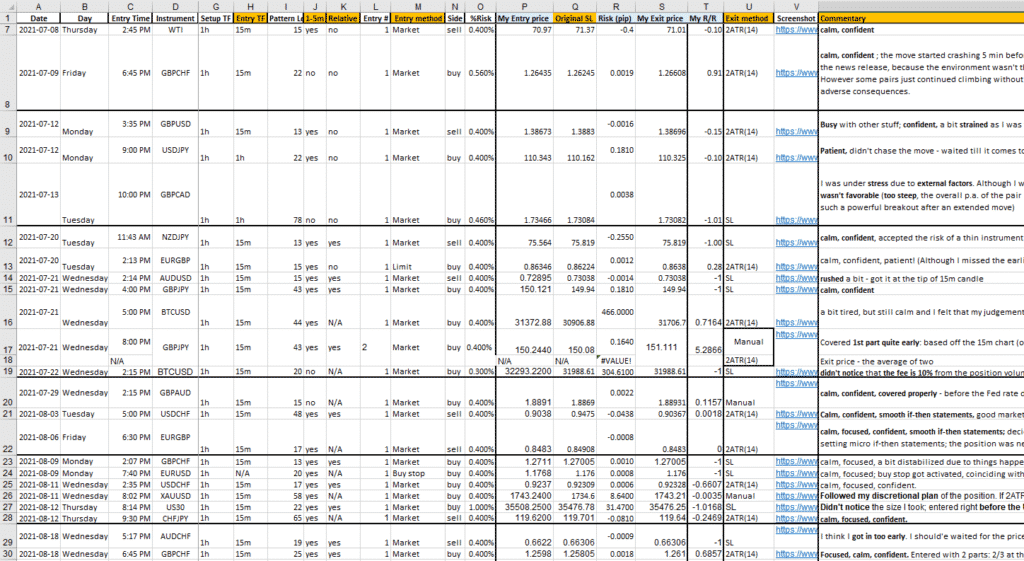

And here is the digital forex trading journal made in an Excel document.

When it comes to dealing with the set of data for the system calibration, digital format is the most helpful.

What should be in your Forex journal?

Typically, a journal includes technical details about trades, such as an entry price and written descriptions, say, the reason for the entry.

You can find all technical data of your trades in a broker’s financial statement, which you should automatically upload into your digital journal. Otherwise, you’ll waste precious time doing mechanical work – typing numbers in the spreadsheet.

Any other trading-related descriptions you should make manually. Below let’s look at some major data points that you should have in your day trading journal.

Instrument: what do you trade?

The kind of asset that you traded should be recorded in the online trading journal. Keeping the record of instruments will help to find out how profitable different forex pairs/indices/cryptos are in your trading.

Date and time of transaction

The records of the time of entries end exits must be recorded, and a free trading journal is a way to go. Later, such data will reveal what’s the best time to trade, so you’ll use your attention wisely.

Position: what is the size of your trade?

The position size is crucial to track as your profitability depends on it. You can use a trading journal in excel to analyze the data. Sometimes you would find yourself irrationally behaving once you hold the position with the abnormal size.

Entry / Exit points

Your entry and exit prices define your typical profits and losses in terms of pips/points. Traders use the forex trading journal template to keep this information for calculating metrics such as risk-to-reward ratio.

Trade result

The financial result of your trading shows your “score” in trading. If you trade digital currencies, a crypto trading journal will track the results to assess your profitability. Notice, trade results are only useful when there is a sufficient sample size of them.

How to keep your forex trading journal?

If you’re still wondering, “what is a trade journal?” below are some practical guidelines of how to use it.

Every trading day, you should keep the journal (whether it’s physical or digital) within your reach, lest you simply forget to use it.

Once you place a trade, open the journal and input the most time-sensitive data, for example, your reasons for opening a position and your current mental state. Other information, such as entry time, you can record later as it’s always accessible in the financial statement.

Frankly, it may become quite exhausting, distracting, and even demotivating to input data manually. FX Audit trading journal frees you from the daunting task – your technical data will be uploaded automatically.

Top metrics that should be included in your trading journal

Many crucial trading metrics require being fluent in Excel if you want to calculate them automatically (you better do that).

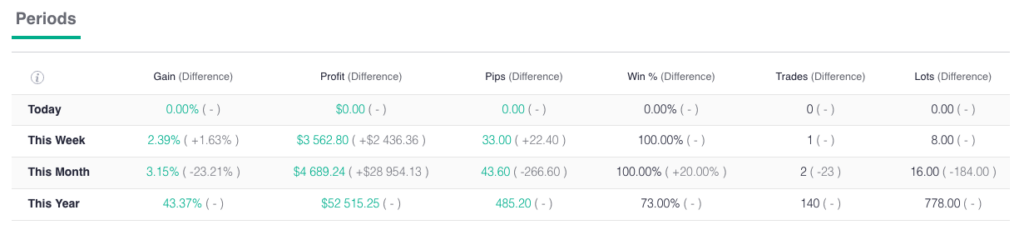

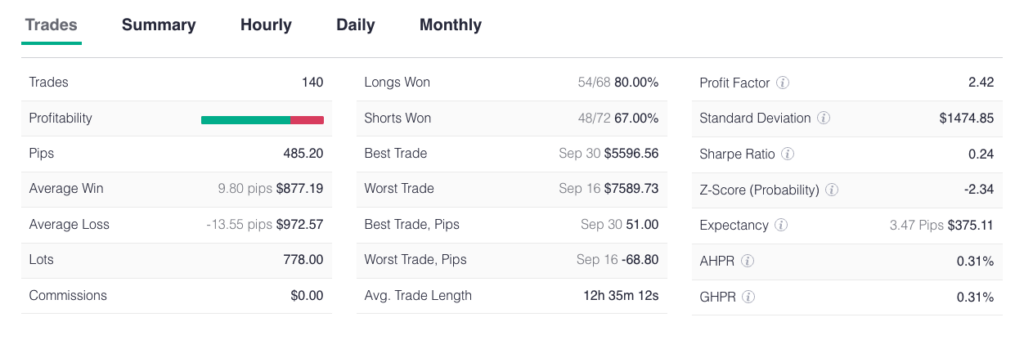

The concepts like drawdown, average/best win, average/biggest loss, trade length, performance by hours/days are bear minimum if you really want to have a rough view of your trading. Calculating all of the metrics becomes frightening when you deal with hundreds of trades.

FX Audit automated trading journal saves you even from bothering opening Excel, as the tool automatically calculates all the top metrics.

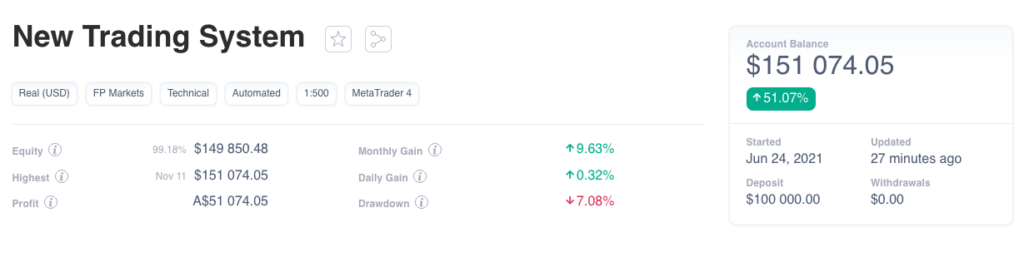

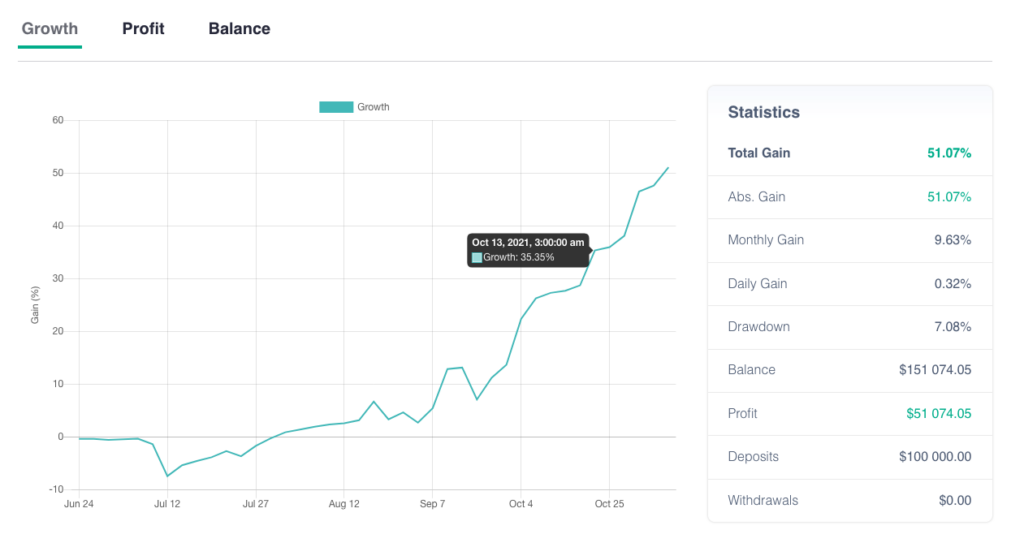

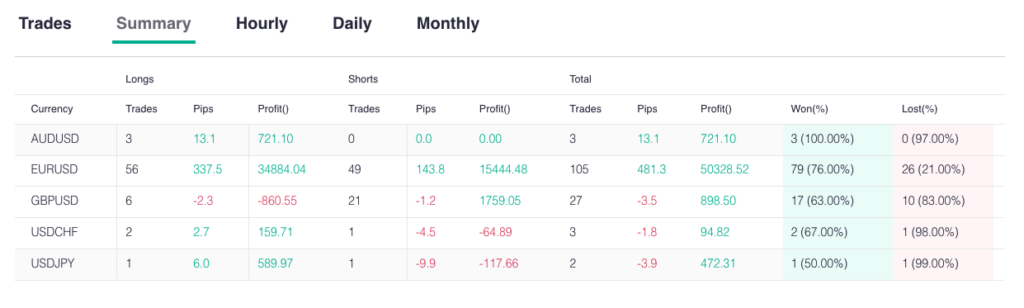

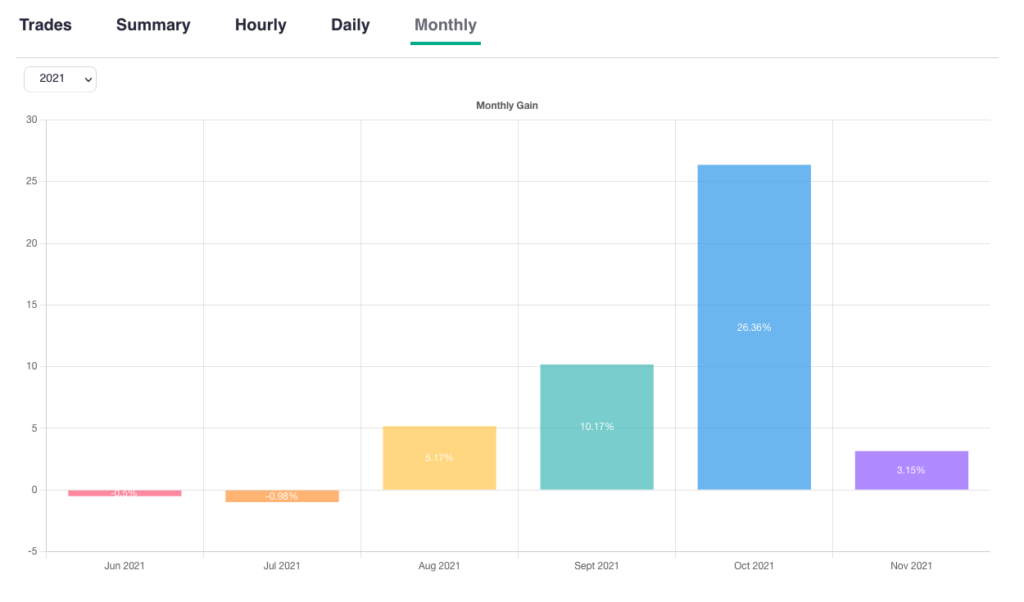

The illustration above shows some of the key metrics fxaudit trading journal calculates for you.

Use your journal to analyze and boost trading performance

We use the trading data to draw conclusions that lead to the profitability of your trading. For example, analyzing the metrics such as best/worst trades, shorts or longs, time, and asset traded give clues of what needs to be changed in the trading system.

The metrics give you strong reasons to have enough discipline to cut losses in time and hold your positions to the targets as the past data will support your conviction.

When you look through the forex trading journal spreadsheet, entry signals that end up in most profit remind you to take only valid setups and follow your rules.