Introduction

Crypto hedge funds are funds that specialize or have additional expertise in crypto investments. Cryptocurrencies are volatile assets by nature. Due to the unknown future demand for them, their values fluctuate significantly more than your typical currencies.

What makes these funds stand out is their performance. Most recent numbers show that while typical hedge funds returned +11.6% in 2020 (as measured by the HFRI Fund Weighted Composite Index), cryptocurrency funds racked up a whopping +192.91% in 2020 (as measured by the HFR Cryptocurrency Index).

Investors find funds with an AuM (Assets Under Management) of more than US$20M attractive. In this article, we shall focus on five such funds that specialize in blockchain and crypto.

Grayscale Investments

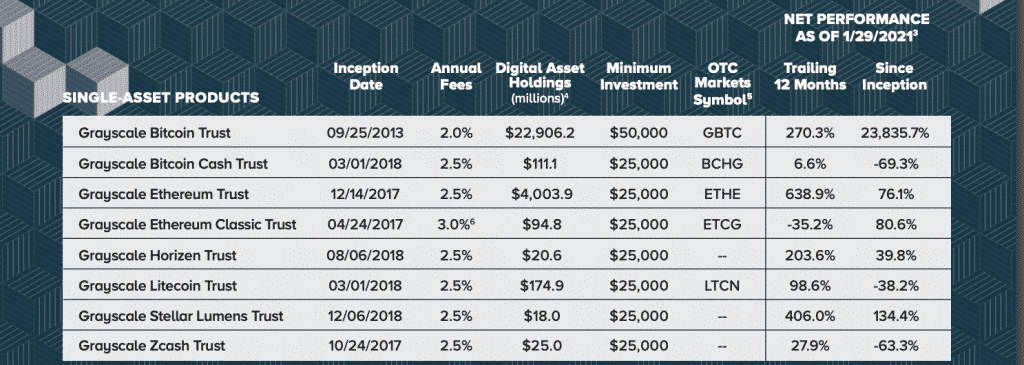

As of February 2021, Grayscale, a crypto hedge fund established by the Digital Currency Group in 2013, reported $37.8B AuM. Grayscale invests heavily in Bitcoin and several large-cap cryptocurrencies. Any news of Grayscale buying a crypto asset inevitably results in a spike in price.

They offer 14 investment products, and the minimum investment for most of them is $25,000, and annual fees are 2.5%. Their Bitcoin Trust, Ethereum Trust, Bitcoin Cash Trust, Ethereum Classic Trust, Litecoin Trust, and Digital Large Cap Fund are publicly traded on OTC markets.

Grayscale’s Bitcoin and Ethereum trusts are regulated by the SEC, which means they file their financial statement, quarterly and annual reports with the SEC. Based on the figures, Grayscale leads the pack at the moment.

Invictus Capital

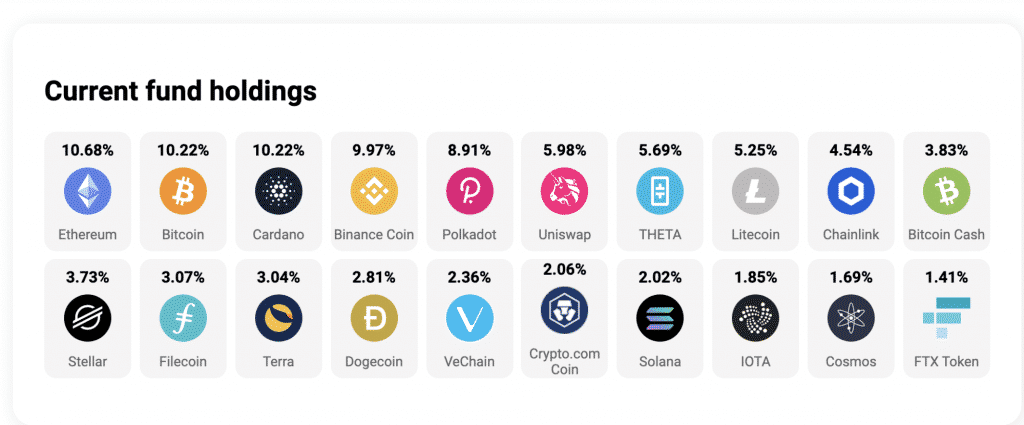

Invictus Capital’s C10 hedged fund uses a unique cash hedged strategy that protects against drawdown risk. The algorithm buys and sells the top 10 best-performing coins every week.

Launched in 2017, the C20 fund is the world’s first tokenized cryptocurrency index fund that tracks and invests in the top 20 best-performing currencies, similar to the S&P 500 tracking the top 500 US companies.

Your investment yields a single C20 token that you can buy and sell as you wish.

The Invictus Bitcoin Alpha tokenized fund focuses only on long-term returns on BTC. With tokenized funds, there is no minimum investment restriction – a major drawback with the other crypto hedge funds.

In January 2021, the C20 fund performed better than Bitcoin, with a 51.2% growth. I consider this a good fund based on its performance and the possibility of investing small.

Polychain Capital

Polychain Capital specializes in protocols and other blockchain-based asset investments. This was the first crypto hedge fund to exceed $1B in AuM in 2018. Coindesk reported that those who invested with Polychain at the beginning enjoyed a 1,332.3 percent return in four years. An investment of $25,000 would have paid you $333,000.

Polychain’s second venture fund opened in December 2020, intending to raise $200M. Eligibility for the second fund is a minimum of $1 million locked in for up to three years.

Founded in 2016 by Olaf Carlson-Wee, the first employee at Coinbase exchange, Polychain has more than 300 high-profile investors. Polychain Capital does not serve short-term investors and requires a minimum lock-in period of six months.

BlockTower Capital

Trading, investing, portfolio, and risk management services are offered exclusively for cryptocurrencies. It offers five funds with lock-up periods of one year for individual investors and three years for institutional investors.

While the firm initially focused on liquid assets, it has recently raised $25M for DeFi projects. In March 2021, it acquired a $20M stake in Fantom, indicating a willingness to invest in more illiquid longer-term assets.

BlockTower was founded in 2017 by Matthew Goetz, a Goldman Sachs executive, and Ari Paul, a trader and portfolio manager. One of the best things about BlockTower Capital is the highly experienced team, many of whom are ex-Goldman Sachs employees.

Galaxy Digital

With over 1.2B in AuM, Galaxy Digital offers many services, but the main focus is on blockchain and cryptocurrency investments. It has three cryptocurrency funds for short and long-term profits: Galaxy Bitcoin Funds, Galaxy Ethereum Funds, and Galaxy Crypto Index Fund.

The minimum investment for the Bitcoin and Ethereum funds is $500k and $250k, respectively. The Crypto Index Fund is a portfolio of investment products, trading the most liquid crypto assets based on the Bloomberg Crypto Index, and the minimum investment is 25k.

Founded by Mike Novogratz, the popular Wall Street legend, Galaxy Digital is based in New York and publicly traded on TSX Venture Exchange, Toronto.

BitSpread

BitSpread describes itself as the ‘gateway to investment in alternative assets,’ specifically related to financial and blockchain technology. At its core, the company is a hedge fund with cryptocurrencies as one of the main instruments it trades.

This includes popular coins like Bitcoin, Ethereum, Ripple, and Litecoin. The firm was established in 2014 by Cedric Jeanson, who was recently named among the top 25 thought leaders within the Asian blockchain industry by Blockchain Asset Review.

BitSpread has headquarters in London, with additional offices in New York City and Singapore. The company’s targeted clientele includes asset managers, family offices, and high net-worth individuals who connect with their proprietary, quant-based trading software, BlockBerry.

The minimum deposit for investing here is $100 000. A 1% applies for subscription and redemption. Clients can also use BlockBerry’s utility token to get up to 75% off in trading fees.

To foster transparency, KPMG audits BitSpread’s financial performance. Although not much information exists in this regard, our research suggests BitSpread does around 33% in annualized returns, with well over $100 million in assets under management.

Pantera Capital

Pantera ventured into the world of investment funds as far back as 2003. The firm was established by Dan Morehead, a former Tiger Management employee. He forms part of a highly experienced team who’ve worked at top financial firms.

The institution describes itself as the ‘first US institutional asset manager focused exclusively on blockchain.’

Pantera went into cryptocurrency investments from 2013 with the launch of the Pantera Bitcoin Fund when BTC was only worth around $65. The firm claims this very fund is up 80,200% since inception and has more than $5.6 billion in assets under management.

In the same year, it also launched the Pantera Venture Fund I, the first blockchain-only venture fund. In its mission of offering investors ‘the full spectrum of exposure to the space,’ Pantera has numerous portfolios.

One of these is the Early-Stage Token Fund, which invests in token projects prior to their launch.

In this regard, well-known blockchain-based services like 0x, 1inch, Aave, NEAR Protocol, Polkadot, Ripple Cosmos, and Balancer have been funded by Pantera. The hedge fund has also provided venture capital (VC) to popular crypto exchanges such as FTX, Coinbase, and Bitstamp.

Overall, Pantera has made 90 venture and 95 early-stage token investments since operating and shows no signs of slowing down.

Altana Digital Currency Fund

While Pantera Capital is the US’ first asset manager to invest in cryptocurrencies, Altana is Europe’s first, specifically the Altana Digital Currency Fund (ADCF). This is a multi-asset, open-ended, award-winning crypto hedge fund founded by Lee Robinson in May 2014.

It forms part of the massive fund portfolio managed by Altana, which is based in London. Much of the ADCF’s value comes from Bitcoin (the fund’s benchmark), having invested in the coin when its price was below $100.

Along with other digital currencies, the ADCF has returned over 1400% over the last five years. The company is all about ‘finding alpha where others don’t look.’

Although much of the ADCF consists of Bitcoin, Altana are proponents of having a well-balanced investment portfolio and will trade in and out of cryptocurrencies where necessary to reduce volatility and enhance returns.

The corporation credits its outperforming alpha in the strategies it uses, combining automated arbitrage, momentum trading, short-term collateralized Bitcoin loans, and even scalping.

An article published in March 2021 by Hedgeweek (which awarded the fund as ‘Best Niche Hedge Fund’ in 2018 and 2019) suggests at least $700 million worth of assets are in the control of Altana.

Multicoin Capital

Established in 2017, Multicoin Capital describes itself as a thesis-driven hedge, and venture fund focused primarily on existing cryptocurrencies, early-stage token launches, and blockchain providers.

The company invests in both the private and public markets and, like most hedge funds, targets large financial institutions, family offices, and high net-worth clientele.

As recently as December 2017, Yahoo! News (based on the research of two other resources) reported the hedge fund had returned over 20 000% since starting in October 2017

Multicoin Capital has offices in Austin, New York City (American cities), and Beijing. The firm’s thesis is that crypto is creating the ‘one-time wealth shift’ in the internet’s history.

Multicoin Capital’s portfolio of early-stage deals, which range from $500 000 to over $100 000 per investment, include funding Audius, DFINITY, The Graph, NEAR Protocol, and Solana.

Solana is a large part of the incredible performance of Multicoin’s venture fund as the company invested in this project in July 2019 at a dirt-cheap price, well before it launched in March 2020.

Much of the corporation’s activities are less about speculating in cryptocurrencies but rather backing the companies behind them. Multicoin is one of the many large VC firms pouring even more cash into crypto and blockchain projects than ever before.

Alphabit Fund

Alphabit Fund is a cryptocurrency hedge and investment fund launched in 2017 by Liam Robertson. It is domiciled in the Cayman Islands and registered with the Cayman Islands Monetary Authority.

Alphabit primarily focuses on promising early-stage investments and quant-based/discretionary strategies for trading highly-liquid cryptocurrency pairs, mostly futures contracts.

For the former, it prides itself on looking for the best possible deals in token and equity ownership using stringent criteria, ensuring only the best opportunities are passed onto investors.

Regarding trading, the fund has produced 3100% in return since inception, with 261% in an annual return for the first quarter of 2021.

The minimum investment amount for Alphabit is $130 000 (only fundable with USD or BTC), with a management fee of 2.5% per annum of NAV (net asset value) and a performance fee of 45% per annum of BTC outperformance.

Alphabit’s most prominent partner is Dalma Capital, an award-winning global alternative platform regulated by the Dubai Financial Services Authority.

How do crypto hedge funds work?

Cryptocurrency hedge funds operate by hedging their bets and longing or shorting crypto assets. Once you invest, the decision on how or where the money is invested remains with the fund manager.

Investors make profits with successful investments, and fund managers make money through fees. Crypto funds invest in any or all of the following:

- Passive index funds

- Active trading funds

- Initial coin offerings (ICOs)

- Pre-ICOs

- Staking

- Mining

- Lending and others

Strategic peculiarities

With the increasing investor interest, funds are improving their management techniques and strategies. According to PWC, fund managers today use a broad range of fundamental and quantitative strategies.

- Fundamental: Long-only funds with a longer investment and lock-up periods. They invest in projects in the early stages, including pre-ICOs. They buy and hold more liquid cryptocurrencies.

- Discretionary: They are based on the discretion of the fund manager and employ a variety of strategies, such as going long/short, news-based, technical analysis, mining, and may also invest in pre-ICO’s and ICO’s. You can expect the lock-up period to be similar to fundamental strategies.

- Quantitative: The most popular is the quantitative approach, where funds use directional or market-neutral investments. Strategies include arbitrage, market-making, and low-latency trading. Only the most liquid cryptocurrencies are traded. High liquidity ensures a short lock-up period of around 6 months.

Crypto funds may use some or all of the above trading strategies either manually or using advanced algorithmic trading tools to achieve their goals.

Fund management

Initially, investor assets remained in the custody of the funds, but PWC reports that 80% of funds now use third-party or exchange custodians. Many jurisdictions have made custodians mandatory and forbid funds from holding investor assets.

With regulation slowly creeping in, fund managers have additional expenses such as paying third-party custodians. The average management fee is 2%, and the performance fee is 20%. Management fees are charged to cover the running costs of the funds.

Many funds shut down because of the increasing costs. Only funds with a large number of investors or those adding additional revenue streams are able to survive.

Taxes and regulations

While other funds are easily classified either as securities or futures, crypto hedge funds are not categorized as a single asset class. There is still a lot of confusion leading to regulatory and tax problems.

If the fund invests in Bitcoin, Ether, or other popular cryptocurrencies, the SEC (U.S. Securities and Exchange Commission) considers them non-securities. What about the other cryptocurrencies? The answer lies with the SEC and the jurisdiction. State laws also vary widely.

Offshore jurisdictions like the British Virgin Islands and the Cayman Islands are very popular with crypto hedge funds, as they can legally obtain relief from direct taxation for a minimum of 20 years.

The following questions need to be answered for tax purposes:

- Are the fund’s investments treated as securities, commodities, or something else?

- What is the source of income? Is it trading, staking, lending, mining, airdrops, or token rewards?

- Where is the fund established?

- What are the jurisdictional tax rules?

The crypto platform Gemini proposed a self-regulatory organization (SRO) called the Virtual Commodity Association to regulate the crypto spot markets. It would be interesting to see if anything comes of this.

Conclusion

While it is easy to worry about the regulatory and tax issues, why not enjoy the competitive advantage? Future regulations may treat crypto funds as other hedge funds or may come with stricter regulation. For now, the lack of or limited regulation gives funds the ability to multiply profits for their investors.

Find a reputed crypto fund that has been posting good results for the past four or five years. Perform due diligence on the fund’s focus, fees, strategies employed, tax, regulation, and associated risks. Knowledge is power, more so with investments as volatile as crypto hedge funds.