The Palantir Technologies (NYSE: PLTR) stock price popped by more than 11% on Thursday after publishing relatively strong quarterly results. The stock then retreated by more than 1.5% in extended hours. This trend brings the company’s total market capitalization to more than $41 billion.

Palantir technologies earnings

Palantir is a technology company that provides government agencies and corporations with data analytics services.

In a statement on Thursday, the firm said that it added 20 new customers in the second quarter alone. This was a remarkable number considering that the firm makes more than $7.9 million in revenue per customer. Its top 20 customers brought in an average of $39 million.

Palantir’s revenue jumped by 49% in the second quarter to $379 million, while its closely watched commercial business rose by 90%. Its adjusted cash flow rose to $201 million, while the adjusted operating income rose to more than $233 million.

All these numbers were better than what analysts were expecting. Most importantly, it raised its full-year guidance, saying that it expects its sales to grow to about $385 million in the third quarter.

The company continued its partnership with the US military. In the US, the firm signed new deals with the US Army, Air Force, and Coast Guard. It also announced that it doubled investments in the Tiberius platform. This is an important platform that the government uses to track vaccine production and distribution.

Is the Palantir stock a buy?

So, is the Palantir stock a buy or sell? Fundamentally, Palantir is a company that has demonstrated its ability to grow in the government and commercial sectors. It also has a growing market share in its business and limited competition in the services it offers.

Most importantly, Palantir offers services that are difficult to disrupt. While other companies like Microsoft offer some of these solutions, they don’t have the exposure that Palantir has.

Also, the firm has long contracts with some of the biggest firms in the world, like Boeing and Airbus. As more companies learn about their services, the firm will likely attract more customers. Therefore, while the Palantir stock is overvalued, the firm’s growth will probably keep supporting it.

The case that the firm is overvalued is relatively easy to prove. For one, this is a company that has been around for almost 20 years, yet its annual revenue is about $1 billion. It is also a loss-making company that loses more than $1 billion a year. Yet, it is valued at more than $40 billion.

Still, analysts are a bit mild about the company. For example, those at Jefferies expect that the share price will rise to about $30. This is just a modest increase from where the shares are. Meanwhile, those at Wolfe Research, Credit Suisse, and Royal Bank of Canada recently lowered their target to about $20.

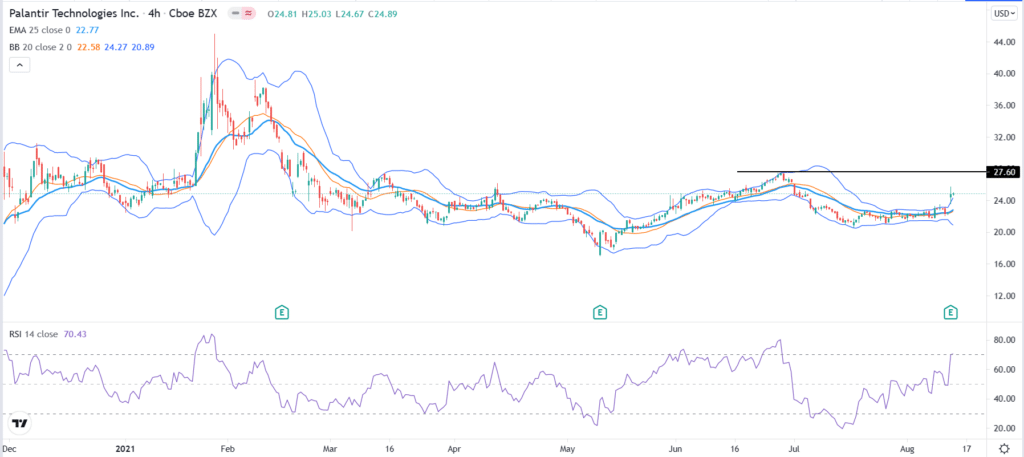

Palantir stock price analysis

The 4H chart shows that the Palantir stock price has bounced back in the past few days. It rose to a high of $25.66, which was the highest level since July 2. Still, the stock has fallen by more than 45% from its all-time high.

The PLTR stock has also moved above the 25-day moving average and is along the upper line of the Bollinger Bands. The Relative Strength Index (RSI) has moved close to the overbought level.

Therefore, the shares will likely keep rising as bulls target the initial resistance at $27.60. This was the highest level on June 28. However, a drop below $20 will invalidate the bullish thesis.