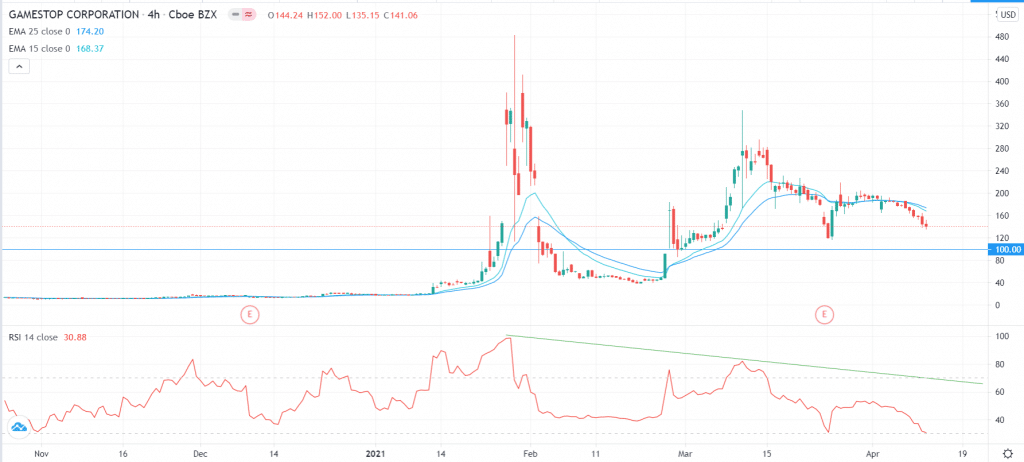

The GameStop stock price has fallen in the past six consecutive days as momentum in the meme stock fades. The GME stock price losses accelerated in extended hours as the firm started an executive search for the next CEO. It is trading at $140, which is 70% below the year-to-date high of $482. This values the company at more than $9.88 billion.

Gamestop losing streak accelerates

It has been a remarkable year for GameStop. The company, which runs old-fashioned game stores, saw its stock rise from below $10 when the year started to above $482. The stock then crashed to $35 and then bounced back to $347 and is now at $140.

For starters, GameStop is a struggling American retailer that specializes in video games. While the gaming industry has seen remarkable growth recently, GameStop has been on the sidelines. That’s because more gamers are using digital marketplaces like Google Stadia, Xbox, and PlayStation stores to buy games.

Indeed, its annual revenue dropped from more than $7 billion in 2017 to more than $5 billion in 2020. In this period, it moved from making an annual net profit of $353 million to a net loss of $250 million.

Therefore, with other retailers like JC Penny and Sears going bankrupt, many hedge funds saw an opportunity by shorting the stock. This means that they would profit when the company went under. However, early this year, most of these short sellers were burned when social media users started embracing the hated companies. In addition to GameStop, other companies that saw increased volatility were AMC Entertainment, Nokia, and Blackberry.

In the past week, however, GameStop stock has been in a major sell-off. The GME stock price has dropped by more than 30% in this period, becoming one of the worst performers.

GME recent announcements

This decline has happened in a period that it has made some important announcements. Last week, the firm selected Ryan Cohen as the new chairman of the board. Ryan is a respected entrepreneur who started Chewy, the $35 billion online pet food company. It also appointed a Chief Growth Officer (CGO) to lead its turnaround.

In the same week, it announced a share offering. It is selling more than 3.5 million shares. This was an important move considering that the GameStop stock price has surged this year, and the offering will help it boost its balance sheet.

The company is now looking for a new CEO who will replace George Sherman. The goal is to get an executive who will help it turn around its brick-and-mortar stores into an e-commerce juggernaut.

So, is the GameStop stock a buy? Analysts have a bearish sentiment on the company. On Monday, analysts at Ascendiant issued a major downgrade of the stock, but they didn’t set a target. Other analysts from banks like Credit Suisse, Wedbush, Benchmark, and Telsey have all issued bearish reports. The stock average analyst target is $13, which is 90% below the current price.

GameStop stock price outlook

The four-hour chart shows that the GameStop stock price has been under pressure lately. It has dropped in the past six consecutive days and moved below the 25-day and 15-day moving averages. The Relative Strength Index (RSI) has moved close to the oversold level of 30. The index has generally been falling. Therefore, in the near term, the GME stock will likely keep falling as investors target the critical support at $100. However, we should not rule out a situation where social media users pump the stock.