- Xpeng stock jumps 8% after Q3 results.

- Q3 revenue beat consensus estimate

- Focus on the impact of semiconductor shortages and supply chain issues.

Xpeng Inc. ADR (NYSE: XPEV) delivered its Q3 2021 results before the market opened on November 23, 2021. It heads into the earnings session, having beaten earnings estimates 50% of the time and revenue estimates 75% of the time over the past year.

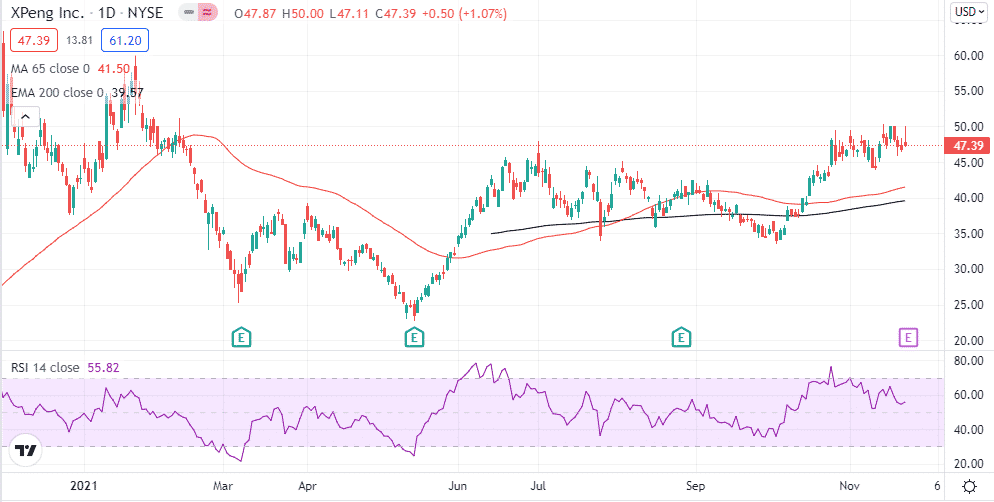

Over the past six months, the stock has also been on an impressive run, rallying by more than 60%. However, the stock has underperformed the overall market as it is up by about 4% year to date compared to a 26% gain for the S&P 500.

Amid the underperformance, the company’s fundamentals have improved significantly over the past year amid strong demand for electric vehicles in China. Additionally, Xpeng Motors has continued to innovate and accelerate deliveries on shrugging off-chip and parts shortages in the industry.

The company is fresh from unveiling the new G9 flagship smart SUV, marking its fourth production model. It became the first car designed with both the Chinese and international market in mind and comes with features for semi-autonomous driving.

As it stands, the Chinese electric vehicle (EV) maker is well positioned to rival Tesla Model Y crossover SUV which explains its improving sentiments in the market.

The expectation is high that the Chinese EV maker will deliver better-than-expected Q3 results following the release of the new SUV.

Q3 financial results

Wall Street expected Xpeng Motors to deliver earnings of 18 cents a share, an improvement from a loss of $0.38 a share delivered the same quarter last year. However, the Chinese EV maker ended up delivering a diluted net loss per ADS of $0.27, a slight improvement year-over-year.

Sales, on the other hand, were expected to grow 163% year-over-year to $788.8 million. Revenue in the second quarter landed at $582 million. The company had projected revenue of between $752 million and $783 million for the third quarter.

In contrast, Xpeng Motors ended up posting record revenue of $887.7 million, beating estimates and boasting a 187.4% year over year increase. Revenue was also up 52.1% sequentially.

Xpeng Motors delivered a record 25,666 vehicles; nearly triple deliveries were achieved in the same quarter last year. The company had projected deliveries of between 21,500 and 22,500 for the quarter.

Deliveries in September alone surpassed the 10,000 mark becoming the company’s best-ever month.

Xpeng Q4 Vehicle Deliveries Outlook

Chip shortages have been a big challenge in the industry, especially in the development of electric and self-driving cars. Nio has already been forced to cut its fiscal third-quarter delivery guidance owing to semiconductor shortages. Consequently, it is interesting to see whether the shortages will affect the company’s manufacturing capability heading into year-end.

For the fourth quarter, Xpeng Motors is projecting vehicle deliveries of between 34,500 and 36,500, a 166.1% to 181.5% year over year growth. The company also expects revenue to range between RMB7.1 billion and RMB7.5 billion, representing year over year growth of approximately 149.0% to 163.0%.

The slowdown in economic recovery amid heightened inflation has been a point of concern in the world’s second-largest economy, waiting to see its potential impact on electric vehicle demand heading into year-end.

Bottom line

Xpeng delivered better than expected third-quarter results, characterized by a record number of vehicle deliveries in the quarter. Impressive delivery numbers have been the catalyst behind the fine form in the market, which explains the 60% plus rally over the past six months.

The fact that the stock is still trading below its all-time high of $74 a share means there is ample growth opportunity to bounce back following the stellar Q3 results and solid Q4 guidance. The stock jumps 8% after the earnings report affirms renewed investor interest in the stock.