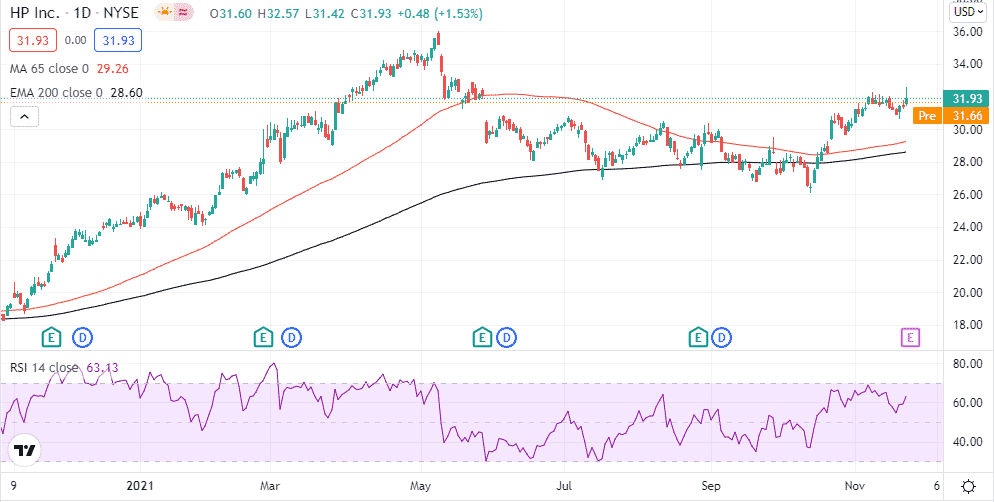

- HP stock up 24% year to date ahead of Q4 results.

- Q3 Earnings and Revenue to top expectations but signal slowing growth.

- The focus will be on supply chain issues and chip shortage impact.

HP Inc. (NYSE: HPQ) is scheduled to deliver its fiscal Q4 2021 results after the market close on November 23, 2021. The company heads into the session, having topped earning consensus estimates 100% of the time over the past two years. Revenue has also topped estimates 63% of the time.

Additionally, the stock has performed in line with market expectations going by the 24% gain year to date. In contrast, the S&P 500 is up by about 26%. However, HP is down by about 11% from all-time highs ahead of the Q4 results.

Over the past year, HP has seen its market sentiments edge higher on the pandemic, disrupting in-office and persona activity. The result was a strong demand for better and faster computers as people worked and learned from home.

Global PC sales were up 5% sequentially to 84.1 million units in the third quarter, while shipments for laptops and mobile workstations rose 3% year-over-year to 67.4 million. Desktop shipments, on the other hand, rose 12% to 16.6 million.

The strong demand for computers in the quarter raises the prospects of HP delivering better-than-expected fiscal Q4 results. The Q4 results look set to have benefited from solid demand for personal systems amid the remote working and online learning trends.

Q4 earnings expectations

Wall Street expects the personal computer and access device company to deliver earnings of $0.88 a share for Q4, an improvement from earnings of $0.62 a share delivered the same quarter last year.

Revenue, on the other hand, is expected to land at $15.40 billion, a slight improvement from $15.26 billion delivered the same quarter last year. The stock came under pressure after the company delivered fiscal Q3 results that showed revenue grew 7% year over year on flat PC sales.

The slight revenue growth in the quarter could be attributed to industry-wide supply constraints affecting HP’s ability to meet the demand for PC’s and printers in the quarter. The emergence of COVID-19 cases could also have affected manufacturing and triggered port and logistics disruptions, affecting revenue growth.

What to look out for when HP reports

HP is poised to deliver Q4 results amid ongoing supply chain disruptions that have affected the delivery of key components to factories. Additionally, chip shortages already threaten to bring many industries to a standstill amid the supply chain issues. Consequently, it will be interesting to see what the company has in store to offset the underlying challenges.

Amid the supply chain issues and chip shortage, investors will pay close watch to the company’s fiscal Q1 2022 guidance. The guidance will paint a clear picture of whether the company expects continued growth as the impetus on PC sales triggered by the pandemic slows down.

In addition to PC sales, HP has in the recent past sought to diversify its revenue streams by building services business around the PC’s shipped. HP Provisioning Connect is the new service offering that seeks to set up and support devices in employees’ homes and offices. Consequently, it will be interesting to see if the new offering helped drive the company’s sales in the quarter.

The focus will also be on the HyperX acquisition, waiting to see if it significantly impacted HPs Personal System business performance. Expectations are high that chrome books priced lower than PC portfolios did have a significant impact in driving sales given the strong demand in the market.

Bottom line

HP is poised to deliver Q4 results at the back of a fine run in the market. The stock has in the recent past bounced back after a pullback from all-time highs. A better than expected Q4 results backed by impressive Q1 guidance that affirms continued growth should strengthen the stock sentiments resulting in it re-rating back to 52-week highs. Similarly, a disappointing earnings report could pause the recent bounce-back momentum.