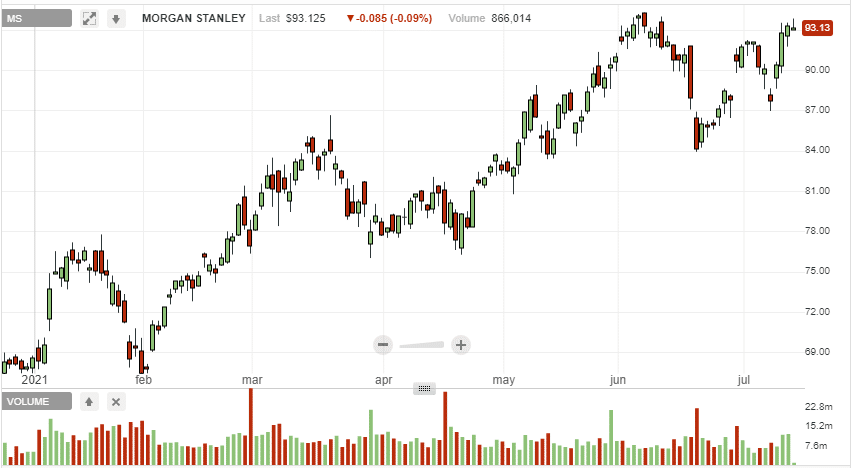

- The stock is up about 34% year to date.

- EPS expected at $1.72.

- Revenue expected at $13.72 billion.

- Investment banking and trading unit in focus.

Morgan Stanley is scheduled to report its second-quarter 2021 results on July 15, 2021. The earnings report comes on the heels of JPMorgan and Goldman Sachs reporting Q2 results that topped consensus estimates. Additionally, it comes when the stock is flirting with 52-week highs after a 34% rally year to date.

The stock has outperformed the overall market, having been on an uptrend for the better part of the year. Additionally, the stock’s sentiments have been boosted by improving economic outlook amid the aggressive vaccination campaign. Federal Reserve’s talk of hiking interest rates to counter inflationary pressures all but continues to strengthen Morgan Stanley’s prospects.

During the first-quarter earnings report, CEO James Gorman reiterated that the bank remains well-positioned to continue growing. The closing of the Eaton Vance acquisition took the bank’s Investment Management segment to over $1.4 trillion in assets under management.

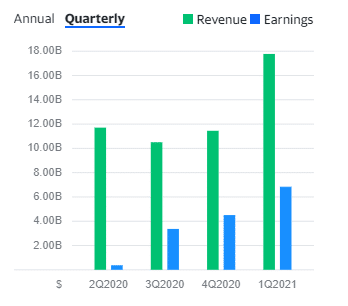

Over the last two quarters, the bank has posted earnings that have come above forecasts. Its top-line growth has increased over the same period affirming solid underlying growth.

Morgan Stanley Q2 earnings expectations

The financial services company is expected to report Q2 earnings per share of $1.72 against the $1.65 that analysts expect. The banks’ profitability has improved significantly in recent quarters on the back of higher revenues and lower operating expenses as a percentage of revenues. The trend continued in the first quarter, waiting to see if it continued in the recent quarter.

However, the financial services company net is believed to have decreased in Q2 to $10.7 billion owing to the effects of the record low-interest rates.

On the other hand, revenue is expected at about $13.72 billion, slightly below the $13.96 billion that Street expects. In recent quarters Morgan Stanley’s revenue growth has mostly been driven by a jump in sales & trading and investment banking revenues. The same trend continued in Q1, waiting to see if it continued in Q2.

Revenue jumped 61% to $15.7 billion in the first quarter, topping consensus estimates. The bank also posted a profit of $4.1 billion or $2.22 a share on an adjusted basis and more than double the $1.7 billion reported a year earlier.

What to look out for

In the first quarter, the bank benefited from an $850 million increase in fixed income trading revenues that came in at $2.97 billion. Equity trading revenue came in at $2.88 billion in revenue, waiting to see if the growth momentum on this front continued in the second quarter.

Investment banking has also been another soft spot in the bank’s financials. The segment posted a 128% increase in revenues in the first quarter that totaled $2.61 billion. The Street will want to see if the momentum continued in Q2 in the aftermath of the reopening of the US economy, as well as the impact of easing monetary policy.

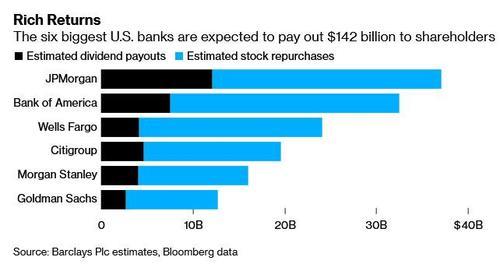

Dividend and buybacks

The Federal Reserve has lifted a ban imposed last year on buybacks and dividend payout. As a result, Morgan Stanley is one of the banks that have affirmed its ability to return maximum value to shareholders.

The financial services company has since increased its common stock dividend payout by 100% to $0.70 a share, starting the third quarter.

Additionally, the bank intends to repurchase $12 billion worth of stock over the next 12 months.

Bottom line

Morgan Stanley has been firing on all angles amid the pandemic. The bank accrues its edge in the sales & trading segment that continues to drive growth and bottom line.

While the stock is trading near 52-week highs, an impressive Q2 earnings report that tops analyst estimates could be the catalyst to trigger another leg higher on strengthening investor’s sentiments on the stock.