- US dollar firms ahead of CPI data.

- USDJPY is struggling for direction.

- USDCAD bounce-back gathers steam.

- Oil prices tank on profit-taking.

- Bitcoin and Ethereum under pressure after sell-off.

The US dollar firmed at 16-month highs against the majors Friday morning ahead of the release of key US inflation figures, which could set the tone for interest rate talks. The greenback is at the back of its seventh consecutive week of gain supported by talk, and the Federal Reserve will accelerate tapering to clamp down on runaway inflation.

The dollar index, which measures the greenback strength against the majors, has already found support above the 96.00 level. The dollar strength remains well-supported by rising treasury yields as investors await next week’s FED meeting outcome.

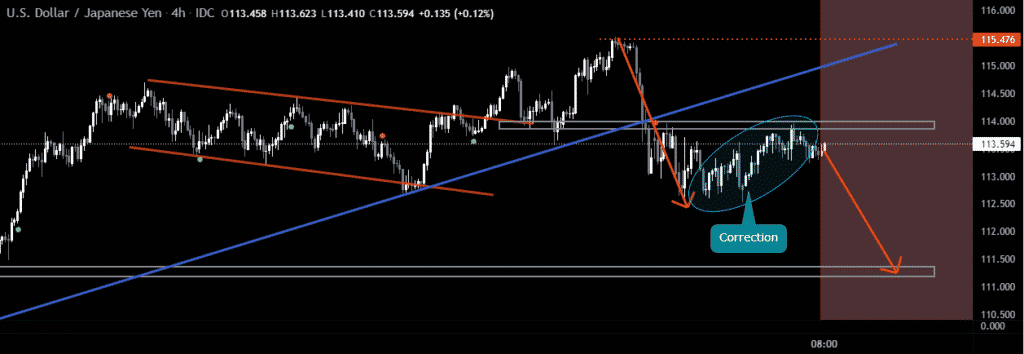

USDJPY range-bound

Meanwhile, the USDJPY is struggling for direction for a fourth consecutive day as it continues to trade in a tight trading range. The pair’s price action has been limited to a tight trading band of between 113.78 and 113.30.

USDJPY has struggled to rally past the 114.00 handle, with bears struggling to steer any downside action below the 113.30 support level. The downside action has been limited due to rising Treasury yields that fuel dollar strength across the board.

Additionally, subsiding Omicron fears have seen demand for safe-havens such as the Japanese yen wane significantly, all but limiting any downside action on the USDJPY pair. Looking ahead, the focus is on the release of US CPI data for November that could have a significant impact on dollar strength.

CPI signaling inflation is still a problem that could accelerate talk of accelerated asset purchases next week by the FED as well as interest rates hikes next year. Consequently, the dollar could strengthen, sending the USDJPY pair higher.

USDCAD edges higher

USDCAD, on the other hand, is increasingly turning bullish after a reversal from three-week lows of 1.2604. Bulls have since steered the pair to session highs of 1.2716 ahead of the release of US CPI data in the day.

Above the 1.2620, USDCAD remains well-supported for further upside action. A rally followed by a close above the 1.2720 could trigger renewed buying pressure to highs of 1.2780. On the flip side, a slide followed by a close below the 1.2700 could trigger renewed sell-off back to three-week lows of 1.2604.

Separately, the EURUSD remains under pressure after struggling to find support above the 1.1300 level. The pair dropped the most in two weeks on Thursday as riders reacted to reports the ECB is looking to extend the easy monetary policies at a time when the FED is planning to cut.

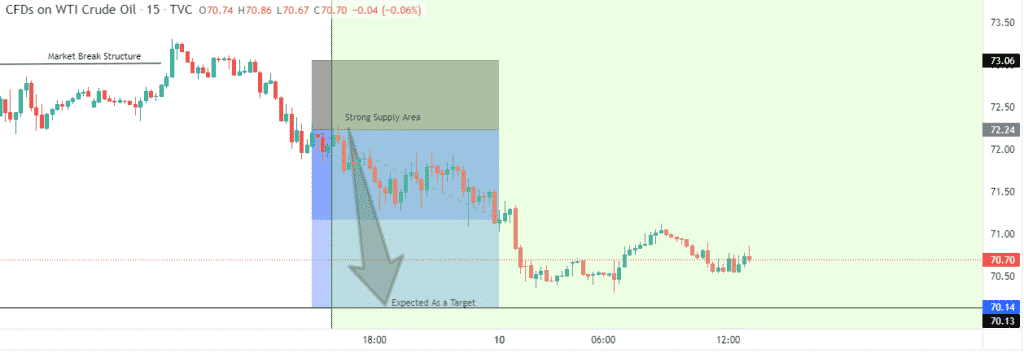

Oil prices retreat

Oil prices remain under pressure in the commodity markets after a recent bounce back above the $70 a barrel level. After initially powering the most since August to highs of $73.45, US oil was down to lows of $70.45 in the early Friday trading session.

The pullback could be attributed to traders taking profits after the recent bounce back. Oil prices have rallied by more than 4% this week amid expectations the Omicron variant will not impact economic recovery or slow down oil demand.

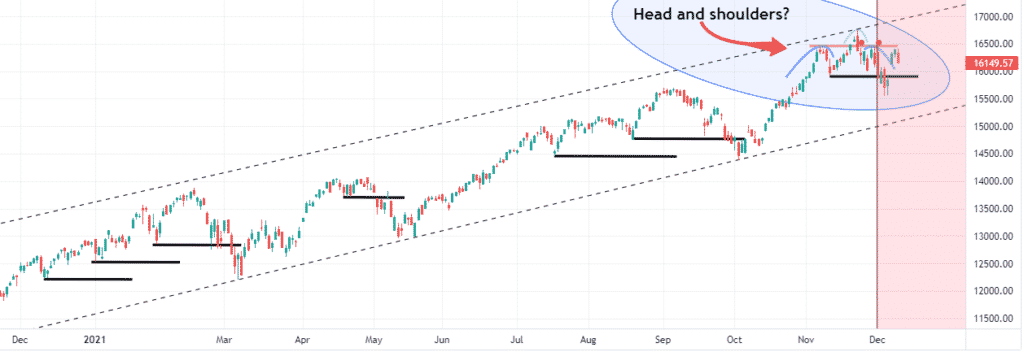

US Benchmarks pull back

US benchmark indices snapped a three-day winning streak edging lower on Thursday. The S&P 500 was down 0.72% as the Dow Jones rose 0.01% and tech-heavy NASDAQ fell 1.71%. The mixed sentiments in the equity markets come amid concerns over the long-term impact of the highly transmissible Omicron invariant.

Additionally, investors are becoming increasingly cautious ahead of next week’s Federal Reserve meeting. Runaway US inflation has been a big concern for policymakers to see a quicker reduction of the central bank’s $120 billion bond purchase program.

Cryptocurrencies under pressure

Separately, cryptocurrencies are yet again under pressure heading into the weekend. Bitcoin and Ethereum have struggled to find support above key support levels. BTCUSD has already slid below the $50,000 level and is flirting with lows of $48,300. A sell-off below the $47,000 level could trigger a drop to two months low near the $43,300 level.

ETHUSD is also struggling for direction after a pullback from highs of $4,400. The pair is at risk of plunging below the $4,000 level as it continues at about $4,129.