- Renewed dollar strength sends GBPUSD lower.

- USDCHF races to one-month highs on dollar strength.

- Gold tanks below $1800 amid rising US Treasury yields.

- Bitcoin tanks 17% as El Salvador buys 400BTC.

The US dollar bounced back from near one-month lows to one-week highs on Tuesday, helped by rising US Treasury yields. The 10-year Treasury note rallied six basis points from Friday’s close to highs of 1.385%, all but fuelling greenback strength across the board.

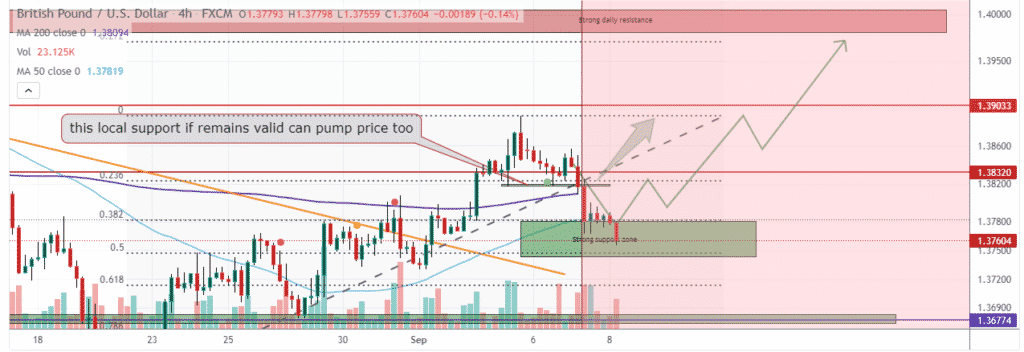

GBPUSD tanks

The renewed dollar strength continues to pile pressure on the majors, with the GBPUSD retreating from one-month highs near the 1.3900 level. The pair has since turned bearish after plunging below the 1.3800 level.

Given the momentum is to the downside, GBPUSD looks destined for the 1.3740 level, the next substantial support level. On the flip side, a rally followed by a close above the 1.3800 level should fuel a rally back to one-month highs.

In addition to the dollar strength, the GBPUSD slide comes as traders react to rising coronavirus in the UK, which is already fuelling concerns about economic recovery. The dollar continues to attract bids amid the rising Covid cases due to its safe-haven credentials.

Additionally, the UK government announcing a new tax hike has continued to pile pressure on the sterling pound on concerns it could hamper economic recovery. Brexit woes on the European Union warning there will be no renegotiations on the UK failing to implement border checks also continues to weigh on the pound against the dollar.

USDCHF rallies to one-month highs

The renewed dollar strength following last week’s sell-off is the catalyst fuelling the rally on the USDCHF pair. The pair has since powered through the 0.9200 level as the Swiss francs remain under pressure on the greenback strengthening on rising Treasury yields.

With bulls in control, USDCHF could rally to the 0.9231 mark, the next substantial resistance level. The rally could be curtailed on the Swiss Francs holding its ground backed by a string of solid economic releases. Immediate data indicates the unemployment rate in Switzerland fell to 2.7% in August, the lowest level since February.

Additionally, some policymakers within the Swiss National Bank remain optimistic about robust GDP growth in 2021.

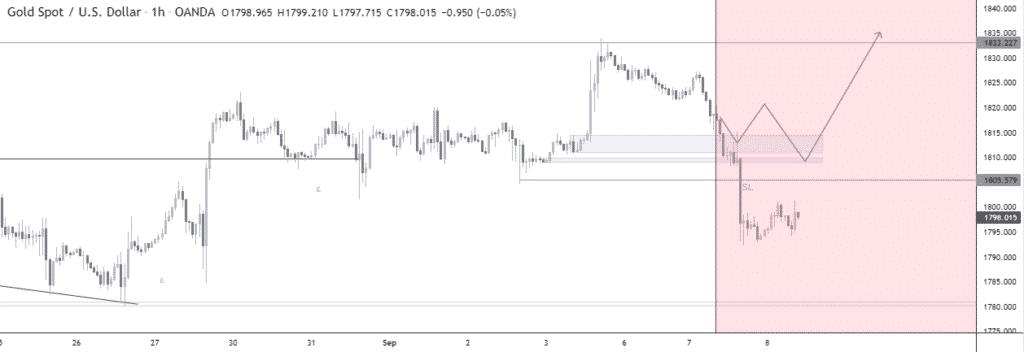

Gold under pressure below $1800

In the commodity markets, gold remains under pressure amid rising Treasury yields. XAUUSD was down by 1.5% on Tuesday, sliding below the $1800 level amid renewed dollar strength. The slide came even on open interest on the precious metal declining by 6.4K contracts on Tuesday.

Bulls will have to steer XAUUSD above the $1800 level to have any chance of averting further sell-off. On the other hand, bears remain in control, with the next support level seen at the $1780 level. Gold price action depends a great deal on how the US Treasury yields behave. A further spike in yields would be negative that could see XAUUSD edging lower.

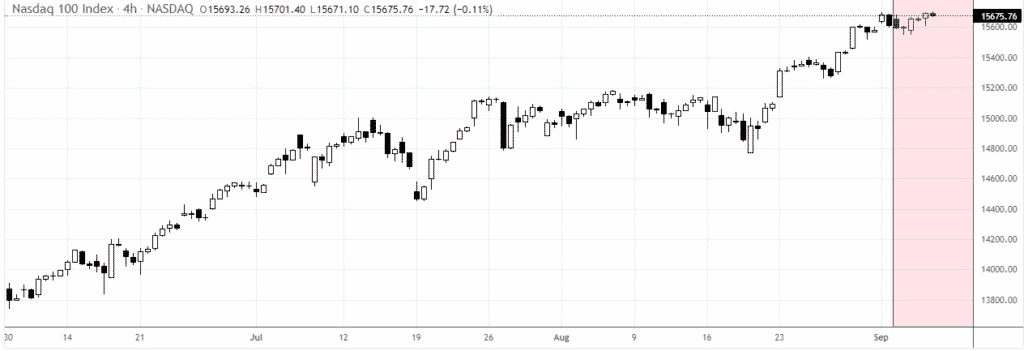

US equity indices slip

Major US equity benchmarks slipped from near-record highs in the stock market as worries about economic recovery amid the delta variant took center stage. The S&P 500 and the Dow Jones Industrial fell as tech stocks offered support for the NASDAQ to finish the day on the green.

Delta variant concerns are weighing down on third-quarter growth prospects, all but pilling pressure on stocks and the indices. In addition, the month of September is not always good for equities, a scenario that could be playing out.

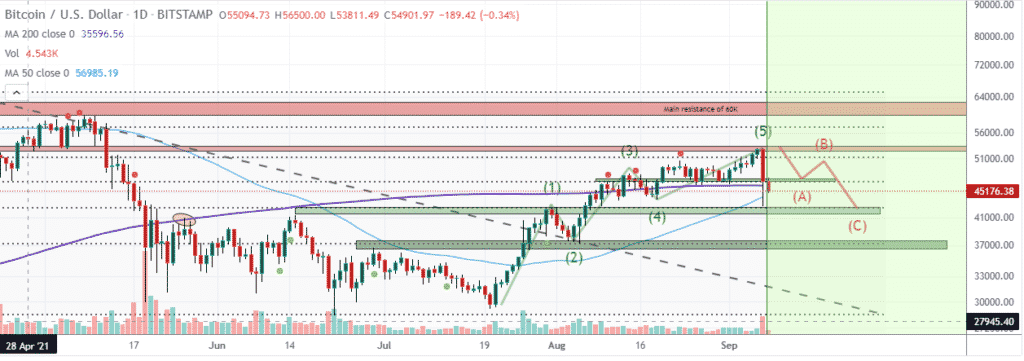

Bitcoin implodes

A massive sell-off came into play in the crypto market, with Bitcoin and Ethereum retreating from four-month highs. BTCUSD fell by as much as 17%, hitting its lowest level in a month. The price fell to $45,200 after powering through the $52,000 in the day.

The steep pullback came as El Salvador adopted BTC as a legal tender. While the government did buy 400 coins, it is the push to take offline a Bitcoin wallet to fix a purported problem that rattled the market, triggering the massive sell-off.