- BTCUSD powers through $40,000

- US FED hikes interest rate by 25 basis points

- Russian-Ukraine talks progress

- Bitcoin’s long term outlook

Bitcoin is one of the cryptocurrencies leading a broader cryptocurrency market recovery in the aftermath of the Federal Reserve living to expectations and announcing 25 basis points interest rate hike. The flagship cryptocurrency has powered through the $40,000 psychological level from where bulls are trying to steer a rally higher.

Bitcoin and other cryptocurrencies have been under pressure amid uncertainty over the monetary policy that the US Federal Reserve will pursue to curtail runaway inflation. Geopolitical tensions pitting Russia and Ukraine and drawing other world powers have only gone to fuel risk-off mood in the market resulting in many virtual currencies edging lower.

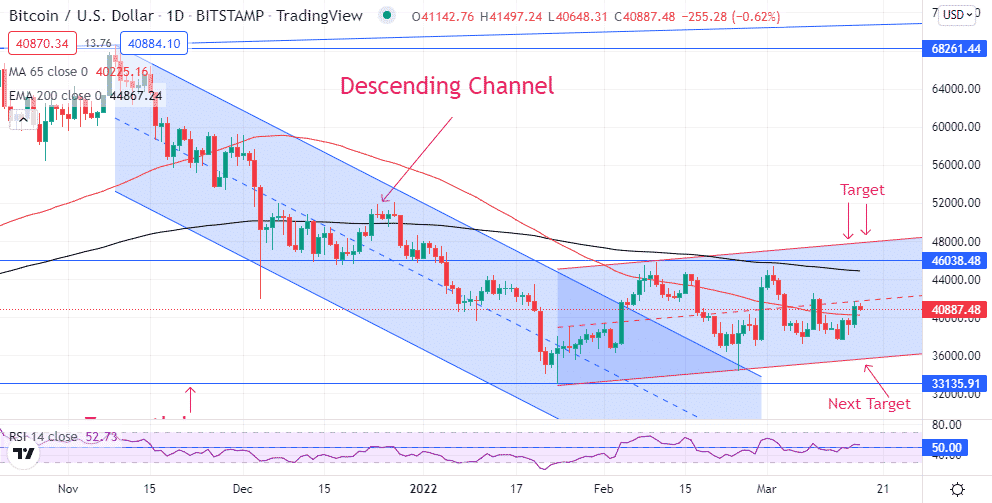

BTCUSD technical analysis

After struggling to find support above the $45,000 level, BTCUSD bears fuelled a drop below the $40,000 psychological level to lows of $37,160, which has emerged as a critical support level in recent weeks. BTCUSD bulls have been piling pressure on short-sellers struggling to steer a drop below the $37,000 level. It appears bulls are winning the battle as Bitcoin has once again powered through the $40,930 level affirming the emerging bullishness.

A rally followed by a close above the $41,900 should re-affirm the emerging uptrend setting the stage for BTCUSD to make a run for the $45,000 handle, which happens to be the next substantial resistance level. Similarly, failure to find support above the $40,000 handle could leave the cryptocurrency susceptible to further losses with a drop to the $37,000 area.

Bitcoin’s short-term outlook

In the meantime, BTCUSD remains bullish and is likely to continue edging higher. News of the FED hiking interest rate by 25 basis points was already priced in, which explains why assets affected by rate hikes rallied and the dollar weakened. The dollar weakening across the board and treasury yields edging lower should continue to offer support to riskier assets which should see BTCUSD edging higher.

The risk-on mood in the markets has improved after the FED decision. Fuelling a rush to riskier assets are reports of progress on peace talks between Russia and Ukraine. Media reports indicate that both Russian and Ukrainian representatives are open to making some compromises that could end the war.

The Russian-Ukrainian situation being taken off the table could eliminate a significant risk factor that has forced investors to shun riskier assets such as cryptocurrencies in favor of safe havens such as gold. However, the market is expected to proceed with caution as the outlook is difficult to predict.

What’s next?

While Bitcoin’s short-term outlook remains uncertain, the same cannot be said about its long-term outlook. Increased blockchain and cryptocurrency adoption in the mainstream sector affirms the cryptos long term prospects which could see Bitcoin appreciate significantly following the 40% plus pull back from record highs.

Institutional investors such as ARK invest are extremely bullish about the flagship crypto. Corporations such as Block, MicroStrategy, and Tesla investing in crypto all but strengthen their credentials as long-term investments.

In addition, Bitcoin has in recent months emerged as a solid hedge against inflation. Ultra-loose monetary policy struggling to curtail inflationary pressure has seen investors turn to digital assets in the recent past.

That said, the prospect of Bitcoin bouncing back after the steep pullback from record highs is high. While it might take some time, given the global uncertainties, the pullback has created attractive valuations that should continue to attract more investors into the coin.