What are the highlights of the fourth quarter of 2020 in the Forex market? The downtrend in the USD is impressive and provides numerous trend-following opportunities across the board.

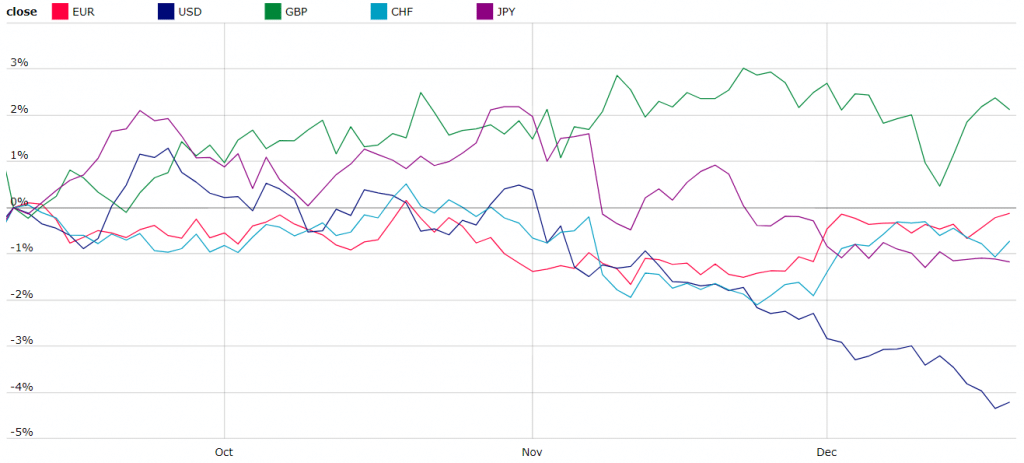

The peculiar tendency has been happening in GBP. Below is the chart that represents the change in one currency by reference to all other foreign currencies. We can see that GBP performed surprisingly well on a relative basis, considering the uncertainties around Brexit.

I excluded the traditional risk currencies like AUD and NZD, as they tend to get predictably volatile and straightforward during the market sentiment transitions.

What’s going on with GBP fundamentally?

Since the UK left the European Union, the economy has been in a state of high uncertainty. Every Brexit update causes more volatility to the British Pound, often not in its favor.

The Level-Playing Field problem has seen some progress, as the EU and the UK seem to agree on the governance of the trade policies. The most probable date of the final agreement on the Brexit deal is December 31, according to the joint statement of the European Parliament.

Any deal would be a good one for the enterprises of both sides. Businesses desperately need certainty in trade policies, as unlike regulators, they are flexible enough to adapt in the new economic realms.

A more open issue remains around fishing. Although, I don’t think the fishing issue would have a significant impact on the UK and the EU economies, as fishing takes less than 0,1% of both economies’ GDP, according to the Office for National Statistics.

What should we buy GBP against?

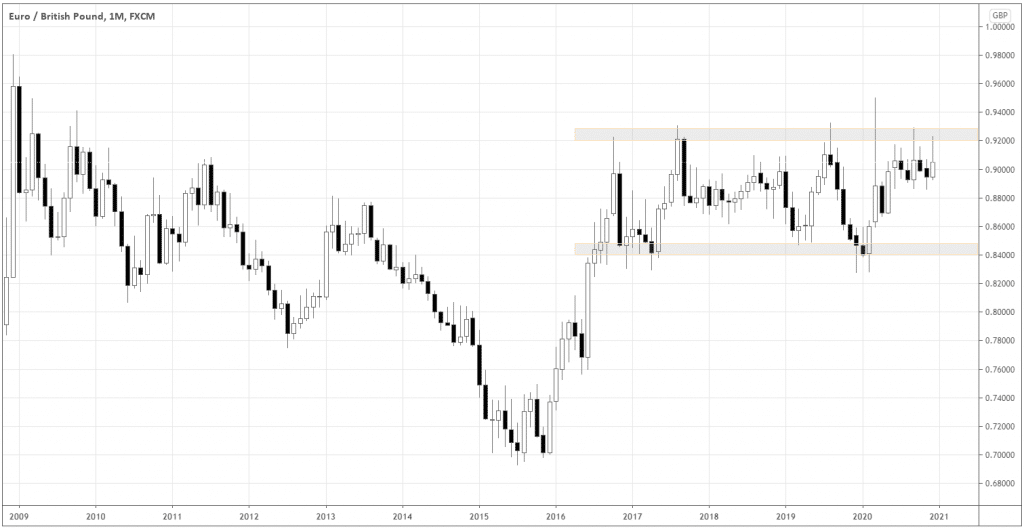

I wouldn’t be eager to consider any long-term trades in EUR/GBP for now, due to a great deal of uncertainty around Brexit. It’s been vividly reflected in the price action since 2016 when the UK left the EU. Look at that choppy range for the last three years on the monthly chart down below!

The pair has been bound in the 0.84-0.92 range since the middle of 2016. There aren’t any obvious enough triggers yet to enter the pair in either direction.

I wouldn’t buy GBP against the franc due to CHF’s strength, which I discussed previously. Although JPY is a classic safe-haven, I don’t like selling it because of the massive descending triangle it had formed against USD.

Therefore, the USD would be a perfect candidate to sell if we want to buy GBP.

How to trade GBP/USD?

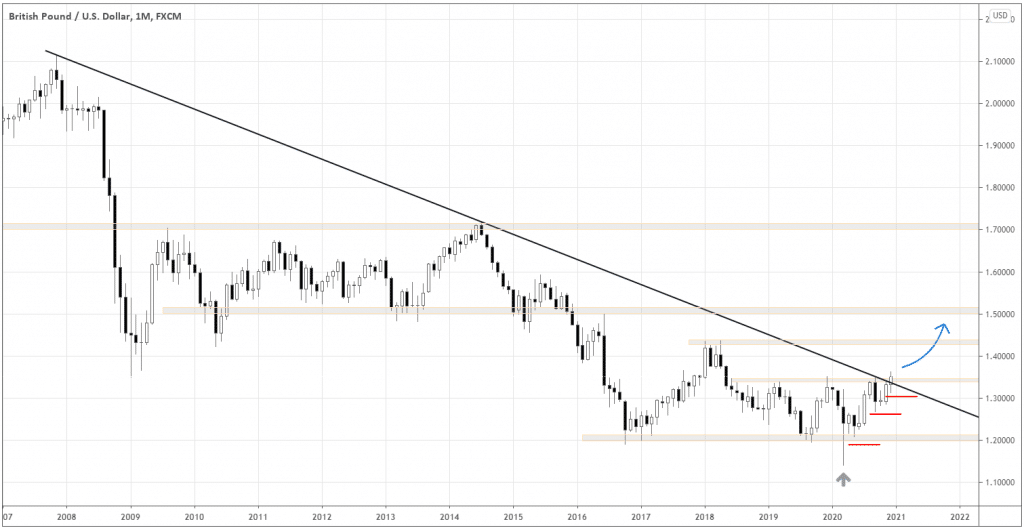

In the chart below, we can see that GBP has been in the downtrend versus USD since the 2008 financial crisis. In March 2020, the pair failed to break down the long-term 1.2 support area, making a long wick and holding above 1.2 since then.

The current monthly candle not only holds above the important local resistance area around 1.34 but also holds above the long-term trendline (the black inclined line), signaling the beginning of the possible upside momentum if December closes above those technical levels. The higher lows (marked with the red lines) also signal the short-term strength of the GBP.

A good trigger to buy would be the strong close above 1.34. Traders can set the protective stops either below the monthly low or below one of the recent local lows (red horizontal lines).

The most conservative price target would be at 1.42, the breakout of which would hint at a stronger possibility of the overall long-term downtrend reversal with the main targets of 1.5 and 1.7.

If a trader uses the stop loss below the December candle low, the risk-reward potential would be 1:1.5, considering the most conservative target 1.42.

Final words

This time the uncertainty around the outlook on the UK isn’t necessarily a bad thing in terms of the exchange rate. As GBP has been relatively strong for the last quarter, the market might be pricing in some structural economic changes yet to be discovered. We identified that GBP/USD would be the best pair to express the bullish view on the Cable.