- US dollar is on the front foot ahead of the FED decision.

- EURUSD tanks below 1.1300.

- GBPUSD is under pressure amid waning BOE expectations.

- Gold is trading in a tight range.

- Cryptocurrency sell-off persists.

The US dollar was on the front foot at the start of one of the most pivotal weeks of the year. The US Federal Reserve is poised to issue its last policy decision for the year, a report expected to drive currency markets, especially the dollar.

On Wednesday, the FED is expected to signal accelerated asset buying to tame the runaway inflation. Such a move is expected to heighten an earlier start to rate hikes expectations. The European Central Bank, Bank of Japan, and Bank of England are also expected to issue their policy decisions this week.

Even as the markets await the central bank decisions, the US dollar firmed at 16-month highs. The dollar index powered to highs of 96.20, all but pilling pressure on the majors.

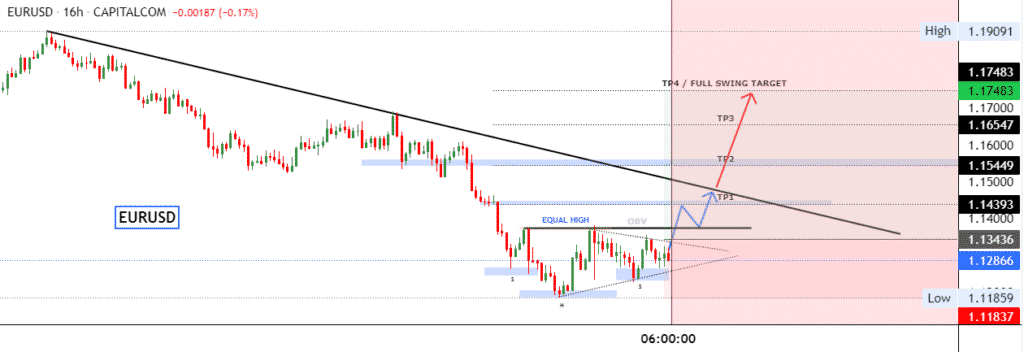

EURUSD sell-off

EURUSD was one of the biggest casualties as the dollar edged higher. The currency pair plunged below 1.3000 after starting the week at highs of 1.1310. A slide to lows of 1.1280 leaves the pair susceptible to slide to lows of 1.2620, the next support level.

The sell-off comes amid growing anxiety ahead of key monetary policy meetings from the FED and the ECB. With caution increasingly gripping the market, traders are increasingly flocking into the dollar and shunning riskier currencies such as the euro. EURUSD sentiments have been weighed heavily by suggestions. ECB inflation forecast will show inflation is below the 2023 target, thus, not supporting the push for rate hikes next year.

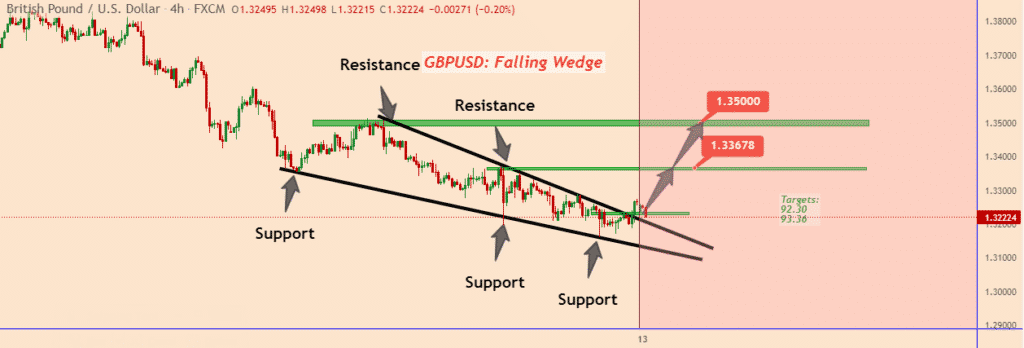

GBPUSD under pressure

Meanwhile, the British pound also remained under pressure against the dollar at the start of the week. After starting the week at highs of 1.3250, GBPUSD has plunged to lows of 1.3230 and looking increasingly bearish amid dollar strength.

Weakness on the GBPUSD stems from waning expectations that the Bank of England will hike interest rates at its next meeting this week. Growing Omicron variant concerns pile pressure all but denting expectations of rate hikes. Economic worries amid the pandemic and political turbulence continue to pile pressure on the pound against the dollar.

USDJPY, on the other hand, is tracking higher even on Japanese prime minister Fumio Kishida reiterating readiness to act should there be crises. The country’s inflation level has jumped to the highest level since 2015. With big manufacturers and non-manufacturers are reiterating cautious outlook for Q4 2021, USDJPY edged higher to highs of 113.50 on yen weakness.

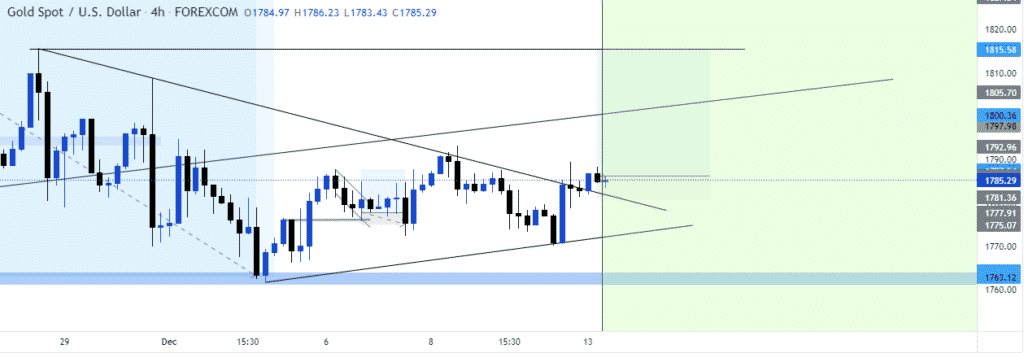

Gold weakness

In the commodity market, gold prices remain sidelined, trading in a narrow band between $1780 and $1788. XUAUSD has struggled to power and find support above the $1790 level. The push down in gold prices can be attributed to rising treasury yields.

With investors turning to yields amid expectations of early rate hikes and accelerated asset purchasing, gold looks set to remain under pressure. Looking ahead, the focus is on the FED meeting on Wednesday likely to influence sentiments on yield and dollar, consequently the yellow metal direction of trade.

Indices rally

Last week, Wall Street was in upbeat mode, with the major benchmark indices finishing near record highs. The S&P 500 gained 0.95% to highs of 4,712 as tech-heavy Nasdaq added 0.73% and Dow Jones Industrial Average gained 0.6%.

The S&P 500 posted its large weekly advance since February as investors reacted to waning jitters around the Omicron variant. US inflation data coming in line with expectations at 6.8% also eased fears in the market, helping support sentiments on equities. Market participants are expected to maintain a cautious approach ahead of the FED decision on Wednesday.

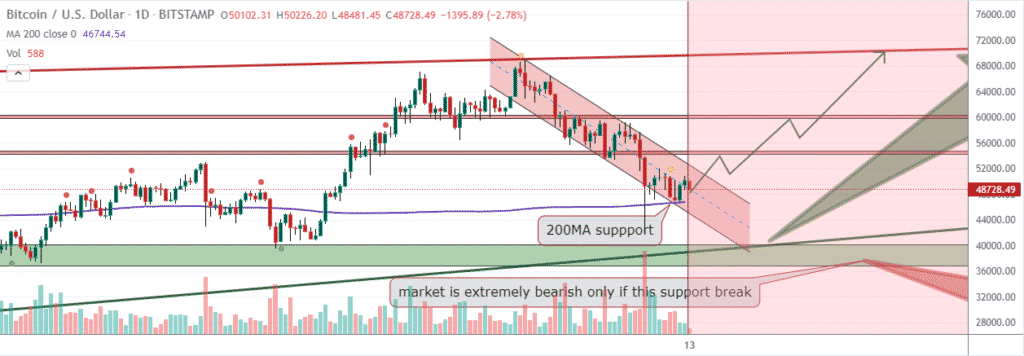

Cryptocurrency sell-off

Bitcoin and Ethereum remain under pressure at the start of the week, struggling to find support above key support levels. BTCUSD is trading at about $48,959 after failing to find support above the $50,000 level.

ETHUSD has also plunged below the $4,000 level to lows of $3,986 amid pilling selling pressure. The sell-off comes at the backdrop of waning inflation concerns as well as the firming of the dollar at 160-month highs.