- The US dollar tries to bounce back from three-week lows.

- USDJPY takes out 110.00 level on renewed dollar strength.

- AUDJPY bottoms out from eight-month lows on yen weakness.

- Gold remains range-bound amid dollar softness.

- US benchmark equities register seven straight monthly gains.

The US dollar continues to recoup some of the losses accrued last week in the aftermath of the Federal Reserve Chairman sounding dovish on monetary stimulus tapering. The chairman pushing back on interest rate hikes has triggered weakness on the greenback, which is trading near three-week lows.

USDJPY Outlook: Rally on the yen weakness

The bounce-back experienced on Tuesday and Wednesday comes as investors continue to keep moves small in the currency market ahead of a pivotal Non-Farm payroll report on Friday. Positive traction on the USDJPY is gaining momentum, with the pair recouping all losses accrued last week.

The pair has since bounced back and taken out the 110.00 level as the yen remains under pressure amid greenback resiliency despite Powell dovish remarks. A rally to two-week highs of 110.20 means the pair is flirting with a key resistance level.

A close above the 110.30 level should pave the way for bulls to make a run for the 111.00 level. On the flip side, support is at the 110.00 level above which the pair remains well-supported for further upside action. A breach of the support level could open the door for USDJPY to slide to 109.68 level.

USDJPY has turned bullish following dovish remarks about Japan’s economy by the deputy governor of the Bank of Japan, Masazumi Wakatabe. The governor raising doubts about the economy in the phase of climate change pressure continues to take a toll on the yen against the dollar.

The deputy governor insists that the economic policy must be accommodative to counter the economy’s pressure from climate change. The governor also insists that the economy faces downside risks amid the pandemic. The remarks should continue to weigh on the yen, likely to continue supporting an uptick in USDJPY.

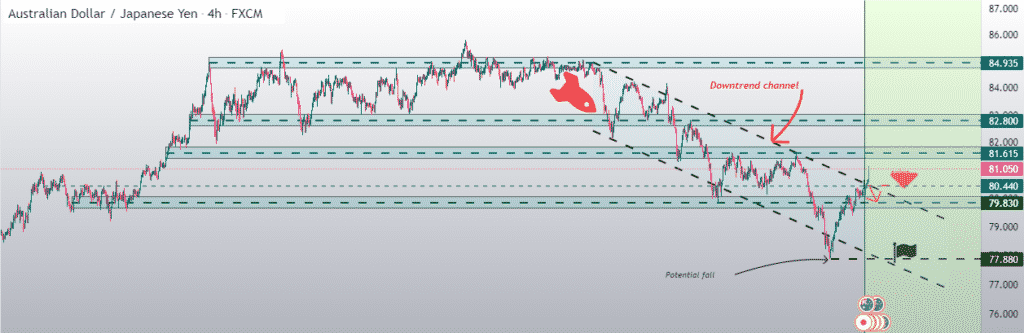

AUDJPY Outlook: Bottoms out 8-month lows

Amid the yen weakness, AUDJPY has raced higher, touching three-week highs as the Australian dollar continues to hold firm against the majors. After sliding to eight-month lows last week, the pair’s bounce-back momentum has gathered steam in the face of the dovish remarks about Japan’s economy.

A rally to highs of 80.81 leaves AUDJPY well-positioned to make a run for the 81.00 handle amid the yen weakness.

Support on any pullback is seen at the 80.00 level from where the upward momentum gathered pace.

AUDJPY positive traction is also supported by a decline in COVID-19 cases in Australia, a development offering support to the Australian dollar, which has come under immense pressure in recent weeks.

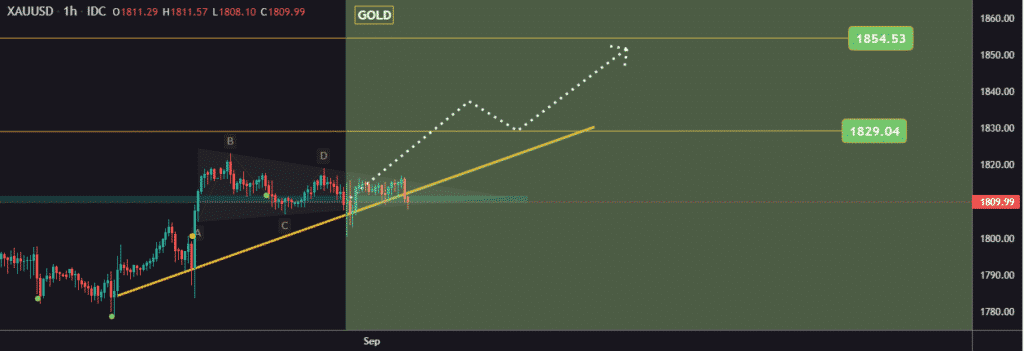

Gold Outlook: Still range-bound

In the commodity markets, Gold remains range-bound, struggling to power through the $1,818 resistance level after finding support above the $1,800 level. XAUUSD’s upward momentum has been weighed heavily by renewed dollar strength following last week’s sell-off.

After starting the week at $1,818, XAUUSD bulls have struggled to push the price above the level, with bears also finding it tough to steer the precious metal below the $1,800 level. The range-bound development around XAUUSD comes amid a cautious approach in the market ahead of the release of the Non-Farm payroll report on Friday.

Gold prices remain well supported above the $1,800 level as slowing global growth momentum and COVID-19 fears continue to fuel demand for safe-havens. Investors have also turned to the precious metal to hedge against the effects of tapering.

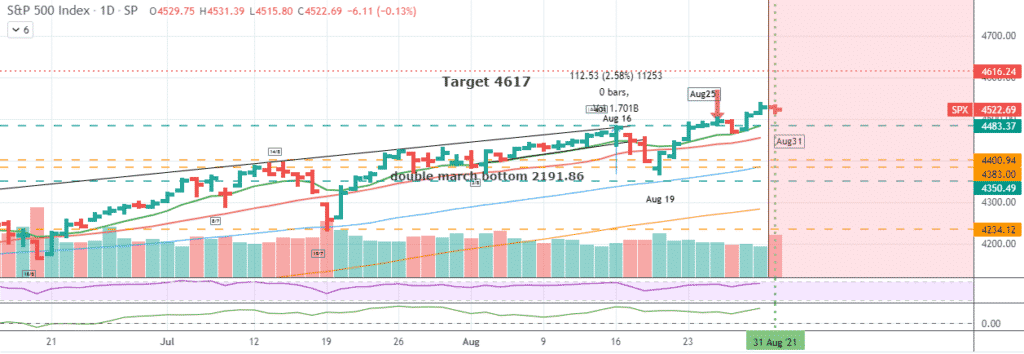

US equity indices at record highs

All the major equity benchmarks ended August on a high, flirting with record highs even as the overall stock market looked ragged. The S&P 500 was down by 0.1% on Tuesday but up by more than 3% for the month.

While the NASDAQ and Dow Jones did drop by 0.1% each on Tuesday, all the three indices registered their seventh straight monthly advance marking the longest winning streak since 2018. The slide on Tuesday came amid valuation concerns as well as growing concerns about the escalating COVID-19 situation.