The markets have finished the week in an upbeat mood, with equity indices making new highs and risk currencies catching a bid. Although the USD is usually considered a safe haven, the world reserve currency’s sentiment resembled a risk asset, following the strength in indices and other risk currencies.

DXY gained over 0.75% in the middle of the last week, without any vivid prior market-moving data releases. The dollar pulled back in the second part of the week as investors focused on the US economy’s promising outlook by buying more equities.

Joe Biden’s $3 trillion infrastructure plan, emphasis on jobs creation, and distributing stimulus checks might have put pressure on the dollar. At the same time, positive employment data supported the dollar on Friday, although average hourly earnings were lower than previous readings as well as forecasted.

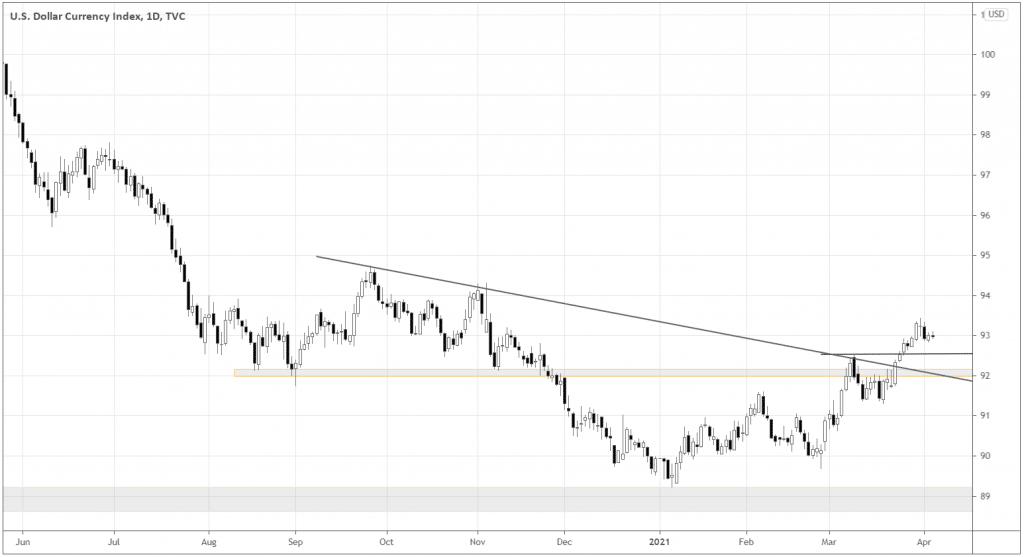

DXY technical picture

The dollar index continues building up a solid upward move, at least in the short term, as the market has been holding above all key support levels.

The DXY chart below shows that the market is building a normal uptrend structure with higher highs and higher lows while holding above the resistance-turned-support 92.0, possible local support 92.5, and the broken trendline (see the inclined line in the chart below).

The next resistance levels may be around previous highs at 94.0 and 95.0. Traders should watch how the market reacts near those prices.

It would make sense to focus on buying the dollar against the old-school safe-haven JPY and European currencies as the Eurozone is affected by new COVID-19 restrictions, France in particular.

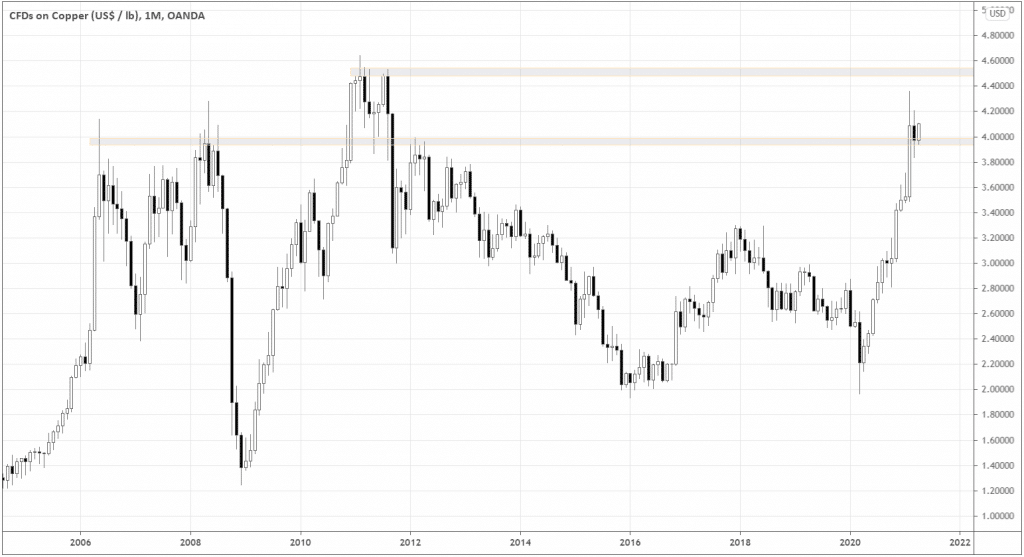

Copper technical analysis

As the hopes of economic recovery rose, commodities got back under the radar, trending higher for several months. Consider Copper. The commodity grew for four consecutive months before it made a pullback in March, as seen in the monthly chart below.

After the market broke the 4.0 resistance level and recovered above it in April, there is still decent room for the upside move until 4.5, where the price may find the next significant resistance.

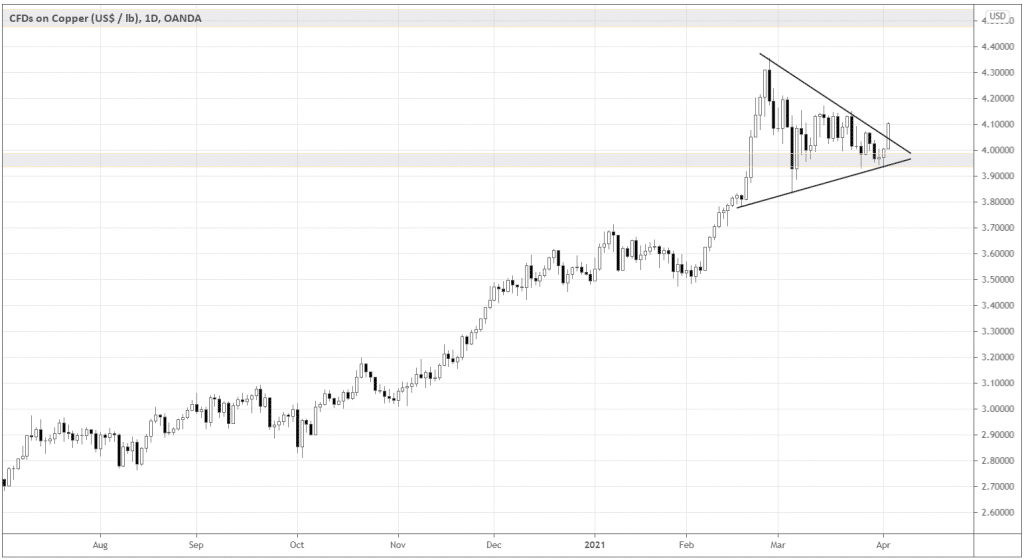

If we zoom in and look at the daily chart, the situation gets even more interesting. As you see in the daily chart below, the market formed a bullish pennant, which is a strong uptrend continuation pattern.

As I’m writing the article, the market is forming a big body white candle that broke that pattern’s upper boundary, triggering short-sellers stop-losses, thus offering an excellent opportunity to join the uptrend.

If the Monday candle closes above the pattern’s upper boundary, traders can open long trades. If you’re more of aggressive trade management, you can set your stop-loss below Monday’s low. More conservative traders can set protective stops below the pattern’s lower boundary.

Depending on your trade management tactic, you may expect the risk-to-reward from 1.6 to 2.2.

Copper fundamentals

Much of the global commodities demand comes from China. Recent China’s data of the industrial firms’ profits shows the surge of 178.9% in January-February 2021, suggesting industrials’ confidence to buy more raw materials as their businesses expand rapidly.

The last week’s LME Copper inventories release shows a decrease of 725 metric tons after the 1950 increase previously, following four positive readings straight. The decrease in inventories creates a shortage and more demand for the commodity, possibly pushing the prices higher. Keep an eye on the next inventory release on Tuesday to gauge how the sentiment develops.

A number of mining companies such as Vedanta, Freeport, and Tsingshan Group are interested in building new copper smelters. This could be the sign of more upcoming demand for Copper, as companies see the need to convert more copper ore in its purest form.

Conclusion

The USD stays bullish following risk assets on the US’s optimistic economic outlook and solid technical factors. The trend continuation technical pattern and bullish fundamentals make Copper an excellent option to profit from the commodities growth cycle.