- US dollar under pressure from FED chairman pushing back on tapering.

- EURUSD rallies to two-week highs on dollar weakness.

- EURJPY rally stalls near 130.00 amid the yen strength.

- Gold turns bullish on dollar weakness above $1800.

- US equity indices rally on rate hikes push back.

The US dollar is on the back foot at the start of the week after sliding to near two-week lows last week. The slide came at the back of the Federal Reserve Chairman Jerome Powell turning out dovish at the Jackson Hole Symposium and pushing back on tapering until year-end. While the FED chair stated that tapering of stimulus measures could begin before year-end, failure to provide a specific timeline sent the market on a tailspin, with the dollar the biggest casualty.

EURUSD eyes $1800

With the dollar under pressure, the EURUSD bounce back gathered steam, powering to two-week highs. The pair turned bullish on Friday, with the upward momentum continuing on Monday morning, resulting in a push to highs of 1.1809. While the pair has since pulled below the 1.1800 psychological level, it remains bullish and well supported for further upside action.

The 1.1760 mark is likely to act as a major support level against any pullback, with the 1.1780 acting as the immediate minor support.

The FED pushing back on any tapering next month is the catalyst behind the risk-on mood that is fuelling demand for riskier currencies such as the euro. The lack of exact timing on tapering signals the gap between taper and rate hike.

In recent weeks, the greenback had strengthened, sending the EURUSD lower on expectations of tapering and rate hikes. With Powell shrugging off such talks, the pair looks set to continue powering high on dollar weakness.

Amid the taper talks, EURUSD’s upward momentum will depend a great deal on the outcome of Germany’s Harmonized Index of Consumer Price index, a key gauge of the block’s inflation.

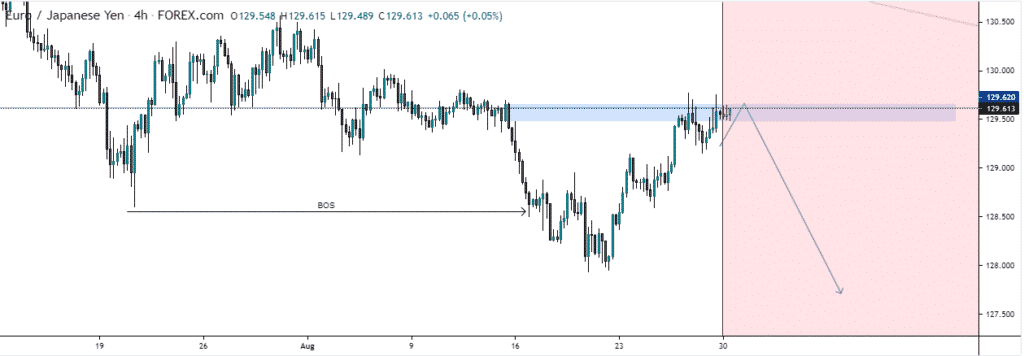

EURJPY rally stalls

Against the Japanese yen, the euro continues to trade in a narrow range, with the EURJPY pair struggling to power through the critical 130.00 level. A bounce back from six-month lows is experiencing strong resistance near the 129.90 level as the yen continues to fend off euro strength.

The euro regained some strength against the yen last week after a strong Purchase Manager Index that stood at 15-year highs in August. However, the gains were limited as a German business, and consumer morale weakened further in the month.

Additionally, the yen gained some ground against the euro as retail sales in Japan rose more than expected in July amid the acceleration of the COVID-19 vaccination. The yen also continues to attract bids as a safe haven amid the deteriorating Delta variant situation that is threatening the global economic slowdown.

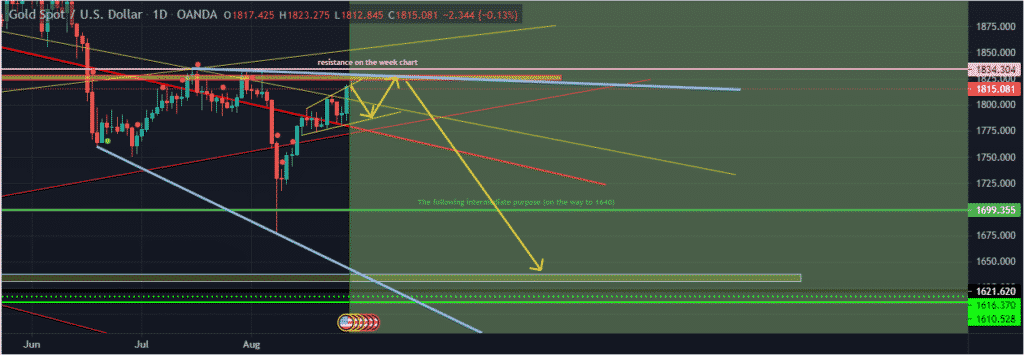

Gold bulls in control

In the commodity markets, gold also turned bullish after powering and finding support above the $1,800 level. The catalyst behind an uptick in the yellow metal price is the FED chair pushing back on tapering until year-end, consequently fuelling dollar weakness.

After powering through the $1,813 level, bulls remain in control and are likely to push XAUUSD to $1834, the next substantial resistance level ahead of $1850.

A spike in open interest in gold futures on Friday by 10.8K ended two consecutive days of declines, all but offering support to an uptick at prices. In addition to an uptick in open interest and a weakened US dollar, XAUUSD remains well supported by an uptick in demand for safe-havens as investors look to hedge their portfolio in the face of escalating COVID-19 situation worldwide.

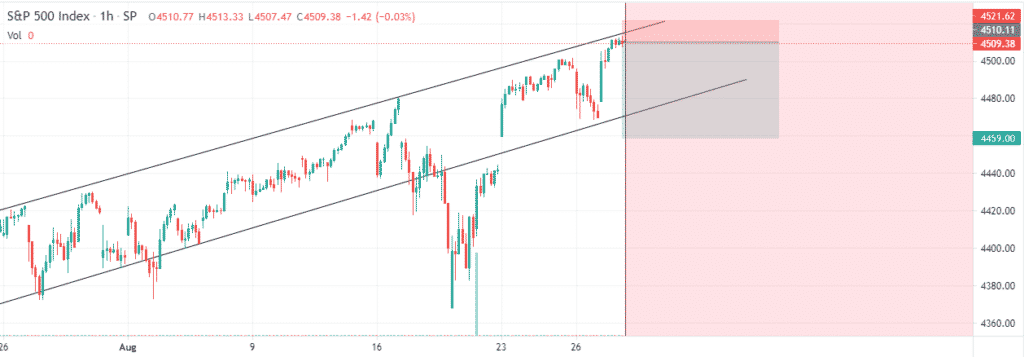

Powell dovishness supports equity markets

In the stock market, major US indices bounced back to record highs on Friday after the FED chairman pushed back on the possibility of rate hikes soon. The markets breathed a sigh of relief after the FED chair reiterated they are not in a rush to hike interest rates even though tapering could start before year-end.

With Monday and Tuesday marking the end of trading days for August, indices look set to remain range-bound as investors await the Non-Farm payroll report on Friday. The S&P 500 is up 2.6% for the month, while the Dow Jones Industrial Average is up 1.5% and NASDAQ up 3.1% for the month.