- US dollar bounces on shrugging off disappointing NFP.

- AUDUSD retreats from two-month highs after RBA remarks.

- AUDJPY is under pressure on renewed yen strength.

- Oil prices are struggling for direction following Saudi price cuts.

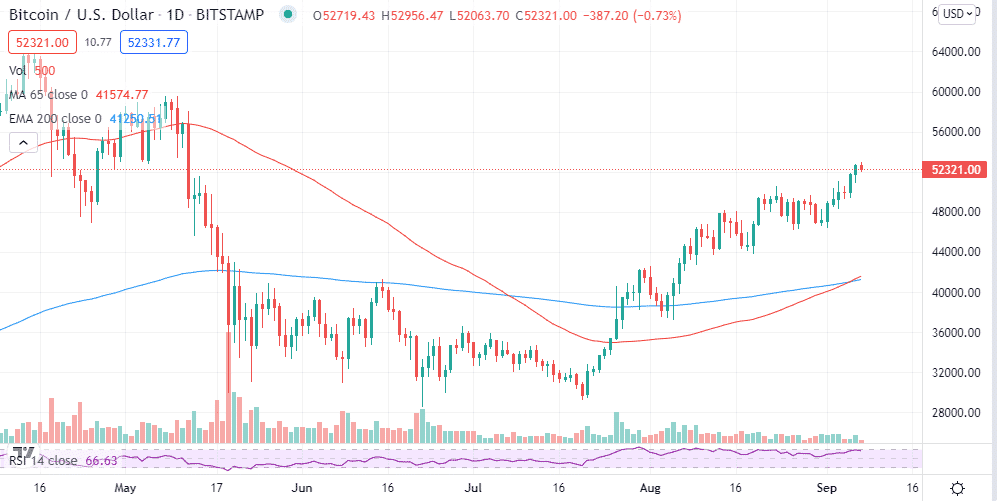

- Bitcoin rally persists, takes out $52,000.

The US dollar was in a recovery mode Tuesday Morning after edging lower last week following a disappointing jobs report. The dollar index, which measures the greenback strength against the majors, appears to have hit strong support near the 92.00 level from where it is trying to bounce back.

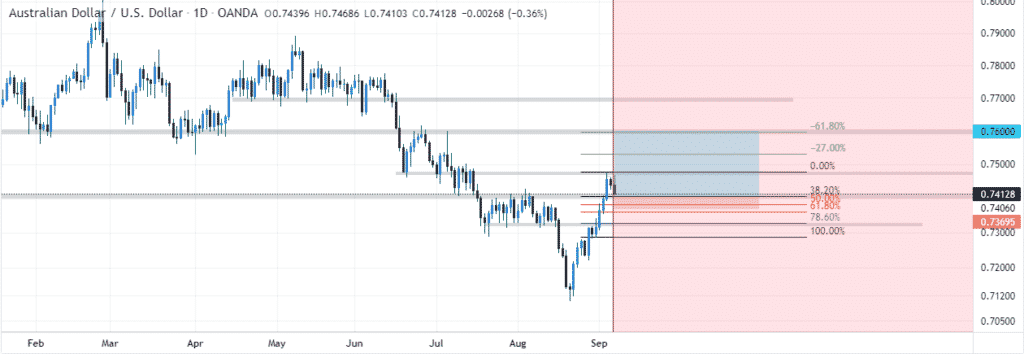

AUDUSD under pressure

A recovering US dollar continues to pile pressure on the AUDUSD pair, which is struggling to hold on to gains in two-month highs. The pair is under immense pressure after the Reserve Bank of Australia spooked the market with dovish remarks.

After struggling to power through the 0.7500 psychological levels, AUDUSD has started edging lower and is at risk of plunging below the 0.7400 handle.

A sell-off followed by a close below the 0.7400 level could trigger renewed sell-off, probably to the 0.7317 mark, the next substantial support level.

Weighing heavily on the Australian dollar against the US dollar is the RBA reiterating its commitment to maintaining the highly accommodative monetary policy. The central bank will continue to purchase government securities at the rate of $4 billion a week until mid-February 2022.

Additionally, the central government has raised concerns about the health of the Australian economy in the face of the Delta outbreak. According to the RBA, recovery has been interrupted by the COVID-19 pandemic. Consequently, GDP is expected to decline in the September quarter with the unemployment rate moving higher.

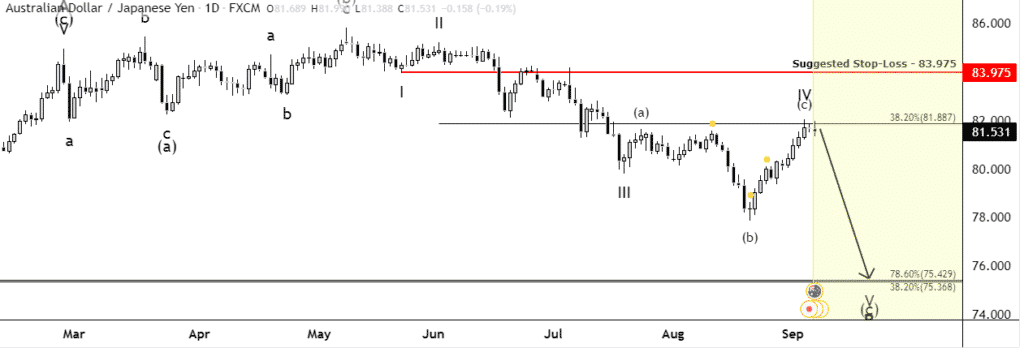

AUDJPY retreats as yen strengthens

With the Australian dollar under pressure amid growing concerns about the health of the Australian economy, AUDJPY has also retreated from two-month highs. Bulls have found the going tough, struggling to fuel a rally past the 82.00 level.

Consequently, AUDJPY has pulled lower, having found strong support near the 81.40 level. The weakness of the AUD against the Japanese yen comesfromn the Australian Bank pushing back on any rate hike before 2024.

A pause on tapering the bond-buying program also weighs heavily on the AUD against the yen, consequently fuelling a pullback from two-month highs.

On the other hand, the Japanese have been gaining some steam across the board following reports that Fumio Kishida is on course to become the island nation’s next prime minister. He is seen as a strong contender to turn around the fortunes of the struggling Japanese economy.

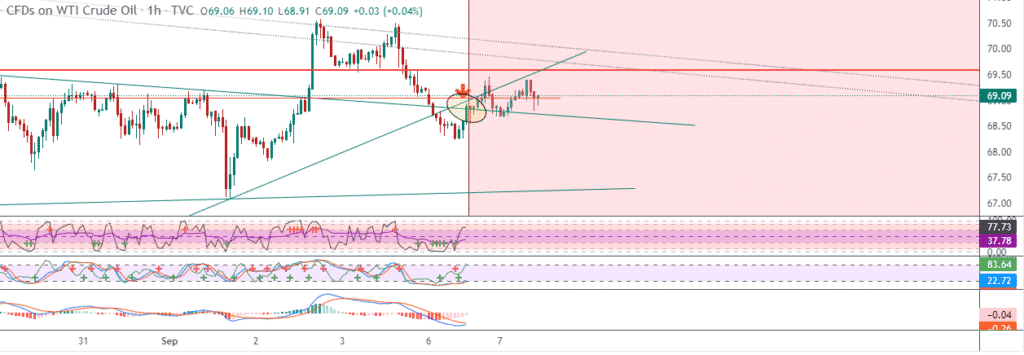

Oil demand woes persist

In the commodity markets, oil prices remain range-bound, struggling to edge higher amid demand concerns. While traders did scoop up some bargains following the recent pullback, US oil is struggling to power through the $70 a barrel level as it continues to trade at about $68.56 a barrel level.

On the other hand, Brent Crude bounced back slightly on Tuesday to $72.57 a barrel after falling 39 cents on Monday.

The mixed sentiments in the oil markets come on the heels of Saudi Arabia cutting its crude contract prices for Asia, all but fuelling concerns about the overall demand outlook. The country’s oil group Aramco has already notified customers that it will cut its October selling prices by at least $1 a barrel. The cut signals that the demand for black gold is tepid.

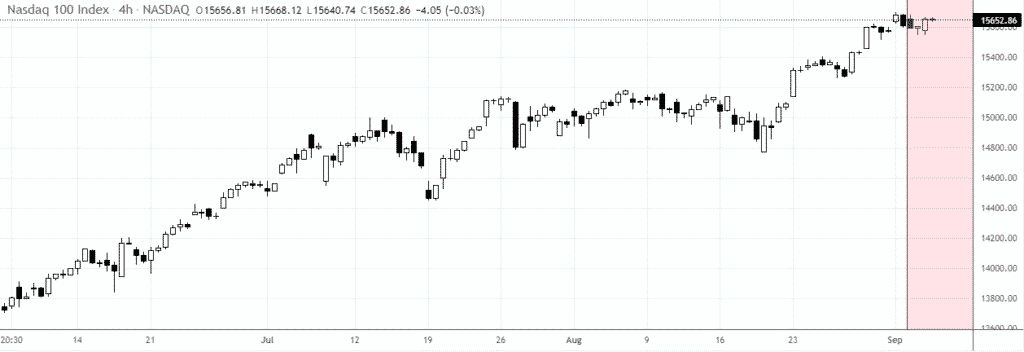

US equity futures rise

US stock futures were trending higher on Tuesday, a day after the Labor Day festivity. The Dow Jones futures were up 0.09% as S&P gained 0.11% and the NASDAQ futures up 0.18%.

Major US equity benchmarks remain elevated at record highs, helped by robust earnings growth and economic recovery from the COVID-19 pandemic. Disappointing jobs report resulting in the easing of tapering talks has also helped offer support to sentiments in the equity market.

Crypto bulls match on

Bitcoin is showing no signs of slowing down even on Ethereum struggling to power through and find support above the $4,000 level in the cryptocurrency market. BTCUSD has since powered through the $52,000 level, with bulls eyeing the $55,000 level.

ETHUSD, on the other hand, experienced some sell-off after a breach of the $4,000 level. The pair has since pulled back to the $3,900 but remains bullish and is likely to continue edging higher.