- U.S. dollar weakness persists after big ADP miss.

- GBPUSD is struggling to capitalize on dollar weakness.

- EURGBP rallies to one-month highs on euro strength.

- Oil prices edge lower on the demand-supply imbalance.

- U.S. equities mixed at the start of September.

The U.S. dollar remains on the defensive against the majors after the ADP National Employment data missed estimates by a big margin ahead of the Non-Farm Payroll on Friday. Weakness in the labor market is already fuelling concerns about the Federal Reserve tapering timeline following last week’s dovish remarks by Chairman Jerome Powell.

The U.S. dollar index has since plunged to three-week lows below the 93.00 levels as weakness prevails ahead of the initial jobless claims later on Thursday and NFP on Friday. U.S. 10-year yield has also dropped below the 1.300 level, all but fuelling dollar weakness.

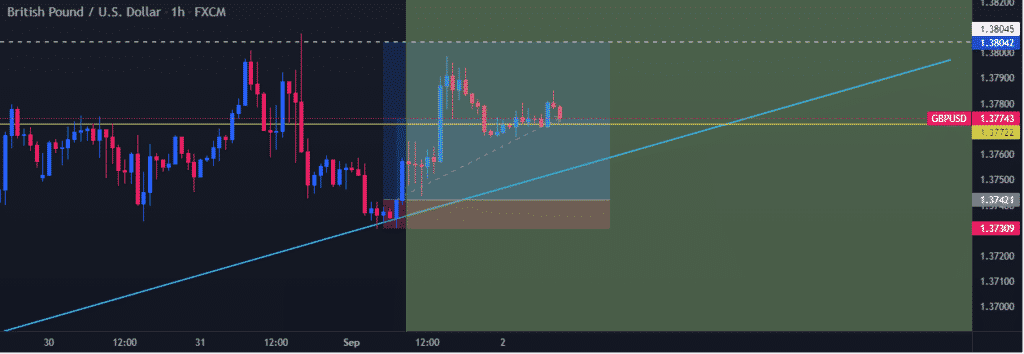

GBPUSD outlook: The pair remains range-bound

However, after last week’s bounce, the GBPUSD pair is struggling to capitalize on the dollar weakness, resorting to trading in a tight trading range. Bulls are struggling to steer the pair above the 1.3800 level, with price action limited to the 1.3720 to 1.3790 range.

The pair looks set to remain range-bound as the markets await the NFP report to ascertain whether the labor market conditions justify tapering before year-end.

Amid the dollar weakness, the British Pound also remains under pressure amid brewing Brexit concerns. Pessimism surrounding the E.U. and the U.K. reaching an agreement over Northern Ireland protocol continues to weigh on the sterling, all but averting any price gains on the GBPUSD pair.

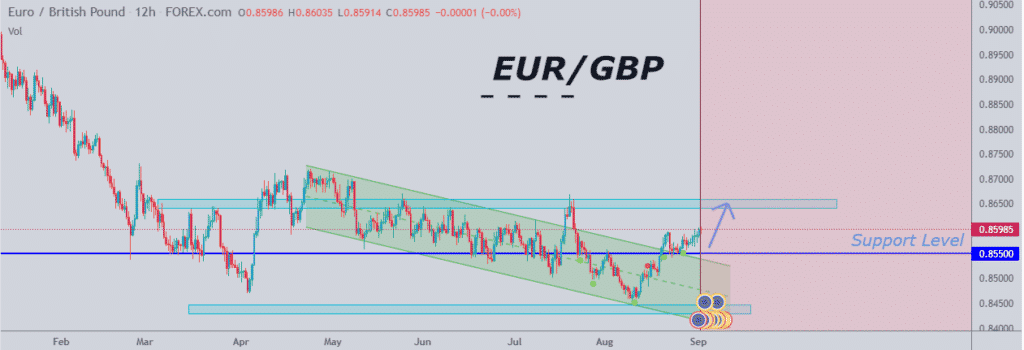

EURGBP outlook: The pair rallies to 1-month high

The pound weakness is the catalyst behind the EURGBP pair powering to one month high. The pair is trading near the 0.8600 level, the positive traction having gained momentum on the euro strengthening to one-month highs against the dollar.

EURGBP remains well supported for further upside action above the 0.8560 level. A rally followed by a close above the 0.8610 level should pave the way for bulls to steer a run to four-month highs above 0.8700.

The euro continues to attract bids in the aftermath of growing calls within the block to taper the accommodative monetary policy. Germany’s Bundesbank President Jens Weidman is fuelling the tapering calls. Additionally, the euro strength against the pound is supported by firmer inflation and a favorable unemployment rate.

In contrast, the U.K. economy is under pressure amid the nation’s battle with a resurgence of Сovid-19 cases with multiple variants.

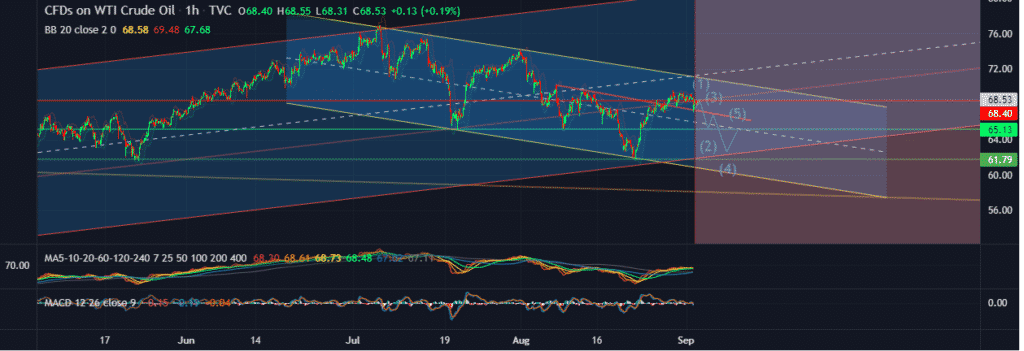

Oil prices tank on supply concerns

In the commodities, oil prices remain under pressure, with OPEC members agreeing to keep a policy of gradually returning supply. The prospects of increased oil supply at a time of wavering demand owing to COVID-19 shocks continue to weigh heavily on sentiments in the oil markets.

U.S. oil is struggling to rise past the $70 a barrel level plunging 0.3% on Thursday to lows of $68 a barrel. Brent crude is also edging lower to lows of $71.43 a barrel.

OPEC members have reached an agreement to continue adding 400,000 barrels a day each month into the market. The increase comes at the worst time as demand has come under pressure due to a slowdown in some big economies.

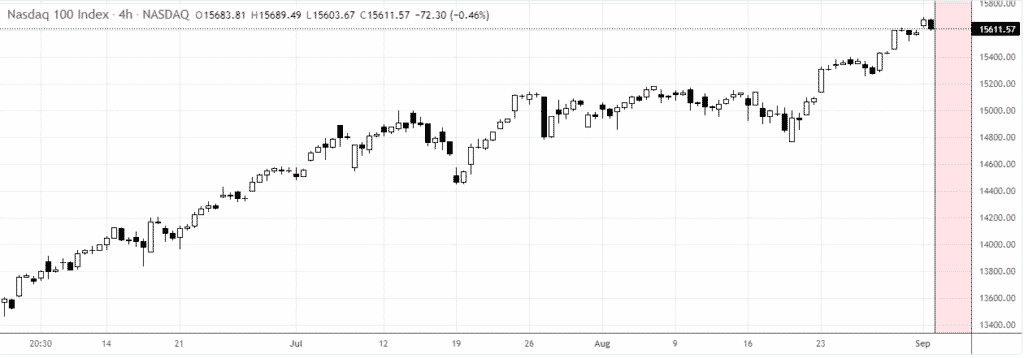

US equity benchmarks at record highs

U.S. equity benchmarks were mixed on the first day of trading in September, billed as one of the toughest for equities. As tech-heavy NASDAQ hit a new record high on rising 0.3%, the S&P 500 was flat, adding 1.41 points. The Dow Jones Industrial Average dipped 48.20 points on Wednesday.

The muted sentiments in the equity markets come at the back of a seven-month winning streak that has seen the benchmark indices edge higher. Disappointing employment report that showed the U.S. companies created fewer jobs of 374,000 against estimates of $600,000 weighed heavily on sentiments.

A disappointing NFP report on Friday could send a signal that the labor market is struggling, all but fuelling concerns about economic growth in the face of COVID-19.