- US dollar under pressure as NFP disappoints.

- USDCAD tanks to three-week lows on dollar weakness.

- AUDUSD shrugs disappointing data, rallies to one-month highs.

- Oil prices rally amid production concerns in the US.

- US equity benchmarks remain elevated at record highs.

The US dollar fell to one-month lows as a disappointing non-farm payroll report rattled the market. The US economy added 235,000 jobs in August compared to 943,000 jobs added in July and 725,000 expected.

The significant drop is expected to fuel the chatter of the Federal Reserve pushing back on tapering at its next meeting, awaiting further confirmation of improvement in the labor market before moving to wind down the accommodative monetary policy.

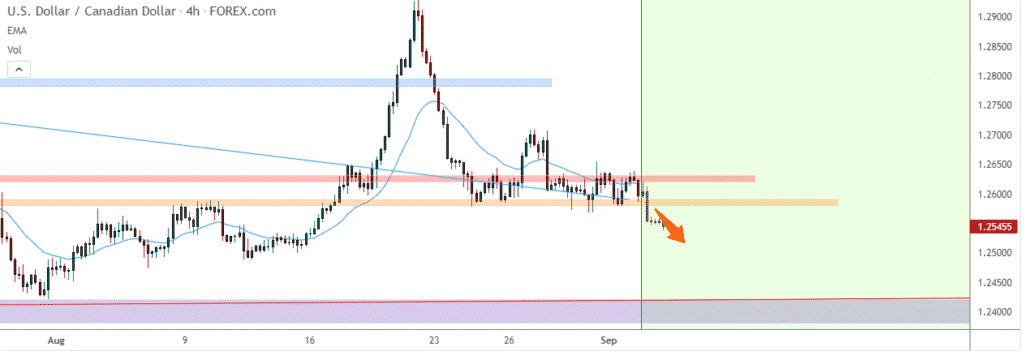

USDCAD sell-off

With the dollar under pressure, the USDCAD pair has turned bearish on tanking below the 1.2600 level in recent days. The slide means the pair is trading near three-week lows.

A sell-off followed by a close below the 1.2500 level could pave the way for bears to push the pair to the 1.2420 level, the next substantial support level. On the contrary, USDCAD will have to close above 1.2580 to fuel any bounce back to 1.2600.

Amid the dollar weakness, a spike in commodity prices, especially oil, has been the main catalyst behind Canadian dollar strength. Higher commodity prices have helped shrug off disappointing Canadian second-quarter GDP data at the start of the week.

AUDUSD at 1-month highs

Taking advantage of the dollar weakness across the board is the Australian dollar which powered to one and a half month high following the disappointing NFP print. The AUDUSD has already rallied past the 0.7400 psychological level and is looking bullish.

Above the 0.7400, AUDUSD remains well supported for further upside action. On the flip side, a slide followed by a close below the critical level could result in the pair tanking to lows of 0.7352, the next substantial support level.

The rally has come at the back of disappointing economic releases out of Australia and China. In July, domestic retail sales in Australia declined 2.7% month over month as China’s Caixin Services PMI dropped to 46.7 versus 52.6 expected. Traders have also continued to shrug off the escalating COVID-19 situation in Australia.

Oil prices rally on US production woes

In the commodity markets, oil prices edged higher early Friday morning as market participants responded to the impact of Hurricane Ida affecting US production in the gulf. With 94% of the gulf remaining shut down, supply concerns have been alleviated, be it for a short while, as major refineries in the US remain offline.

US oil raced to one-month highs above the $70 barrel level amid the production concerns in the US. Brent crude also remains well supported above the $73 a barrel level. Both benchmarks are on course to close the week up by more than 1.6% for the week.

The spike in oil prices also comes at the backdrop of a falling US dollar, making oil cheaper in other countries, consequently fuelling demand.

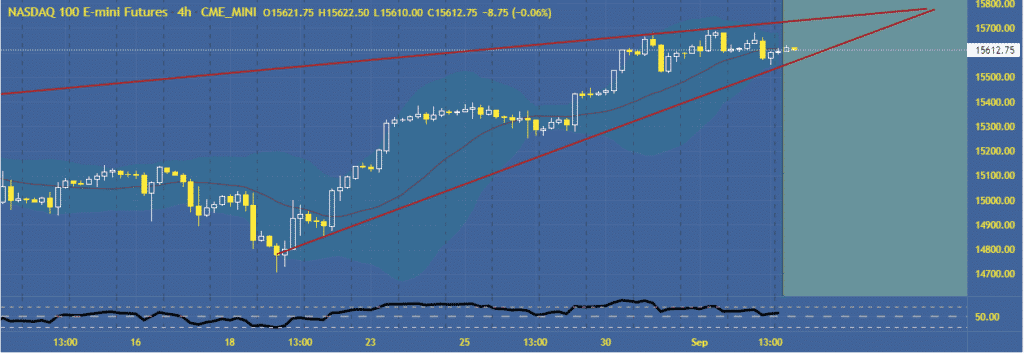

US benchmark rally persists

In the stock market, US equity benchmarks are not showing any signs of slowing down. The indices edged to record highs on Thursday as fresh data from the labor market affirmed ongoing economic recovery.

The Dow Jones Industrial Average rose 0.2% as the S&P 500 hit new record highs after rising 0.3%. The NASDAQ index also posted another record high after rising 0.2%.

The rally in the equity market came as jobless claims dropped to 340,000, reaching a new pandemic low. Data also showed that the US trade deficit narrowed to $70.1 billion in July as consumer spending shifted to in-person services rather than goods.