- US dollar firms amid a thin trading environment.

- USDCAD edges lower as oil prices rise.

- US indices poised for solid yearly gains.

- Cryptocurrencies on the defensive despite yearly gains.

The US dollar is holding firm on the last day of the year, posting small moves to the upwards. The dollar index has firmed above 96.02 but remains under pressure. The dollar strength is supported by initial jobless claims dropping to 198,000 last week, affirming that the job market was unaffected by the spread of the Omicron variant.

Additionally, treasury yield holding steady with the 10-year yield above 1.50% continues to affirm dollar strength.

USDCAD edging lower

However, the Canadian dollar continues to shrug off the dollar strength fuelling a downside action on the USDCAD pair. The pair has since dropped to three-week lows of 1.2729 after breaking through the 1.2762 short-term support.

As the Canadian dollar continues to strengthen, USDCAD could drop to 1.2700, a break below which could fuel a sell-off to lows of 1.2640, the next key support level. On the flip side, bulls need to fuel a rally above the 1.2800 level, to avert further drops.

The sell-off on USDCAD comes on easing Omicron concerns. Easing fears has seen an uptick in risk appetite in the currency market, benefiting the CAD against the greenback. In addition, CAD is strengthening amid an uptick in oil prices with the $80 a barrel level insight.

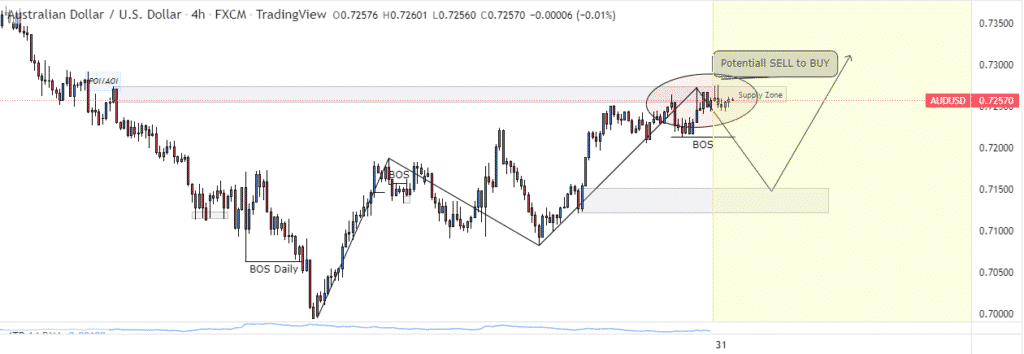

AUDUSD turns bullish

The Australian dollar is another currency benefiting from an uptick in risk appetite in the currency market. The AUDUSD pair has since powered to a one-and-a-half-month high of 0.7258. The pair is currently staring at strong resistance near the 0.7270 level, a breach of which could trigger a rally to the 0.7300 handle.

Sluggishness on dollar strength is not the only factor supporting upward momentum in AUDUSD. Solid economic data out of China, Australia’s biggest trading partner, also continues to offer support to the AUD. China’s NBS Manufacturing PMI grew past 50.1% forecast to 50.3% averting concerns about the economy.

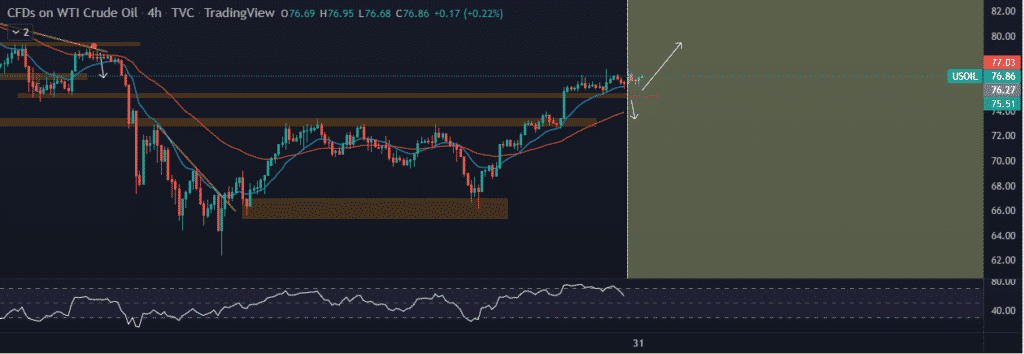

Oil prices edging higher

In the commodity markets, oil prices are set to post their biggest annual gains in more than 12 years as the trading year comes to a close. Brent crude is staring at the $80 a barrel level, trading at around $79.22 a barrel, with US oil trading at about $76.62 a barrel.

Brent is on course to finish the year up 53%, while WTI is heading for a 57% gain in 2021. The gains come on an uptick in economic activity in the aftermath of COVID-19 fuelling strong demand for black gold, therefore driving prices higher. Oil prices are expected to edge higher next year as jet fuel demand catches up.

US indices near record highs

In the equity market, it is a similar story with major indices poised for a third consecutive year of big gains. All the major US indices are trading near record highs heading into 2022. The S&P 500 is headed for a 27% gain for 2021.

The Dow Jones Industrial Average and tech-heavy Nasdaq Index has gained 19% and 22%, respectively, heading into 2022. Amid the gains, signs of potential pullbacks are ringing amid the runaway inflation and a move by policymakers to ease accommodative monetary policies.

Cryptocurrencies on the defensive

In the cryptocurrency market, Bitcoin and Ethereum are on the defensive heading into the year-end. A drop to the $47,340 level leaves BTCUSD flirting with key support near the $45,600 level. However, the flagship crypto is up by more than 70% year to date, heading into 2022.

ETHUSD, on the other hand, has been on an impressive run outperforming Bitcoin, going by the 400% plus gain year to date. However, the pair has come under pressure plunging to the $3,834 level on failing to find support above $4,000.