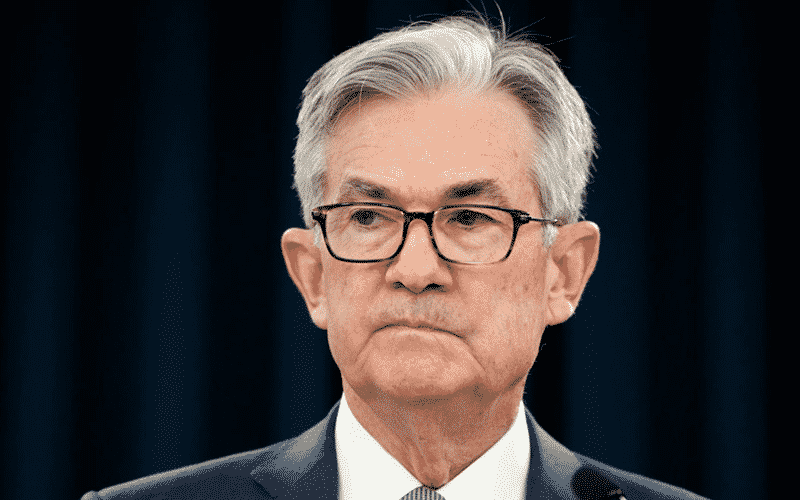

(Fed) Fed’s Chair Jerome Powell has reiterated that the uptick in inflation is temporary, reaffirming the central bank’s plan to taper monthly bond purchases later this year.

The Fed chair did not elaborate when tapering will start, with the process seen unlikely to kick off before early November.

Powell said the economy still has ground to cover to achieve maximum employment and a sustained 2% inflation target, promising to keep the current policy in place.

Powell expects inflation to moderate in the coming months, noting that prices of some items such as used cars are already coming down.

Powell noted that while the Delta variant continued to pose a near-term risk, there are still brighter prospects towards attaining maximum employment.

The Fed is expected to meet on September 21-22 and several officials are already warming up to support bond tapering if the recent momentum of hiring continues.

SPY is up +0.69%, DXY is down -0.37%.