- US dollar holding firm supported by rising treasury yields.

- AUDUSD tanks to two weeks lows.

- USDJPY bulls eye the 116.00 level.

- Oil prices edge higher amid supply concerns.

- Bitcoin and Ethereum tank as sell-off persists.

Despite snapping up a two-week bearish move, the US dollar is struggling to build on recent gains against the majors. The dollar index, which measures the greenback strength, appears to have hit strong resistance near the 96.35 level from where rejections have come into play.

Amid the sluggishness, the greenback has continued to hold steady its sentiments bolstered by a hawkish report from the Federal Reserve that hinted of sooner than expected interest rate hikes. Treasury yields edging higher have also continued to affirm dollar strength against the major. The 10-year yield has already powered to nine-week highs of 1.73%.

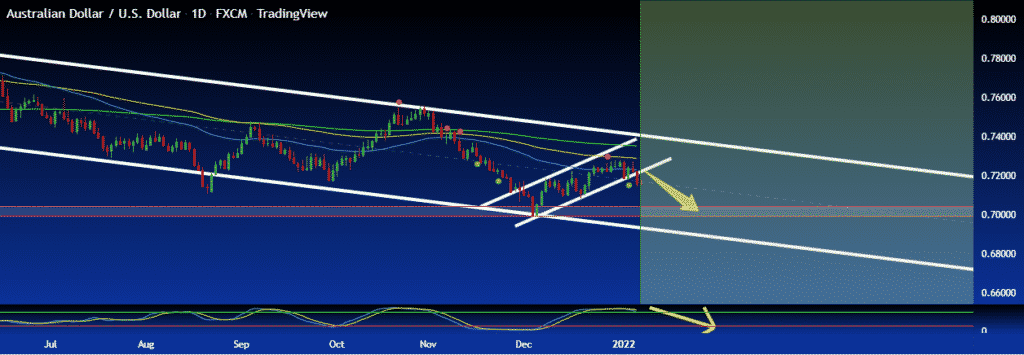

AUDUSD under pressure

The Australian dollar is one of the casualties on the dollar, remaining resilient across the board. After starting the year at five-week highs, AUDUSD has given up most of the gains plunging to two-week lows.

A drop to the 0.7150 level has left AUDUSD susceptible to further losses back to the 0.7080 level. The pair is licking its wounds at two-week lows on the dollar strengthening amid rising US treasury yields. Similarly, hopes that the People’s Bank of China will move to ease monetary policy has offered some support averting the risk of strong moves to the downside.

Looking forward, the focus is on the release of the December Non-Farm Payroll report. The report is expected to show the economy added 410K jobs from 210 in November. Additionally, the unemployment rate is expected to drop to 4.1% from 4.2% A better than expected report could trigger dollar strength which could result in the AUDUSD sliding further.

USDJPY rally to 116.00

Meanwhile, USDJPY is picking up fresh bids, with bulls eyeing the elusive 116.00 level. A spike has fueled the rally in recent days in US treasury yields, seeing market participants shun the safe-haven Japanese yen.

The risk barometer dropping the most since mid-December on easing Omicron variant fears has left the yen on the defensive against the greenback. The US Federal Reserve hinting of interest rates hikes as early as March has only gone to fuel dollar strength, all but sending the USDJPY pair higher. The USDJPY finding support above the 115.63 level means it is well-positioned to make a run for the 116.00 handle.

Oil supply woes

Oil is heading for its best week since December in the commodity markets. Supply worries amid escalating tension in Kazakhstan and outages in Libya have continued to support a spike in oil prices for the better part of the week.

Brent crude is on track to register a 6% gain this week, with prices rallying to their highest level of $82.56 a barrel level since November. The gains have come at the backdrop of the demand-side remaining strong despite the Omicron concerns. With production in Libya and Kazakhstan dropping, a decline in supply could offer support for a further uptick in prices.

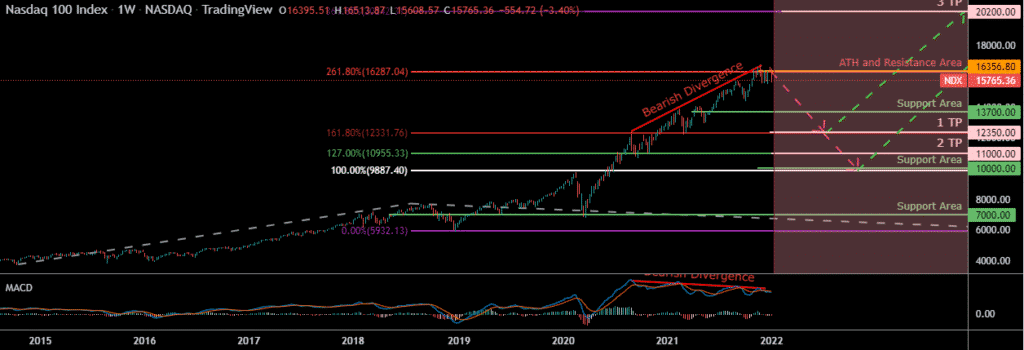

US indices drop

In the equity markets, all the major indices finished on the red on Thursday as investors reacted to the prospects of the Federal Reserve hiking interties rates in March. Tech heavy NASDAQ fell 0.1%, S&P 500 down 0.1%, while the Dow Jones Industrial Average fell 0.6%.

The sell-off comes after all the major indices posted solid gains last year, rallying to record highs as the FED left accommodative policy in place for the better part of the year. The direction the US treasury yields move will determine a great deal on how US marks move.

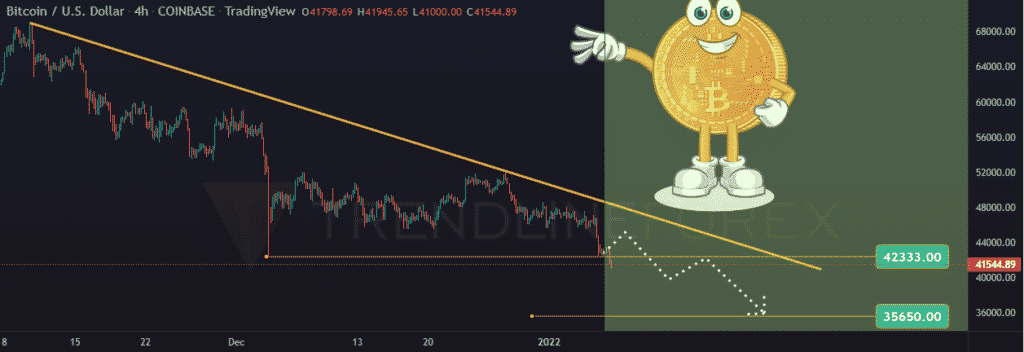

Bitcoin and Ethereum slide

Meanwhile, Bitcoin and Ethereum remain under immense selling pressure in the cryptocurrency market. BTCUSD had dropped to three-month lows of $41,463 and flirted with key support near the $40,000 level.

ETHUSD is also on a three-day losing streak plunging to lows of $3,155. The massive sell-off comes at the backdrop of investors taking profits after a rally to record highs. The dollar strengthening across the board has only moved to fuel the sell-off.