Blue-chip stocks are companies that have a substantial market share in their industries and an overall stable business. They often have a slower growth rate than fast and upcoming companies, but their shareholders can be sure about their returns. In this article, we will look at some of the best blue-chip stocks to buy and hold in 2022.

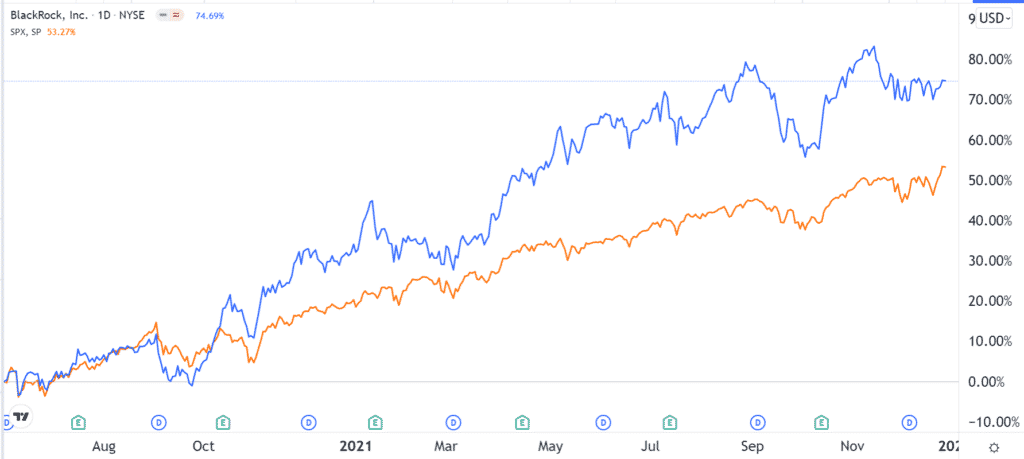

Blackrock

Blackrock (BLK) is the biggest investment company in the world, with $9.5 trillion in assets under management. The company is best-known for iShares, its exchange-traded fund (ETF) business that has trillions of dollars in assets. It bought the business from Barclays after the 2008 Global Financial Crisis.

Because of its scale, Blackrock is the biggest investor in most companies in the US and around the world. It owns $5 trillion worth of equities and $2.8 trillion worth of fixed assets. In addition to these services, the company also owns Aladdin, a technology product that is used by most asset managers globally.

Blackrock has seen its business grow over the last few years. Its revenue has jumped to over $18 billion while its annual profits have soared to about $5 billion. It has also boosted its dividends in the past few years.

Blackrock is a good blue-chip stock to buy because of the steady growth of its business. Analysts expect that its assets will cross $10 trillion in 2022. Also, because of its revenue model, the company will keep making money regardless of the market performance. It makes most of its money from the small expense ratios that it charges its customers.

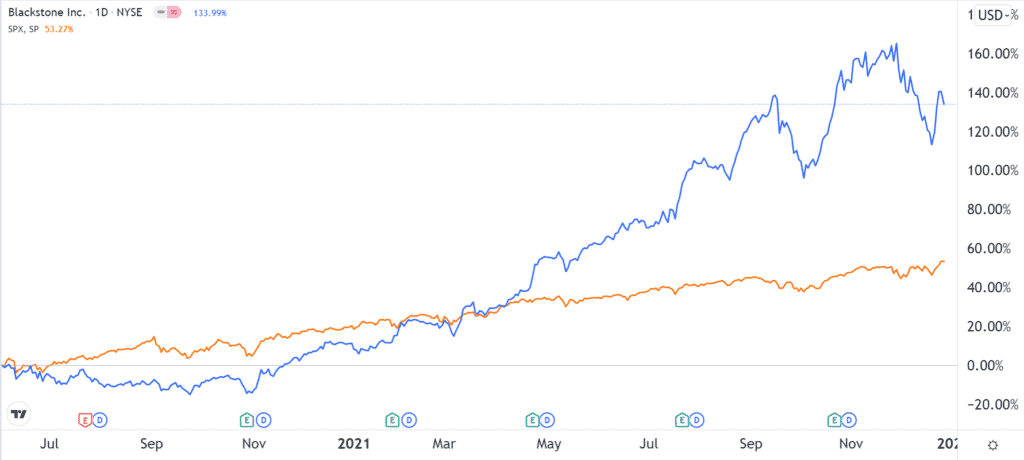

Blackstone

Blackstone (BX) is leading private equity (PE) company that has $731 billion in assets under management. This is a strong performance considering that the firm started 2021 with $649 billion in assets.

The company’s business is divided into four key categories. Its real estate business has $230 billion in assets, making it the biggest owner of real estate projects globally. Its private equity has $242 billion in assets, while its hedge fund and credit and insurance business have $81 billion and $188 billion, respectively.

As one of the biggest PE firms in the world, Blackstone has benefited from the ongoing trend towards private equity long-term investments by pension firms. Subsequently, the company’s revenue has jumped from $4.6 billion in 2017 to $20 billion in the trailing 12 months. Its net income has jumped to $5.2 billion.

Blackstone is a good blue-chip company because of its large size, strong profitability, and the fact that its assets could rise to $1 trillion in the coming years.

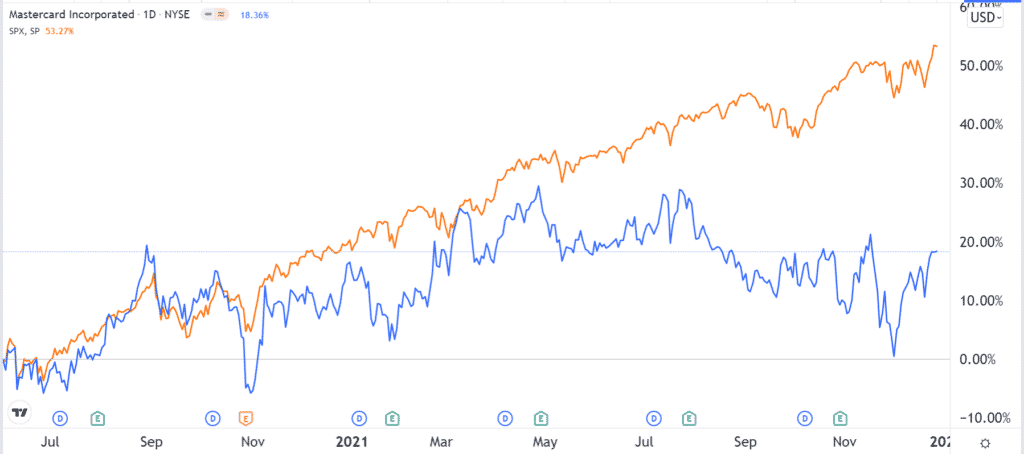

Mastercard

Mastercard is a leading fintech company that is used by millions of people globally. The company provides debit and credit cards that make it possible for people to transact around the world.

Mastercard, Visa, and American Express have one of the best financial models in the world, which explains why they have a net profit margin of almost 50%. The company only provides the technology to banks and other firms.

It then makes a small cut whenever people transact using their cards. As such, it is not exposed to risks such as when someone with a credit card debt defaults.

Mastercard has seen its total revenue and profitability growth over the years. Its revenue declined to $15 billion in 2020 because of the Covid-19 pandemic. Still, in the past 12 months, the company’s revenue has jumped to $17.3 billion.

It is a good blue-chip stock to own for several reasons. First, it has an excellent business model with high-profit margins. Second, the company has a large moat that is difficult to break since it operates in an oligopoly. Third, the firm has more room to grow in the future as more people embrace the use of plastic cards.

Still, a key risk for Mastercard is that the concept of buy now, pay later is getting popular. Also, there have been concerns about the company’s fees.

The chart above portrays the MA performance against the benchmark index. As you see, the stock underperformed in 2021.

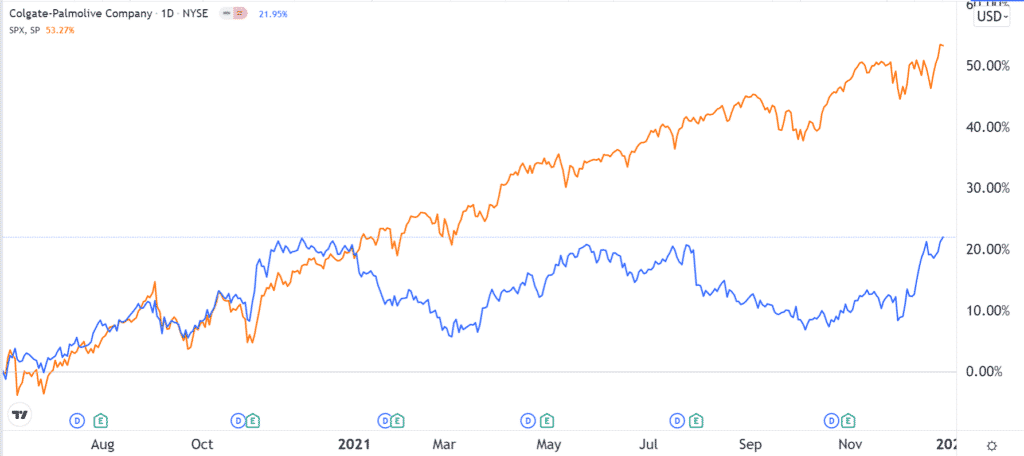

Colgate-Palmolive

Colgate-Palmolive (CL) is a large consumer company that is known well for its toothpaste. It also has other products like charcoal and pet products. Colgate operates globally.

It is an all-weather company that does well in all market conditions. Besides, people will always brush their teeth and feed their pets regardless of the market conditions. This explains why the company’s revenue jumped by about $1 billion in 2020 during the Covid-19 pandemic. Its net income also rose by $320 million during the pandemic.

Colgate-Palmolive is a good blue-chip company to invest in because of its strong brand. For example, its Colgate toothpaste has a market share of about 34% in the US. This is a remarkable number since the industry is highly congested.

Above is the performance of the stock against the broad index. The company is also an excellent friend of shareholders since it has increased its dividends for years.

Intercontinental Exchange (ICE)

Intercontinental Exchange (ICE) is a financial services company that most people have never heard about. Yet it owns some of the biggest brands in the industry.

ICE is the parent company of the New York Stock Exchange (NYSE), the biggest exchange in the United States. It also owns 12 other exchanges and several clearing houses in Europe.

ICE operates in four business segments: exchanges, fixed income and data, mortgage, and technology. In the exchange segment, the firm makes money from stocks listings, agricultural and metals futures and options, cash equities and options, and data and connectivity services.

Like Mastercard, ICE operates a high-margin business. It has a net income margin of about 45%. Also, the company operates in a duopoly since it competes mostly with Nasdaq.

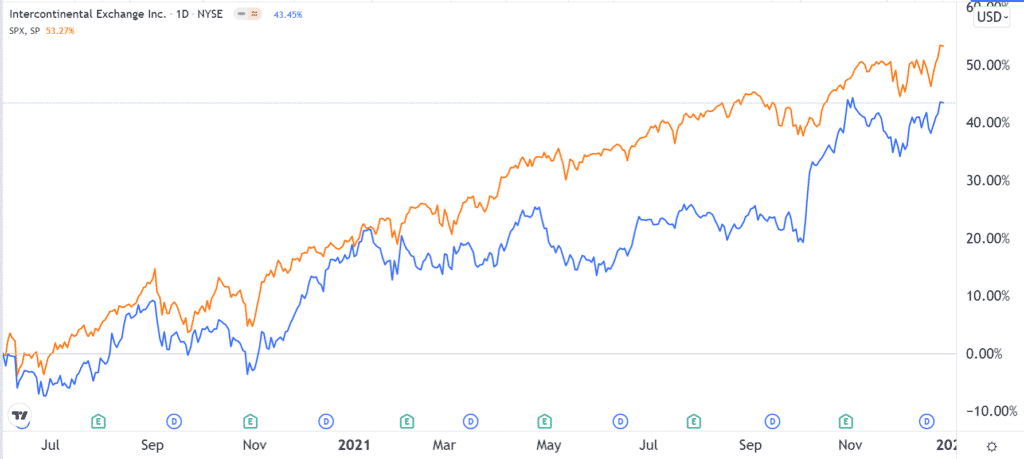

The chart below shows ICE’s performance versus S&P 500.

Also, it operates in an all-weather industry that is rarely affected by economic events. Its revenue jumped by $1 billion in 2020 to $6 billion as the number of SPAC listings soared.

Nasdaq

Nasdaq (NDAQ) is another blue-chip company in the financial services industry. The company is similar to ICE in that it runs one of the best-known exchanges in the US. Its exchange is mostly known for technology companies, which are among the biggest firms in the US.

Nasdaq makes money in a number of ways. For example, new listings pay a fee for the opportunity to list in the exchange. And existing companies pay an annual fee that provides consistent returns for the company. Like ICE, Nasdaq also sells data to other financial services companies.

Broadly, Nasdaq reports its results in the following segments: market services, corporate platforms, market technology, and market intelligence.

Market services include equities, cash equity trading, FICC, and trade management while corporate platforms include listing, investor relations, analytics, index, and ESG products.

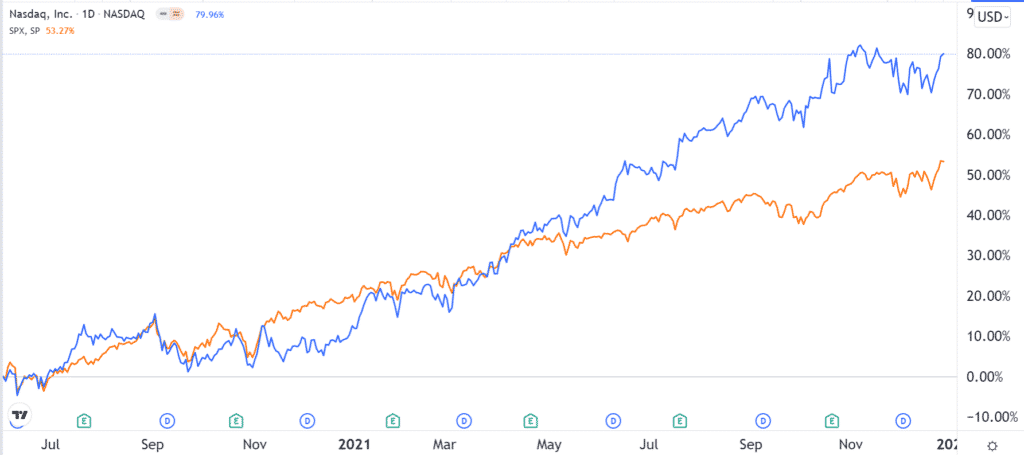

Nasdaq is a good blue-chip stock to own because of the strength of its business, steady income, and high margins.

Nike

Nike (NIKE) is one of the best-known brands in the world. The company has a market cap of $263 billion and annual revenue of over $40 billion. Its revenue dipped by $2 billion to $37 billion in 2020 and then rebounded sharply in 2021. It has a revenue of more than $44 billion in the trailing 12 months. Its profit has also risen to $6.1 billion.

Nike is mostly a sporting goods brand that is well-known for its running, basketball, and soccer brands. The firm has also become a leading player in the fast-growing athleisure business. Also, it sells Air Jordans and other sneakers.

Nike sells its products in its retail stores that total about 1,100 globally. Its fastest-growing segment is its e-commerce business, which accounts for more than 50% of its total revenue.

Nike is a good blue-chip company to invest in for a number of reasons. First, the company has a strong market share in its industry. Second, the firm has a strong edge against its key competitors like Adidas, ANTA, Puma, and Under Armour. Third, it is an excellent rewarder for shareholders through its dividend and buyback policies. Finally, it has a large total addressable market.

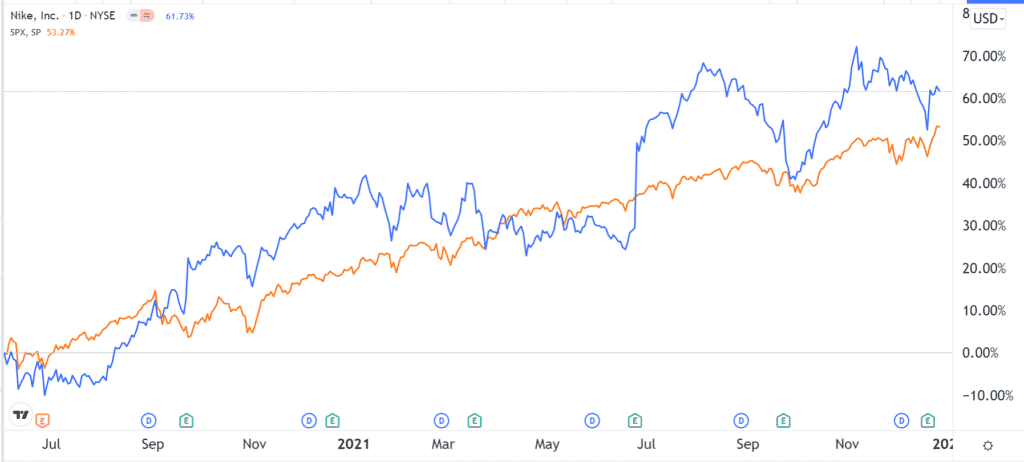

The image above shows how Nike outperformed the benchmark index in 2021.

FactSet Research Systems

FactSet (FDS) is a financial technology company that is not well-known by many Americans. But it is a company that is known well by most people in the investment banking industry. It has a total market cap of more than $18 billion.

FactSet is a company that offers tools and data that helps investors make better decisions in the market. Its services are used by over 160,000 people from around the world. Clients include companies like Blackrock, Goldman Sachs, and Morgan Stanley.

FactSet offers its services across three key segments: Research and advisory, analytics and trading, and CTS. In research, the firm’s software helps investors find good investment ideas, while analytics helps to connect the front and middle-office operations. It competes with the likes of Refinitiv and Bloomberg.

By providing its services to institutional investors, FactSet has managed to keep its revenue very stable over the years. Besides, most institutions rarely cancel their subscriptions, even in tough market conditions. As a result, the company’s revenue has grown steadily to $1.59 billion. Its annual income has risen to $400 million.

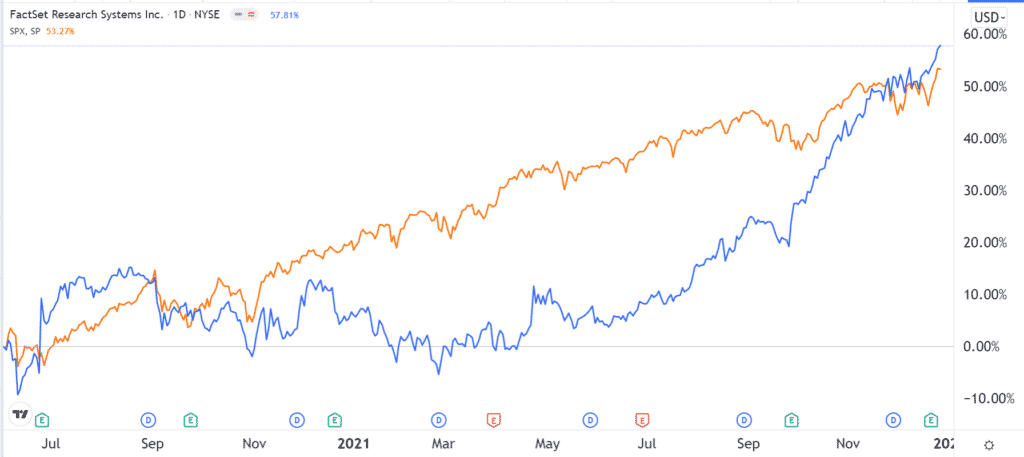

FactSet is a good blue-chip stock to buy because of the nature of its business and the fact that its revenue does well in all market conditions (see the comparison chart above).

Goldman Sachs

Goldman Sachs (GS) is one of the best-known Wall Street banks. It is a storied bank whose history goes back more than 100 years ago.

While many Americans know about Goldman Sachs, a very small percentage of them know how the bank makes its money.

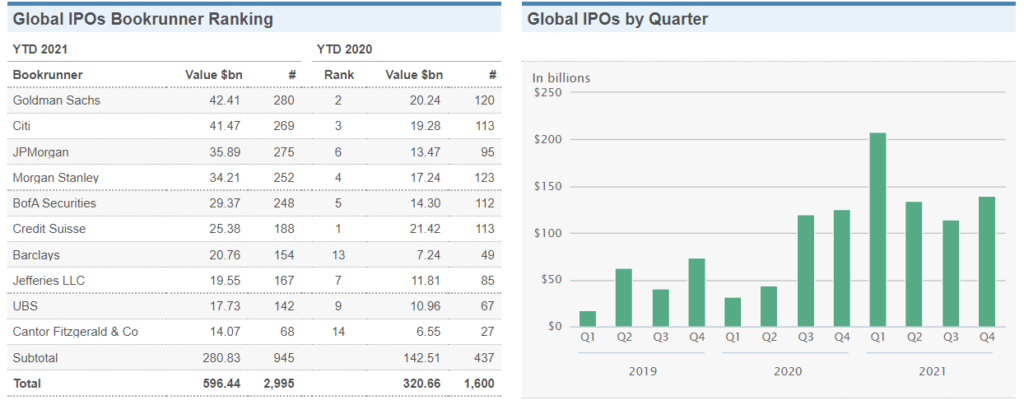

Goldman makes most of its money in investment banking. This is a service where the company helps other firms raise capital in the form of initial public offering (IPO) and debt. It then makes a commission for every deal that it advises.

As shown below, the company was the best performer in 2021 in terms of IPO. It was also the leader in mergers and acquisitions (M&A) and global equity capital markets (ECM). Its total investment banking revenue was second only from JP Morgan.

Goldman Sachs also makes money from global markets, which includes trading and investment, asset management, and consumer and wealth management.

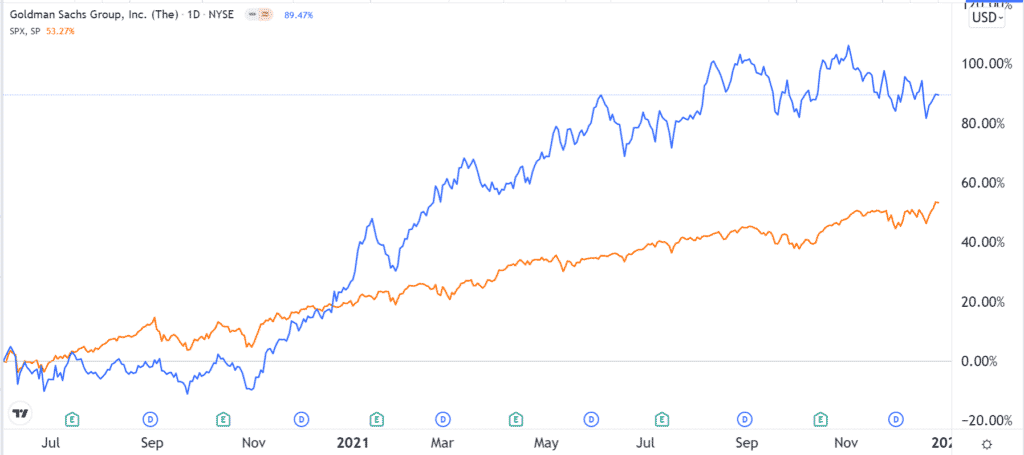

The illustration below shows a vivid GS’s outperformance of the SPX.

The growth of these divisions has led to strong results by the company. Its revenue in the trailing twelve months jumped to $58 billion, which is higher than its 2020 revenue of $41 billion. Its profit also rose to $22.2 billion. Its strong brand and strong growth of its business make Goldman a good blue-chip company to own.

Ford

Ford (F) is a leading automaker that is best known for its leading brands like Ford F-150 and Mustang. It is one of the biggest Detroit automakers.

Ford, like other automakers, has gone through significant challenges in 2021. While demand for its products has risen, the supply chain constraints and the chip shortage have led to key challenges.

The company is also playing catch-up to Tesla, the biggest electric vehicle (EV) company in the world. Tesla is in a pole position, thanks to its brand loyalty and the strong distribution of its charger network.

Ford is also facing the challenge of upstarting auto companies like Rivian. Rivian is a major competitor because it is focusing on the truck and SUV industry that Ford dominates.

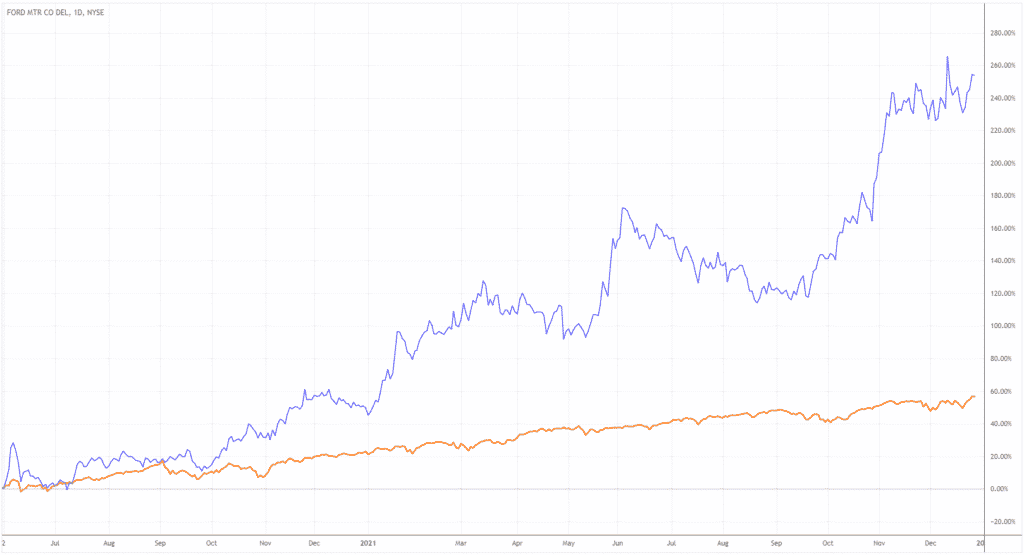

Still, the Ford stock price has done well in the past few years. In 2021, its stock price more than doubled, and many analysts believe that the company is undervalued.

The idea behind this is simple. For example, Rivian is valued at around $85 billion because of its strong pickup reservations. However, Ford’s Lightning electric truck has reservations of more than 200k.

Look how far Ford (blue) outperformed the broad index(orange) in the chart above.

Considering that the F-150 is the best-selling vehicle of all time in America, it is easy to see why analysts believe that Ford is undervalued. In other words, if Ford spun off its Lightning product to be a separate company, it would be a bigger company than Rivian.

Summary

There are many quality blue-chip companies that you can invest in in the United States. As you select the firms to select from, you should use a simple criterion. First, think of companies with a good moat in their businesses. As shown, it is a bit hard for companies like ICE and Nasdaq to be disrupted.

Second, look at their performance during the past crisis. The only firm in this list that struggled during the past two crises is Ford, but it then made a swift recovery. Second, look at its payouts to shareholders.