- US dollar holds steady near one-year highs after NFP miss.

- AUDUSD bounced continues amid dollar softness.

- AUDJPY rallies to three-month highs amid yen weakness.

- Gold under pressure after rejection at $1780.

- US equity posts weekly gain despite Friday loss.

- The Bitcoin rally continues.

The US dollar is holding steady near one-year highs against the majors as the market remains optimistic about the Federal Reserve announcement tapering of the massive bond-buying program next month. The greenback remains undeterred against the majors despite a disappointing jobs report last week that showed the economy added 194,000 jobs, with the unemployment rate improving to 4.8%.

The dollar index, which measures the greenback strength against the majors, is trying to hold on to gains above 94.06 after rejection above 94.50. Despite the softness, the dollar remains well-positioned to strengthen, with the benchmark 10-year Treasury yield rallying to four-month highs of 1.617%.

AUDUSD bounce continues

Amid the dollar softness, the Australian dollar extended its bounce from one-month lows. The AUDUSD has since powered through the 0.7300, touching season highs of 0.7336 at the time of writing.

A rally followed by a close above the 0.7340 should pave the way for bulls to steer AUDUSD to highs of 0.7370. On the flip side, a sell-off below the 0.7300 will reignite renewed sell-off to lows of 0.7224.

The AUD remains on the front foot at the back of a string of positive news over the weekend. New South Wales reopened after over 100 days of the virus-led lockdowns, the vaccination rate having jumped to over 70%. Australia’s COVID infections have declined significantly, raising hopes of economic recovery after months of lockdowns.

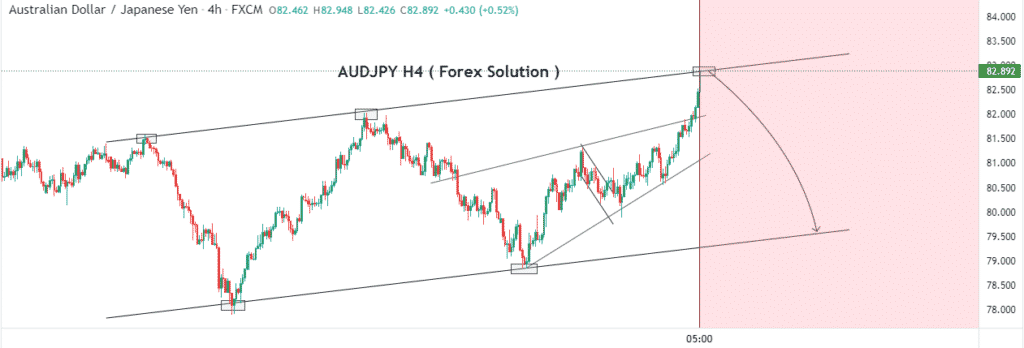

AUDJPY rallies to 3-month highs

Meanwhile, the Australian dollar strengthens against the Japanese yen, which has come under immense pressure in recent days. AUDJPY has since powered to three-month highs above 82.60 and looking increasingly bearish.

The Japanese yen has been hurt by a slight tilt towards riskier currencies at the start of the week, with the Australian dollar and British pound the biggest beneficiaries. Additionally, the Australian dollar remains well supported for further gains against the yen on the strong commodity prices.

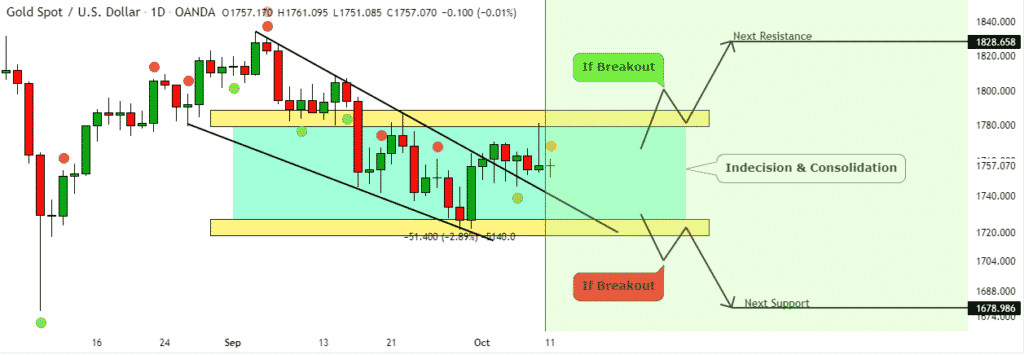

Gold under pressure

In the commodity markets, gold remains under pressure at the start of the week after powering to highs of $1780 on Friday, only to retreat and stay on the back foot. The technical outlook remains bearish, with XAUUSD susceptible to further losses on tanking below the $1750 level.

Failure to find support above the $1770 level has once again affirmed bears are in control and likely to fuel a sell-off to lows of $1725. XAUUSD should remain under pressure, especially on US treasury yields rising to four-month highs and triggering demand for yield-bearing securities.

US equity bounce back

In the equity markets, major benchmark indices booked weekly gains last week despite stocks edging lower on Friday. Technology stocks remain under pressure amid rising bond yields that continue to fuel chatter of the Federal Reserve hiking interest rates.

The Dow Jones Industrial Average fell 0.03% on Friday to close at 34,746 while the S&P 500 fell 0.19%, and tech-heavy NASDAQ lost 0.51%. For the week, the Dow was up 1.2% as the S&P 500 rose 0.8% and the NASDAQ rose 0.1%.

Benchmark indices finished lower on Friday as investors continue to assess whether the disappointing jobs report is sufficient to keep the Federal Reserve on track to taper monetary policy. Rising Treasury yields already hint that the disappointing jobs report won’t derail the central bank’s plans.

Bitcoin eyes $60,000

Meanwhile, Bitcoin continues to edge higher, powering through the $55,000 level with the $60,000 level now insight. BTCUSD has been in fine form ever since it bounced off the $40,000 level powering through the $50,000 level.

BTCUSD faces strong resistance near the $59,600 level above which it rallied to highs of $63, 000 ahead of all-time highs of $64,000.