- BTCUSD is trading in a tight trading range but with a bearish bias.

- EURUSD has bounced back following dovish sentiments by the Fed chair.

- EURGBP has bounced off three months, shrugging off pound strength.

- XAUUSD is shrugging off dollar strength powering to $1820.

Bitcoin prices have resorted to trading in a well-defined range after imploding from record highs and struggling to find support above the $40,000 level. BTCUSD price action remains restricted in the $32,000 to $35,000 trading range amid the lack of catalysts needed to trigger breakouts.

After rallying to record highs of $64,000, Bitcoin has lost all the gains and is now flirting with five months’ lows. It’s becoming increasingly clear that the flagship cryptocurrency is in consolidation mode, after which breakouts could come into play.

With the current sentiment being extremely bearish, the prospect of BTCUSD edging lower is higher. Soaring bearish pressure could see the pair breaking below the $30,000 level below which a sell-off to the $28,000 level could come into play. On the flipside, BTC will have to rally and find support above the $36,000 level to have any chance of bouncing back to the $40,000 level.

Fundamentally, Bitcoin is bearish as regulatory concerns and crackdowns in China continue to weigh heavily on the cryptocurrency sentiments. Institutional interest, which was the key driver behind the previous rally to record highs, has cooled off in the aftermath of Tesla banning BTC payments and China cracking down on BTC trading and mining.

EURUSD bounce back

The EURUSD pair has retaken the 1.1800 level in the forex market after coming under pressure on Tuesday in the aftermath of stronger than expected US CPI data for June. The pair finding support above the 1.1800 level comes on the US yields declining and the US dollar weakening on the Federal Reserve chair Jerome Powell insisting that inflation is transitory and will lose traction.

The pair finding support above the 1.1800 level increases the prospects of bulls coming into play and fueling a rally back to the 1.1900 level.

In contrast, a sell-off below the 1.1800 level would only fuel another leg lower. Price action around the pair is likely to remain fixated on dollar dynamics as support for the euro remains mitigated by a lot of weak economic data in the Eurozone.

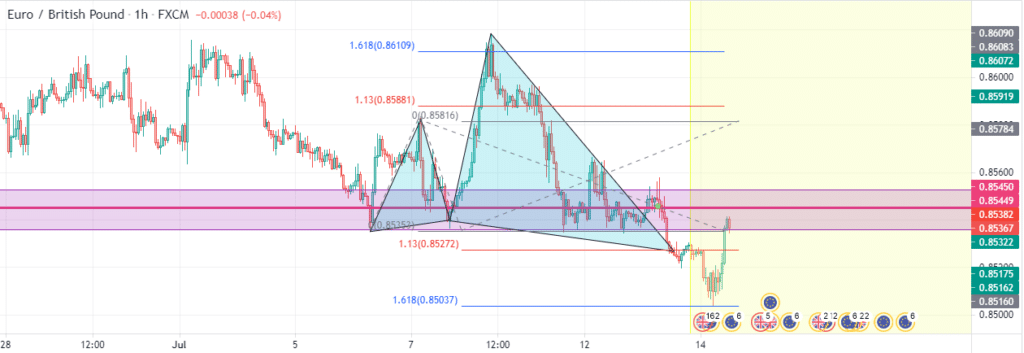

EURGBP breakout

A resurgent euro is one reason EURGBP did bounce back from three-month lows after coming under pressure early Wednesday morning. The British pound was on the front foot against the common currency early in the day, buoyed by stronger than expected UK CPI data for June.

The EURGBP has since retaken the 0.8500, waiting to see if the bulls have what it takes to push the pair higher. The British pound is the center of attention after the UK CPI data for June rose to 2.5% year over year, the highest level in more than three years.

Gold resilient against the dollar

Gold is yet again on the front foot for the second day running in the commodity market, helped by the greenback’s weakness. XAUUSD has since broken out of a tight trading range of between $1800 and $1813. The pair is currently trading near one-month highs of $1830.

XAUUSD rallying and finding support above $1830 would open the door for bulls to push the precious metal back to the $1850 levels.

The breakout has mostly been fuelled by dovish comments by the Federal Reserve chair, who insists inflationary pressure is temporary and likely to fade away. The sentiments have only gone to ease fears about the Fed hiking interest rates soon.

Investors scaling back on their expectations about policy tightening by the Fed are one of the factors offering support to the precious metal, consequently triggering a spike in prices.

US equity standoff

In the equity markets, fears of rising inflation are once again pilling pressure on investors’ sentiments. All the major indices are struggling to hold on to gains at all-time highs, with pullbacks coming into play. However, pullbacks in recent days have emerged as buying opportunities from where bulls have come in and pushed the indices higher.

Fed monetary policy has been the catalyst behind the bull run in the markets since the pandemic started. Similarly, signs or hints of the Fed starting to withdraw the monetary policies continue to spark turbulence in asset prices.