- US dollar firms near one-year highs on rising energy prices.

- NZDUSD is struggling for direction amid dollar strength.

- USDCAD drops to two-month lows on higher oil prices.

- Oil prices retreat but are still above seven-year highs.

- US benchmark indices sell-off persists amid inflationary concerns.

The US dollar remains elevated near one-year highs after attracting safe-haven flows amid soaring energy prices. Growing expectations that the Federal Reserve will announce the tapering of bond purchases in November has also continued to fuel greenback strength against the majors.

The dollar index, which measures the greenback strength against the majors, touched highs of 94.32 on Tuesday as it closed in on one-year highs above 94.50. The US 10-year yield rallying to four-month highs of 1.617% should continue to fuel greenbacks strength against the majors, despite the disappointing jobs report last week.

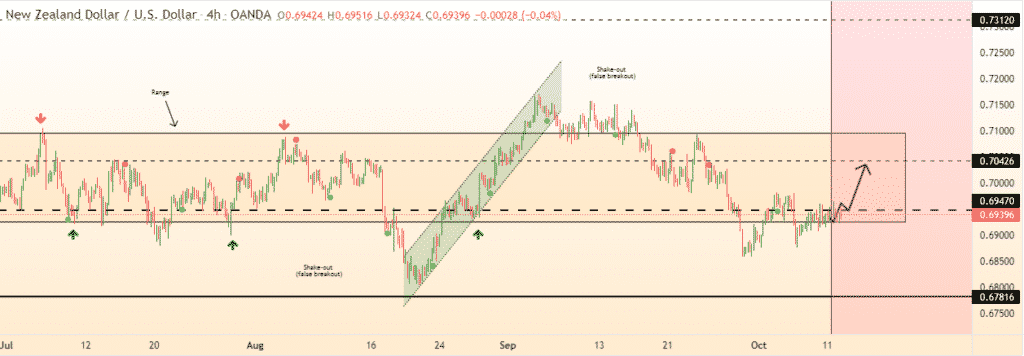

NZDUSD range-bound

Amid the dollar strength, NZDUSD is struggling for direction, remaining range-bound after struggling to power through the 0.7000 psychological level. Bulls have struggled to fuel a rally above the 0.6960 level, where the pair continues to experience strong resistance.

On the flipside, 0.6909 has emerged as a crucial support level from which bulls have come into play and helped steer the rally to the 0.6960 resistance level.

The buying pressure on the US dollar continues to keep the pair edgy, averting any possible upside action. A surge in oil prices has triggered capital inflows to the greenback as a safe haven, all but fuelling pressure on the NZD.

Additionally, NZD has been weighed heavily against the dollar on New Zealand Prime minister Jacinda Arden reiterating Auckland will remain in alert level 3 for at least one more week. Waikato and Northland also remain under lockdown, all but putting pressure on economic activities.

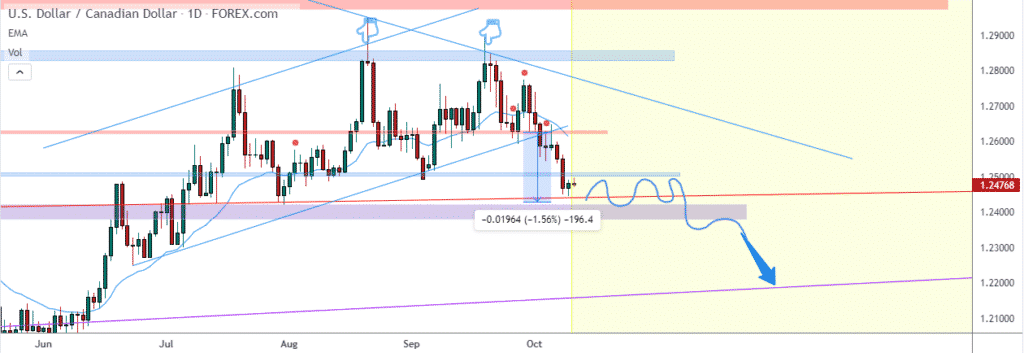

USDCAD at two-month lows

Meanwhile, USDCAD remains muted despite US oil powering through the $80 barrier. However, the pair remains subdued at two-month lows affirming Canadian dollar strength against the greenback. The 1.2449 has emerged as a crucial support level from which the pair has continued to bounce.

Additionally, bulls have struggled to fuel a rally above the 1.2500 level despite the dollar strength across the board. Better than expected Canadian employment data last week has also affirmed sentiments about the economy, all but fuelling CAD strength against the buck.

The prospects of another cut by the Bank of Canada on the asset-buying scheme should continue to offer support to the CAD, likely to fuel further movements to the downside on the USDCAD pair.

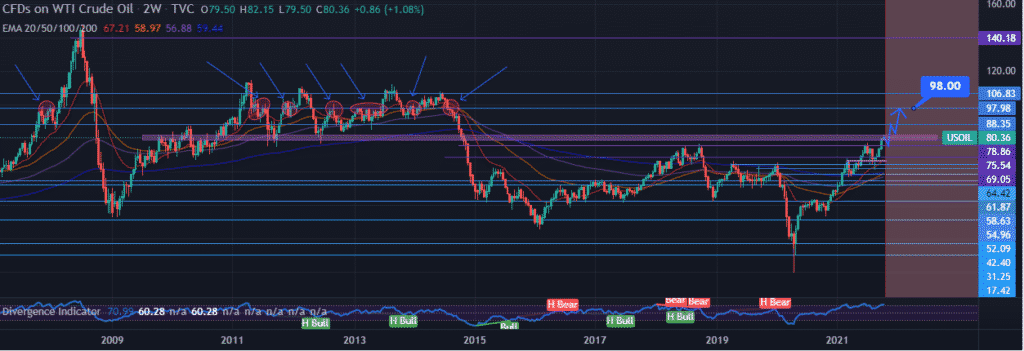

Oil prices retreat

In the commodity markets, oil prices were down Tuesday morning but continued to hold above the 80 a barrel level. Brent crude was down 5 cents to $83.59 after touching three-year highs on Monday. US oil, on the other hand, was down 13 cents after gaining 1.5% on Monday to seven-year highs above $80.39 a barrel.

Despite the pullback, there is plenty of momentum for the higher oil process as fundamentals remain favorable. Energy shortages in Asia, Europe, and the US continue to affirm the case for a spike in prices. Rising natural gas prices are forcing power plants around the world to resort to crude oil, all but pushing demand higher.

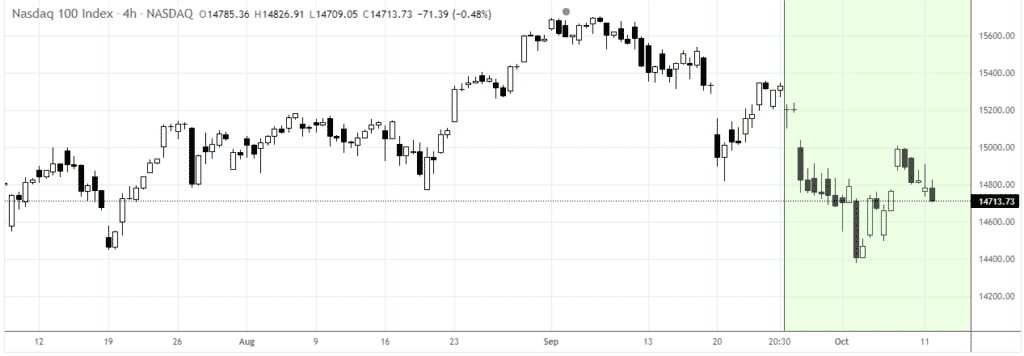

US benchmark sell-off

In the equity markets, US stocks started the week on the back foot, with major indices finishing on the red as a surge in oil prices fuelled inflationary pressures. The S&P 500 and the Dow Jones Industrial Average fell 0.7% each as NASDAQ fell 0.6%.

Stocks fell amid growing concerns that runaway inflation will force the Fed’s hands into tapering. A report by Goldman Sachs indicates that Post-pandemic recovery has slowed and weighs heavily on sentiments fuelling a cautious approach. Investors also remain fixated on the earning session, which starts later in the week.

Bitcoin and Ethereum rally stalls

Meanwhile, Bitcoin and Ethereum are under pressure after a recent spike to five-month highs. BTCUSD is struggling to power through the $58,000 level. However, the bullish bias remains in place, and the pair could power to highs of 59,731 at the next resistance level.

Ethereum, on the other hand, is under immense pressure to hold on to gains above $3,500 ahead of a critical resistance level near $3,672.