- US dollar on the front foot ahead of the NFP report.

- EURUSD under pressure at one-year lows.

- EURGBP trying to bounce back amid euro weakness.

- Oil prices race higher amid market tightening.

- Bitcoin and Ethereum rally persists.

The US dollar is on the front foot against the major peers ahead of the much-awaited Nonfarm Payroll report later in the day. The outcome of the jobs report is likely to provide clues on the pace of Federal Reserve policy normalization.

The dollar index, which measures the greenback strength against the basket of six peers, has already found support above the 94.20 level but slightly below last week’s one-year peak of 94.50. Dollar strength in the recent past has been fuelled by rising Treasury yields, with the 10-year note hitting three-month highs at 1.60%.

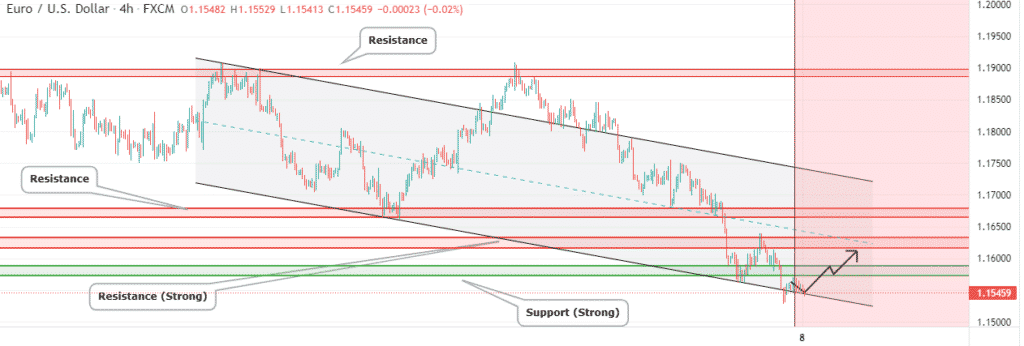

EURUSD weakness

Amid the dollar strength across the board, the euro has come under pressure, with the EURUSD sliding to one-year lows at 1.1535 levels.

Amid the bearish biases, EURUSD remains susceptible to further losses to the 1.1500 level, especially on the NFP report affirming the need for asset tapering. On the flip side, a bounce-back above the 1.1600 level could help fuel a rally from one-year lows.

Current estimates signal the Nonfarm Payroll report rising by 488k versus the prior 235K. The unemployment rate is expected to ease to lows of 5.1% versus the prior 5.2%. A better-than-expected report on this front should fuel tapering talks sending the dollar higher and EURUSD lower.

EURGBP bounce back

Meanwhile, the EURGBP pair is trying to bounce back after sliding to one-month lows below the 0.8500 level. Below the critical 0.8500 level, the pair remains susceptible to further losses to the 0.8407 level. On the flip side, a rally followed by close above the 0.8500 should affirm the bounce back from one-month lows.

The EURGBP has come under immense pressure on the euro, weakening across the board on the European Central Bank failing to offer a clear path to asset tapering. Multiple policymakers from the bloc’s central bank have continued to reject reflation fears and monetary policy tightening concerns.

Oil prices rally

In the commodity markets, oil prices are heading for a seventh weekly gain, the longest run since prices plunged to record lows in the aftermath of the COVID-19 pandemic. US oil futures are closing in on the $80 barrel level after edging higher 1.1% Friday morning to highs of $79 a barrel.

Oil prices edged higher on Thursday after the US Energy department reiterated it had no plans to tap the nation’s oil reserves. The remarks came on the heels of the energy secretary reiterating that stockpiles were being used to counter surging gasoline prices.

However, it is oil cartel OPEC’s failure to boost supply, opting to stick with a 400,000 barrel a day increase amid the tightening market that continues to send prices higher. Recovery in the global economy from the pandemic and the disruption in the Gulf of Mexico have resulted in the tightening of the oil market, fuelling a spike in prices.

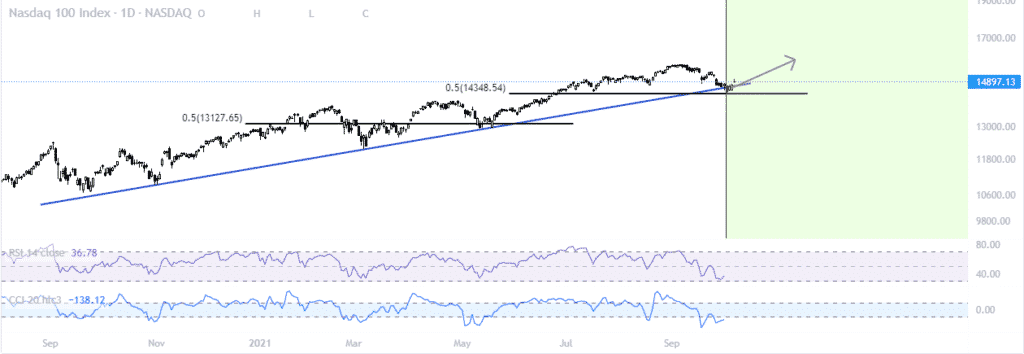

US equities rally

Major equity benchmarks edged higher on Thursday as the US Senate reached an agreement on a stop-gap measure to extend the debt ceiling. The proposed agreement raised the debt ceiling by $480 billion. With the deal, the S&P 500 closed 0.8% higher as NASDAQ gained 1.1%.

The two indices are now in positive territory after losing more than 5% in September. However, investor sentiments remain jittery ahead of a pivotal nonfarm payroll report. The outcome of the report could have a huge say on monetary policy tapering.

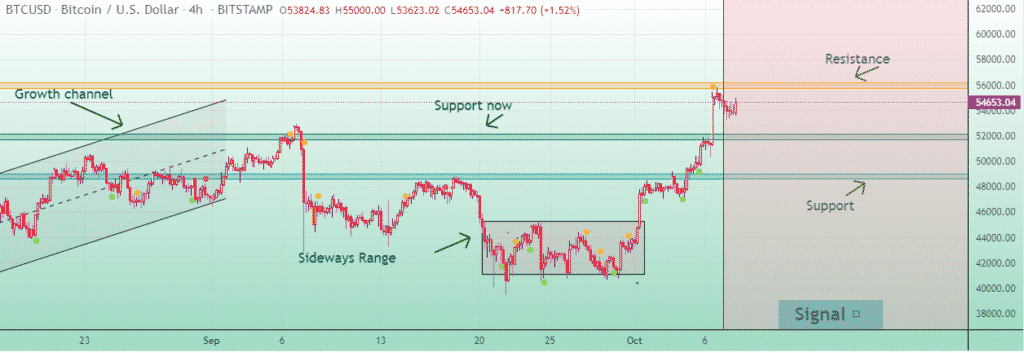

Bitcoin & Ethereum bounce back

In the cryptocurrency market, Bitcoin and Ethereum are poised to finish the week on a high above critical support levels. BTCUSD has been on a fine run this week, powering through the $50,000 level to highs of $55,891.

While BTCUSD has pulled lower to about $54,514, it remains well supported for further price gains. On the other hand, ETHUSD also remains well supported for further upside action after powering through the $3,500 level.