- Japanese stocks rise after the government reaffirms its commitment to bring the pandemic under control and host the Olympics.

- Australia’s mining and financial sectors rise in China’s economic optimism.

- Korean investors look past Samsung leader’s jail sentencing to drive up stocks.

Asian stocks generally rose Tuesday as China’s positive economic data for the final quarter of 2020 bolstered investor sentiment. Hong Kong continues to benefit from mainland capital inflow amid the hunt for bargains.

Japan stocks rise as government talks getting the pandemic under control

Stocks of Japanese companies rose a day after PM Yoshihide Suga said the government is focused on getting the pandemic under control and ensuring the country hosts the 2021 Olympics in the summer. Investors have recently traded Japanese shares cautiously after the government put the capital Tokyo under curfew amid spiking coronavirus cases.

The Nikkei 225 Index advanced 1.39% to 28,633.46. The broader market benchmark Topix rose 0.56% to 1,855.84. Auto and semiconductor companies were investors’ favorite stocks. The charts show the bears struck early in Japanese stocks, but the bulls swiftly repelled them and took charge to the closing bell.

In addition to the government’s assurance about getting the pandemic under control, investors also poured on Japanese stocks in the hunt for bargains following recent selloffs. Moreover, China’s encouraging economic data also appeared to be in play.

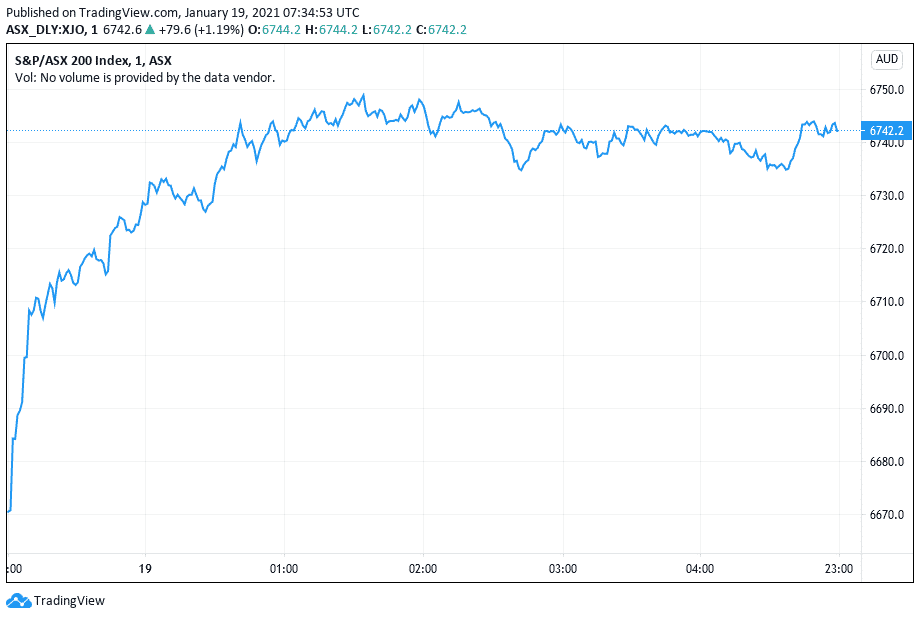

Australia stocks jump as mining and financial companies shine

Trading Australian shares wrapped up on a positive note, with mining and financial sectors leading the gains. The S&P/ASX 200 index advanced 1.2% to 6,742.60. The bears sought to take control immediately, trading began, but the bulls stopped them in their tracks and remained in control until the closing bell.

The hunt for bargains after the index’s 0.8% decline in the previous session and positive economic data out of China appeared to be in play in the Australian stock market. China’s economy grew at a faster pace than expected in the final quarter of 2020. China is Australia’s largest trading partner, so investors believe Australian companies will benefit from its economic recovery.

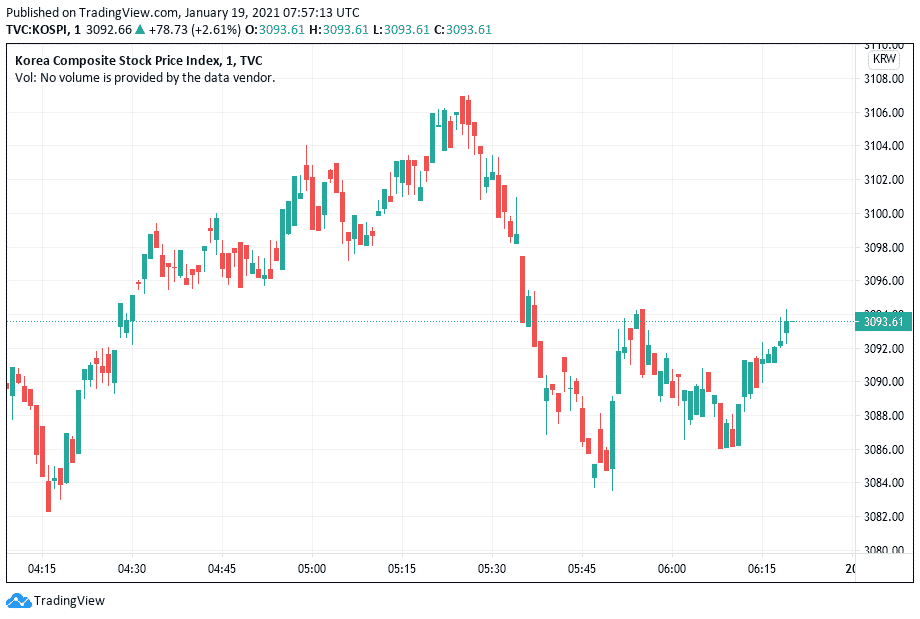

Samsung rebound drives Korean stocks

South Korean stock market benchmark KOSPI gained 2.61% to 3,092.66, marking its best day in more than a week. The bears attempted to take charge in KOSPI stocks as soon as trading began, but the bulls overpowered them around noon and controlled the scene to the closing bell.

Leading the index higher were stocks of Samsung Electronics and automaker Hyundai Motor. Samsung rebound from a sharp selloff the previous day that was triggered by the jailing of its leader. Foreign investors were largely responsible for the KOSPI’s rise.

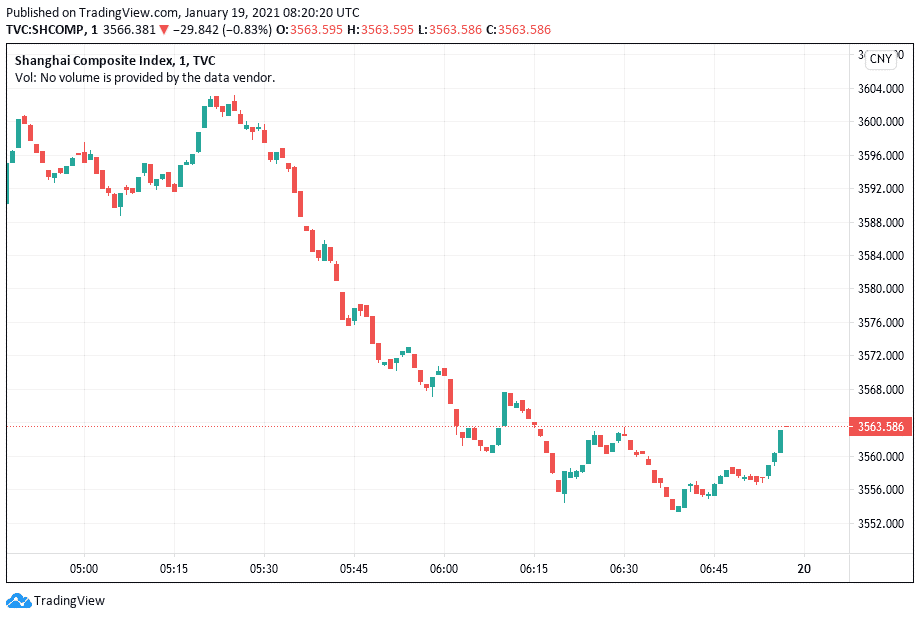

China stocks tumble Covid-19 concerns shift focus from bright economic data

Stocks of Chinese companies fell as investors appeared more concerned about spiking coronavirus cases in the country. Parts of China have been put on lockdown to curb the spread of the virus and minimize the economic impact of the resurgence.

The blue-chip CSI 300 Index declined 1.5% to 5,437.52. The Shanghai Composite Index tumbled 0.8% to 3,566.38. Meanwhile, the tech-heavy ChiNext index dropped 2.1%, and the STAR50 index fell 2.5%. Consumer discretionary and materials companies stood out as major drags on China’s stock market.

Chinese stocks fell despite stocks in other Asian countries, with big China trade partners rising in hopes of China’s economic rebound. China’s economy recorded stronger growth than expected in the final quarter of 2020.

Hong Kong stock rise as mainland China investors seek bargains

Stock in Hong Kong jumped as mainland investors continued to look south for bargain opportunities. The Hang Seng index advanced 3.1% to 29,746.17, marking its highest close in nearly two years. The Hong Kong China Enterprises Index jumped 2.9% to 11,796.28.

Leading Hong Kong stocks higher were tech and financial companies. The Hong Kong stock market is benefiting lately from mainland investors’ money. Mainland investors have been browsing Hong Kong for bargains in sectors that have taken hit from the US-China tensions in hopes that those sectors will rebound once Joe Biden replaces Donald Trump in the White House.