- Cardano down 70%

- Cardano blockchain competitive edge

- ADAUSD short term outlook

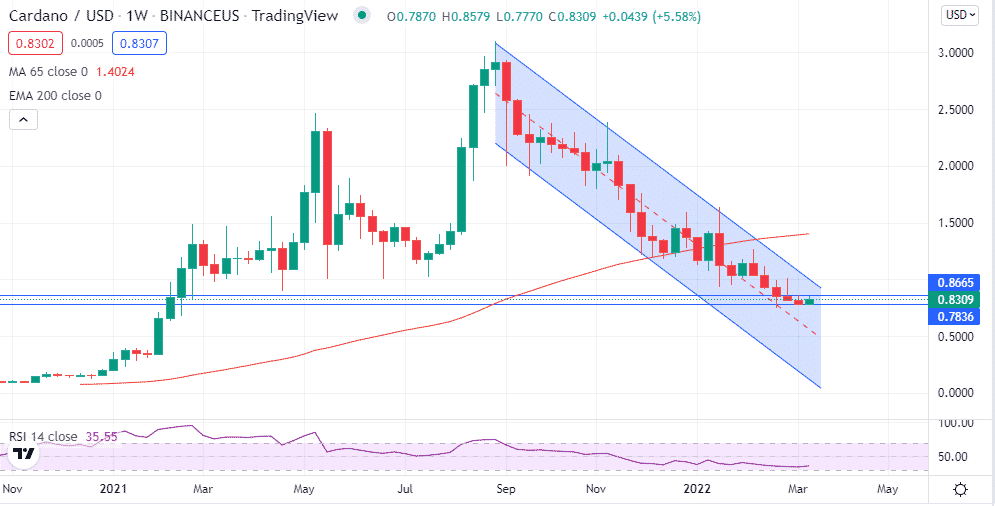

Cardano has been stuck in a tight trading range over the past two weeks after a 70% plus pull back from all-time highs. While the cryptocurrency has underperformed the overall sector in recent weeks, a potential breakout could be looming.

ADAUSD technical analysis

Waning short-selling pressure is already fuelling the suggestion of bulls slowly coming into the fold as ADAUSD tries to bottom out. The $0.78 area has emerged as a crucial support level from where the cryptocurrency is trying to bounce back. Short sellers have struggled to steer a drop below this level, all but fuelling suggestions of a potential bounce back.

In the meantime, $0.86 is the immediate short-term resistance level standing in the way of ADAUSD making a run for the $1 a coin level. A rally followed by a close above the resistance level could trigger renewed buying pressure. However, the bull’s failure to steer a rally past this level could leave Cardano susceptible to further losses.

The Relative Strength Index setting up higher highs since February 21 is already affirming suggestions of a buildup in buying pressure adding credence to a potential break out to the upside. Several indicators showing bullish confluence all but affirm waning short-selling pressure.

Cardano blockchain edge

While Cardano native token ADA has been battered heavily in recent weeks, the long-term outlook remains positive. Launched in 2017, the Cardano network has emerged as one of the biggest platforms for launching decentralized applications and smart contracts. In most cases, it is referred to as an “Ethereum Killer,” given its high-profile competitive features.

Impressive technical specs and a dynamic development team have helped Cardano maintain an edge over its peers, affirming its long-term prospects amid growing blockchain adoption and use cases. Cardano’s ability to process up to 257 transactions per second sets it apart from the crowd.

In contrast, the Ethereum blockchain can only process 15 to 20 transactions a second and Bitcoin just 4.6. Cardano’s network ability to handle more transactions a second has seen it gain interest in handling cross-border payments. Consequently, it’s often been compared to Visa.

Cardano’s edge in processing more transactions per second stems from its Ouroboros consensus mechanism, which is a special type of proof-of-stake system. In the system, miners verify transactions based on tokens held rather than solving complex math puzzles.

The high number of transactions that Cardano can process without facing any network congestions explains why it could be a great success amid the ongoing blockchain adoption. As people and more sectors look to deploy the ledger technology to enhance supply chain operations, secure data, and enable fast and secure transactions, Cardano will be one of the biggest beneficiaries of the development of dApps and smart contracts to enable the same.

What’s next?

After months of sell-offs, cryptocurrencies are increasingly showing signs of bottoming out, supported by a number of factors. Bitcoin is leading the bounce-back spree bouncing above the $40,000 psychological level in recent days.

Improving risk-on mood in the capital market is one factor that supports the prospects of Cardano re-rating higher after the recent consolidation. Investors are increasingly flocking highly battered securities looking to enter long positions at a discount. Cardano fits the bill, given its solid fundamentals as a long-term play.

In addition to improving risk-on mood, the US dollar easing after a 25 basis points hike by the US Federal Reserve is also helping offer support in the broader cryptocurrency sector. The dollar weakening across the board as risk sentiments in the market improve should help support ADAUSD price gains.