- Crude oil is trading lower on the first day of the week.

- Brent futures were down by 0.41% at $67.92.

- WTI futures fell by 0.06% at $64.86.

Prolonged shutdown of the system is likely to impact the supply of gasoline, since the pipeline system is the largest in the US. In Tuesday’s session, the focus will be on EIA’S short-term energy outlook and the OPEC monthly report. With coronavirus ravaging the third-largest consumer of crude oil, India, investors will be keen on the agencies’ outlook on global oil demand. The weekly US inventories will also be a key factor in this week’s oil price movements. Analysts expect a reading of -2.346 million barrels compared to the previous week’s decline of 7.99 million barrels. A lower-than-expected number will be a bearish catalyst for crude oil price.

Colonial Pipeline’s cyberattack

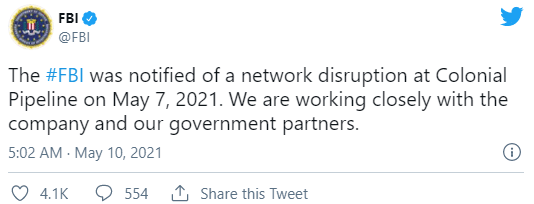

Among the events that investors will focus on as the week unfolds is the cyberattack on Colonial Pipeline’s system. On Friday, the FBI released a tweet about the attack, indicating that it was collaborating with other relevant parties to tackle the issue.

Colonial Pipeline’s system is the largest in the United States. The 5,500-mile pipeline transports oil products including jet fuel, heating oil, diesel, and gasoline from the Gulf Coast to New York. It delivers over 100 million gallons daily, which equates to about 45% of the fuel used in the East Coast. While DarkSide has not claimed responsibility for the attack, it remains the key suspect.

Investors are now keen on how fast the law enforcement agencies, in collaboration with Colonial Pipeline, can solve the issue. Prolonged shutdown is likely to impact gasoline supply, thus fuelling a surge in crude oil price.

OPEC, EIA Outlook

OPEC is scheduled to release its monthly report on Tuesday. On the same day, EIA will be releasing its short-term energy outlook (STEO). The events are bound to have a significant impact on crude oil price in the ensuing sessions. In April’s outlook, EIA noted that the uncertainty surrounding the COVID-19 pandemic would continue to impact crude oil’s demand and supply patterns.

Besides, the agency forecasted that Brent price will average at $65 per barrel in Q2’21 and $61 per barrel in the year’s second half. May STEO comes at a time when coronavirus continues to ravage India and other parts of the world. India, which is the third-largest crude oil consumer in the world, has recorded 366,000 more COVID-19 cases on Monday. The total number of infections now stands at 22.7 million. Coronavirus-related deaths in the country have also soared by 3,769 to 246,000.

On the part of OPEC, its monthly report comes at a time when the coalition is set to gradually increase oil production. Between May and July, it plans on pumping in over 2 million bpd. As such, its report will offer cues on the recovery status of global oil demand. In April, OPEC produced about 25.27 million bpd, which was less than that of March by 50,000 bpd.

US oil inventories

Another factor that will influence crude oil price in the current week is the US oil inventories data. In the previous release, the stockpiles have fallen by 7.99 million barrels compared to the expected -2.346 million barrels. The figure was also better than the prior 0.090 million barrels. This week, analysts expect a lower reading of -2.346 million barrels, which would be a bearish catalyst for crude oil price.

Brent technical outlook

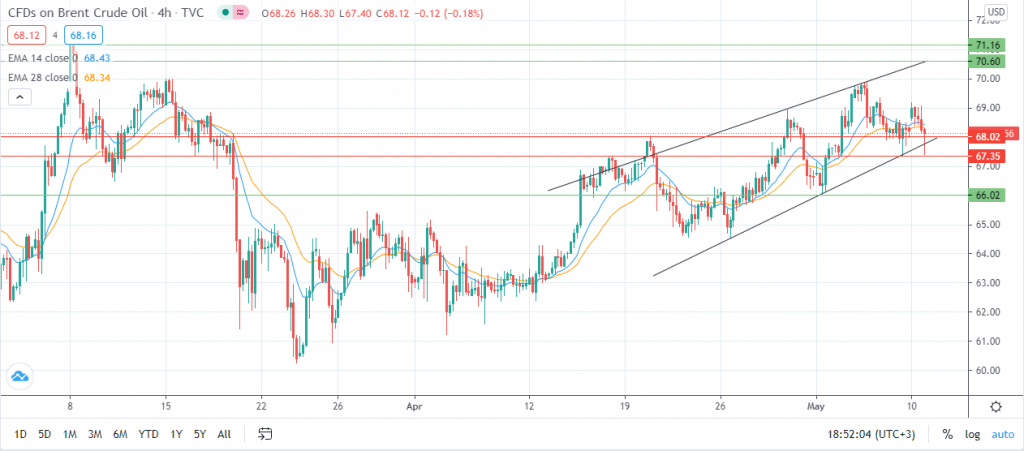

Crude oil price is on a decline on the first day of the week. In particular, Brent futures dropped by 0.41% at $67.92. While it remains on an ascending channel, it had declined past the lower trend line to $67.43. On a four-hour chart, it is trading below the 14 and 28-day exponential moving averages.

Crude oil price is likely to consolidate ahead of the EIA’s outlook and OPEC’s report on Tuesday. The move below the current support level at $68 will lower it to $67.35. A bullish sentiment from the two entities will probably push the price higher to $70, which would be its highest level since mid-March. Above that, the levels to watch out for are $70.60 and $71.16. However, this thesis will be invalidated by a move below $66.