- US dollar firms at 16-month highs amid safe-haven demand.

- USDCAD snaps three-day fall rises above 1.2700.

- USDJPY retreats below 115.00.

- Oil price down by 2% amid glut supply concerns.

- US equities sell-off over renewed COVID-19 fears.

The US dollar was slightly lower on Friday morning, but losses were minimized amid renewed demand for safe havens. Demand for risk appetite has taken a significant hit following the discovery of a new COVID-19 variant that could make vaccines less effective.

The dollar index, which measures the greenback strength, remains well supported at 16-month highs of 96.60. Suggestions the Federal Reserve could hike interest rate and accelerate asset purchases, to clamp down on runaway inflation, continue to fuel the dollar strength. However, it is the increasing worries about COVID-19 likely to fuel dollar strength in the short term.

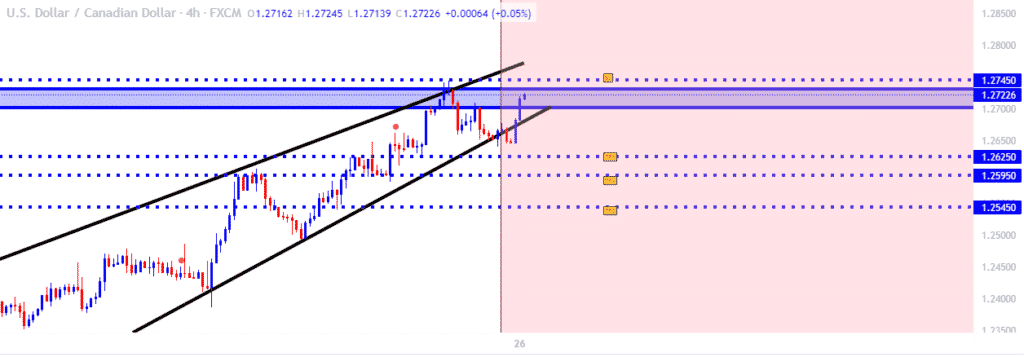

USDCAD above 1.2700

With the dollar holding firm at 16-month highs, USDCAD has snapped three day fall, spiking above the 1.2700 level. In recent sessions, the rally comes at the backdrop of sour sentiment on the Canadian dollar and weak oil prices.

After the spike, the 1.2642 has emerged as the immediate support level affirming upside action on the USDCAD. With bulls in control, a rally to the 1.2741 is on the cards above which the pair could make a run for two-month highs of 1.2801.

The bullish momentum on the USDCAD is supported by oil prices failing to bounce back above the $80 a barrel level and edging lower to lows of $75 a barrel. Additionally, CAD sentiments have been weighed by traders leaving riskier assets in favor of safe-havens amid the escalating COVID-19 situation in Europe.

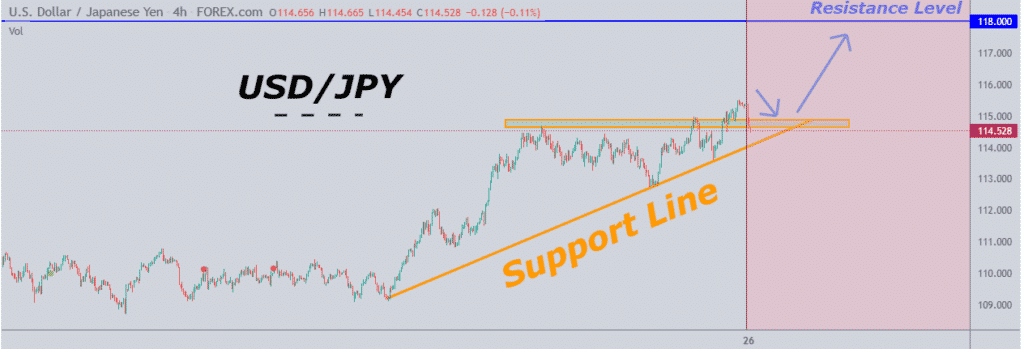

USDJPY tanks

Meanwhile, USDJPY remains on the back foot for the second day running after rising past the 115.00 level on rising yields. The pair has since pulled back to lows of 114.69 on treasury yields edging lower and triggering dollar softness across the board.

The pullback has also come at the backdrop of fears that coronavirus woes could have a negative impact on the FED hiking interest rates. Poland, Germany, and France have resorted to lockdowns in a bid to slow the spread of the new variant.

Additionally, the pullback on the USDJPY is supported by impressive economic data out of Japan. Japan’s Tokyo Consumer Price Index (CPI) data for November jumped 0.5% versus 0.1% the prior month. Prime Minister Fumio Kishida pushing for a 3% wage hike also continues to add to yen strength sending USDJPY lower.

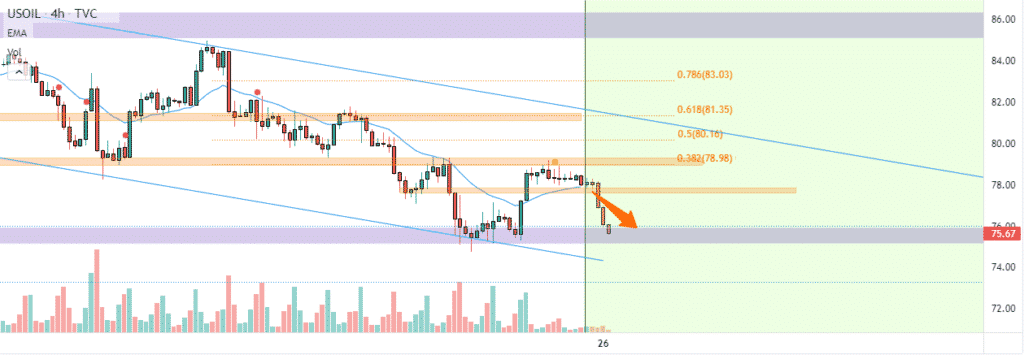

Oil prices tank

In the commodities market, oil prices are on the back foot, sliding more than 2% Friday morning. The slide comes amid growing concerns that the US-led coordinated release of crude reserves could result in a glut of supply in the volatile oil market.

Brent crude futures is down by about 2% at $80.56 a barrel WTI future, having slid to lows of 75.78 a barrel.

A release of oil from strategic reserves in the US, Japan, China, and India comes at one of the worst times. Countries are already going into lockdown amid skyrocketing COVID-19 cases. The lockdown measures are expected to put pressure on oil demand amid rising supply.

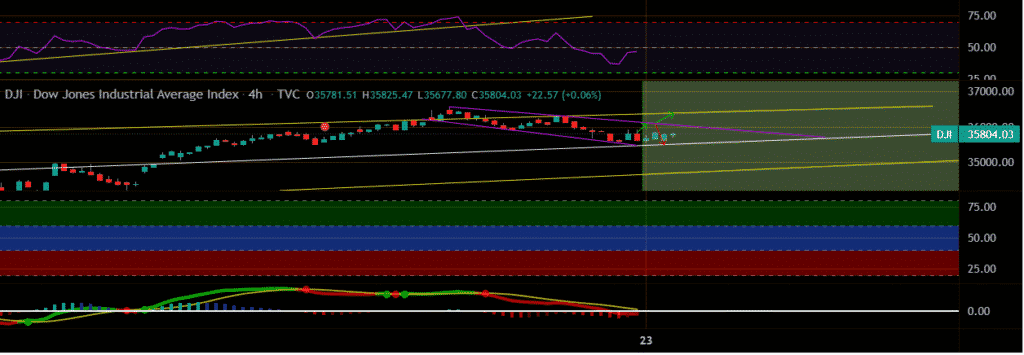

US stock market sell-off

In the equity market, US stock futures edged lower overnight as investors geared for a shortened trading day. The sell-off in the futures market comes amid growing concerns of renewed COVID-19 fears following the discovery of a new variant in South Africa.

The Dow Jones Industrial Average was down by more than 400 points Friday morning, with the S&P 500 and the Nasdaq 100 also in negative territory. The downward pressure comes on the WHO warning of the new COVID-19 variant.

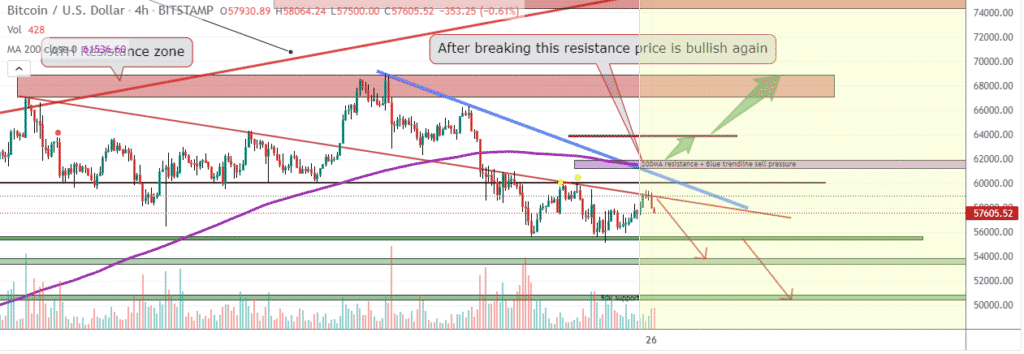

Ethereum outperforms Bitcoin

In the cryptocurrency market, Bitcoin is holding a firm near a critical support level but under pressure. BTCUSD is trading at around $57,694 and at risk of selling off on tanking and closing below the $55,600 support level.

Ethereum, on the other hand, continues to outperform Bitcoin, having powered through the $4,400 handle. ETHUSD remains well supported for further upside action as long as it is above the $4,000 handle.