- Facebook Q3 results are likely to show a slow-down in growth.

- Focus on daily active users growth.

- Scrutiny on Apple iOS update impact.

Facebook Inc. (NASDAQ: FB) is scheduled to report its third-quarter results after the market closes on October 25, 2021. The social media titan heads into the earnings session at the back of strong concerns mostly fuelled by regulatory scrutiny.

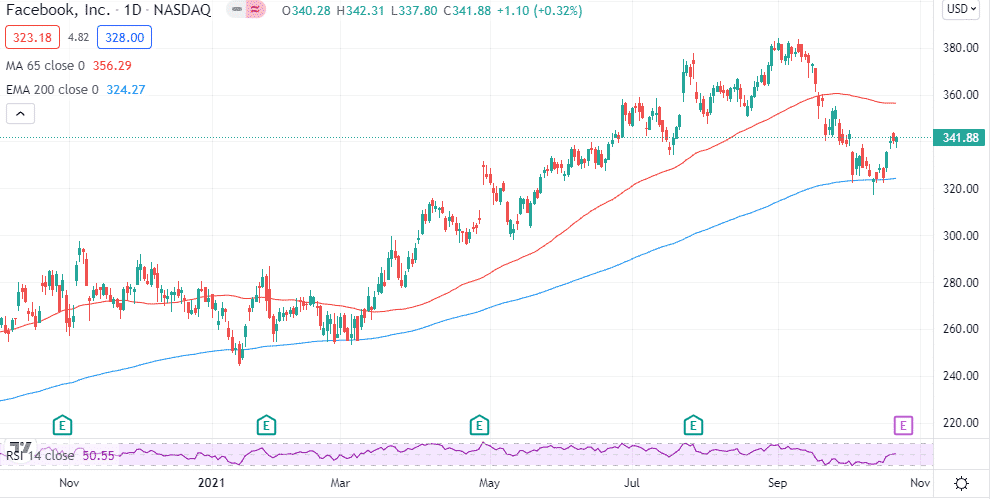

While the stock is up by more than 20% year to date, it has pulled back by more than 9% from all-time highs, with the sell-off gaining momentum ahead of the earnings call. Consequently, the earnings call is pivotal as its outcome will significantly influence investors’ sentiments.

While delivering second-quarter results, the tech giant warned of revenue growth slow-down in subsequent quarters. It also warned of the potential impact of regulatory and platform challenges owing to the iOS update.

Q3 Earnings Expectations

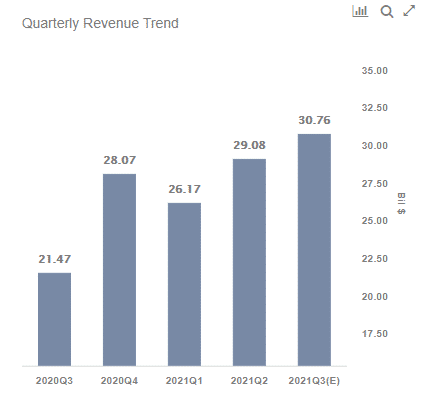

Wall Street expects the social networking giant to deliver revenue of $30.76 billion for its third quarter, a significant improvement from $21.47 billion delivered the same quarter last year. Revenue in the second quarter was up 56% year over year to $29.1 billion. The increase in revenues will mostly be driven by continued lifts on advertising prices as the global economy continues to open.

Net income, on the other hand, is expected to jump to $9.24 billion from $7.84 billion delivered the same quarter last year. However, it will be a decline from a net income of $10.4 billion delivered in the second quarter.

Earnings per share are projected to grow from $2.71 delivered the same quarter last year to $3.17. It will also represent a decline from an EPS of $3.61 delivered in the second quarter.

What to look out for when Facebook reports

In addition to revenue and earnings, the focus is expected to be on daily active users. Wall Street expects the company to deliver a 14.1 million DAU increase in the quarter, taking its total to 1.924 billion. Monthly active users is also believed to have increased by 24 million to 2.924 billion.

Daily active user growth in Q3 is believed to have been fuelled by growth in Asia emerging as a soft sport for the network. However, the social networking giant is believed to be experiencing slow growth in Europe, a situation compounded by a mild slow-down in North America, where it is believed to have reached saturation levels.

Amid the slow-down in revenue increase, the focus will be on whether Facebook is benefiting as global economies reopen and businesses start to ramp up marketing budgets. Last year advertising spending tanked significantly as businesses were forced to close shops owing to COVID-19 shocks.

Facebook also warned that it expected increased ad targeting headwinds heading into year-end. Changes to Apple’s iOS as part of the latest update could significantly impact Q3 revenue.

While the recent Facebook outage that lasted for hours is not expected to have any notable effect on the company, it might have long-term repercussions. There is already talk that businesses are increasingly re-evaluating their reliance on the network for advertising. It will be interesting to see how Facebook intends to respond, considering other social networks saw a surge in activity during the outrage.

Additionally, investors should pay close watch to regulatory pressures as regulators increasingly target, given the amount of power it wields in the social networking space. There have been calls for the breaking up of the company.

There have been reports that Facebook is contemplating a rebranding drive that could result in a name change in the recent past. If true, investors will want to know the kind of impact these changes will have on the company’s outlook heading into the year-end.

Bottom line

Facebook stock is under immense pressure after pulling back by more than 9% from all-time highs. Regulatory pressure and concerns about revenue growth are some of the factors that continue to weigh on sentiments on the stock. A better-than-expected report could help calm the nerves and cause the stock to bounce back. Similarly, a disappointing earnings report could accelerate the sell-off.