The Affirm stock price soared in extended hours on Thursday as investors cheered the companys’ spectacular results and guidance. The shares jumped by more than $110, which was about 20% above its closing price. This rally pushed the company’s market capitalization to more than $23 billion.

Era of BNPL

Affirm is a leading financial technology (fintech) company that offers buy now pay later (BNPL) services in the United States and several other countries.

The BNPL is a fast-growing trend that allows customers to buy items and then pay in equal installments. It is one of the fastest trends in the world. For example, in August, Square announced that it would acquire AfterPay, an Australian company, for more than $29 billion. And this week, PayPal spent more than $1 billion to acquire Paidy, a Japanese company.

The Affirm stock price jumped after the company announced its quarterly results. The company’s gross merchandise value (GMV) and revenue rose by 106% and 71% in the quarter as demand for its services rose. Its GMV rose to more than $2.5 billion, driven by the ongoing American reopening. Fashion was the best performing parts of its business while the company doubled its customers to more than 7.1 million. Merchants rose to more than 28,000.

Affirm’s interest income more than doubled to more than $104 million, while its total net income came in at more than $108 million. This trend is set to accelerate as the company boosts its forward guidance. It expects its GMV to rise to between $12.45 billion to $12,75 billion. It also expects its revenue to grow by about 37% to $1.19 billion in the next fiscal year.

Is Affirm a good investment?

Affirm is a fast-growing fintech company that went public this year. The firm is growing so fast that its revenue has moved from more than $264 million in 2019 to more than $509 million in 2020. And the company expects that this revenue growth will accelerate to more than $1.19 billion.

This growth will be driven by several factors. The most important one is that Amazon has selected the company to become one of its payment providers. This means that Amazon customers can now pay in equal installments using Affirm’s technology. This is notable because of the strength of Amazon, which is the most significant e-commerce player in the country.

The company is already offered by most of the biggest retailers in the US, like Walmart and Target. It is also widely used by many companies like Pottery Barn, Purple, Expedia, and TheRealReal. The value proposition is there. Besides, it is cheaper to buy with Affirm than using a credit card.

Still, the company faces several challenges ahead. First, the company is facing significant competition from the likes of PayPal and Square. These are two big companies that are investing billions to win the industry. It is also facing competition from incumbent companies like Klarna and Zip. Second, BNPL companies have been accused of putting many people in debt. As such, there is a likelihood that there will be additional regulations.

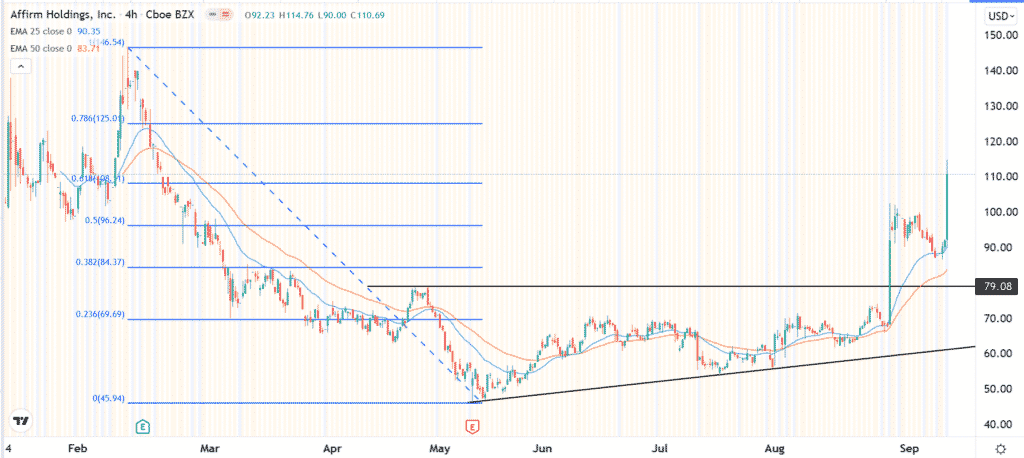

Affirm stock price forecast

The four-hour chart shows that the AFRM stock price popped in extended hours. The shares rose to $92.06, which was the highest level since February 21. Along the way, the stock moved above the key resistance level at $79. It also moved above the 25-day and 50-day moving averages (MA). The price also moved above the 61.8% Fibonacci retracement level. Therefore, the stock will likely keep rising as bulls target the 78.6% retracement level at $125.