- Airbnb stock up 14% ahead of Q3 results.

- Q3 revenue and earnings are expected to top estimates.

- Focus on gross booking value.

Airbnb is scheduled to report its third-quarter results after the market closes on November 4. The earnings report comes at a time the company is trying to recover from the devastation caused by the COVID-19 pandemic on its core rental bookings business.

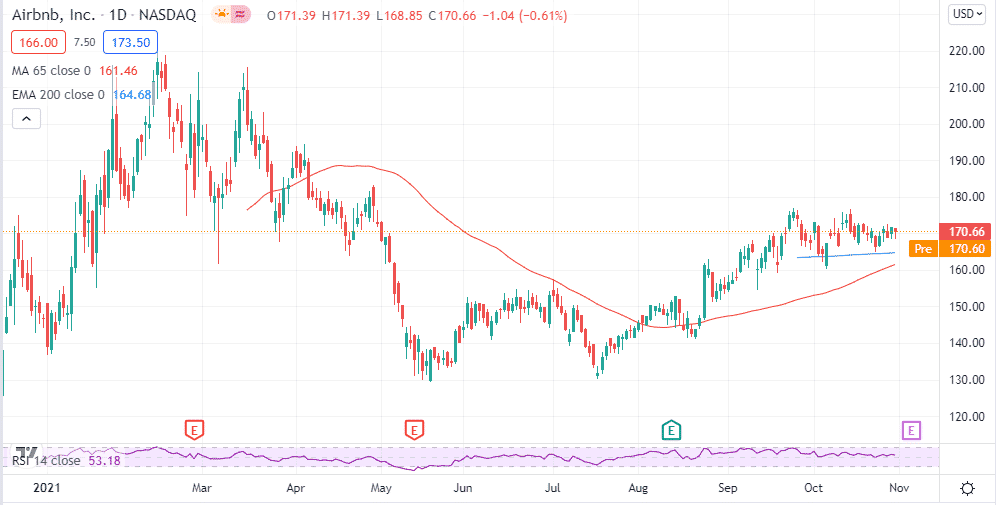

While the stock is up by about 14% year-to-date, it is only now that it is trying to bounce back after plunging by more than 20% from all-time highs. The bounce-back has been fuelled by improving underlying fundamentals owing to aggressive vaccination worldwide.

Airbnb remains well-positioned to profit from secular growth in travel. The company boasts of an attractive growth runaway, given its robust and unique inventory. A powerful platform and system enhancements continue to affirm its competitive edge.

The easing of COVID-19 restrictions has seen an uptick in travel activities in top travel destinations, all but fuelling the Airbnb house rental business. Consequently, better than expected third-quarter results could strengthen the stock’s sentiments by affirming that the worst is behind and that the company is on a recovery path.

Q3 earnings expectations

Wall Street expects Airbnb to deliver revenue of $2.04 billion for Q3, a significant improvement from $1.3 billion delivered in the third quarter. The sequential increase comes at the backdrop of continued travel rebound in the quarter.

Additionally, revenue growth should have benefited from product innovations that allow the company to meet changing needs of its guests. Airbnb has improved every aspect of its service, from website to app. Revenue is expected to come much higher thanks to rising prices.

Airbnb is expected to bounce back to profitability with an EPS of $0.75 compared to a net loss of $68 million delivered in the second quarter.

What to look out for when Airbnb reports

Airbnb does not operate or own any hotels and resorts. It simply runs a platform that connects people on the move with people looking to rent out their properties for a temporary stay. In return, the company earns fees by enabling a connection between the host and guests on its platform.

Consequently, the focus will be on the gross booking value when Airbnb reports its Q3 results. In the second quarter, the company delivered a gross booking value of $13.4 billion, up 320% year-over-year. Consequently, it will be interesting to see if the robust growth continued in Q3 at the back of the opening of the global economy.

Given that gross bookings in the second quarter were much higher, by 37% compared to 2019 levels, it underscores the pent-up demand for travel. The easing of covid-19 restrictions to most travel destinations will be crucial if Airbnb maintains the growth momentum heading into year-end.

In addition, the focus will be on the impact of the upgrades that Airbnb has carried out in the recent past as it looks to enhance service delivery. The company has already introduced more than 100 upgrades across all aspects of service as it looks to give guests more flexibility while planning for travel.

In the second quarter, the company also embarked on a widespread push to recruit more hosts on the platform. It will be interesting to see if this approach is working as it will go a long way in strengthening its revenue base given the widened pool for charging fees.

Bottom line

Airbnb stock is up by 15% year to date. However, it is still trading near its lowest level of free cash flow ratio of 71. Given that its fortune is tied to improving coronavirus trends, it is highly likely to deliver better-than-expected results with the opening of the global economy.

Consequently, the stock could edge even higher on Q3 results topping estimates and affirming underlying growth. Similarly, a disappointing report could send jitters in the market, which could see the stock edging lower.