Heightened volatility gives rise to unique trading opportunities in the cryptocurrency market. Scalping is one strategy that traders rely on to take advantage of the wild swings that come into play due to the high volatility.

What is Scalping?

Scalping is a trading strategy whereby traders look to profit from the smallest of price changes. Consequently, trades are opened and closed within seconds and minutes, allowing people to lock in small profits with each position. When compounded, the small profits accrued with each position amount to big gains in the long run. The technique stands out partly because it does not require a lot of funds to earn profits.

While, in most cases, traders use their gut to decide when to trade and not to, automated trading systems have cropped up, making the process much easier. In addition, the systems have relieved the burden of spending hours glued to the screen opening and closing trades.

The use of automated trading bots reduces the risk of human error while trading. The system is programmed to open and close positions based on preset rules. Therefore, it will consistently execute and lock in profits even if the trader is not around. This way, you can always make profits even when not around.

Building scalper bot without coding

Contrary to perception, you do not need coding skills to develop a crypto scalping bot. Some platforms allow traders to set up scalping bots easily without any coding barrier. Bitsgap is one platform that is making it easy to scalp and generate small profits trading various coins on the KuCoin exchange.

How to create a scalper bot

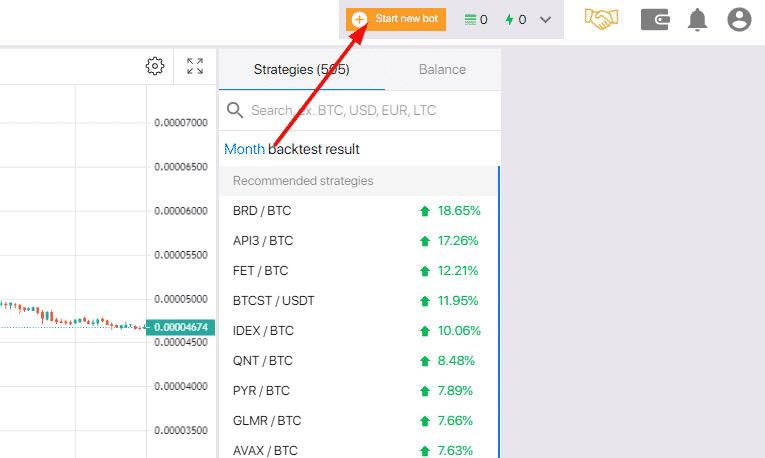

Simply click on the “Start new bot” on the top menu tab of the Bots page in the Bitsgap platform.

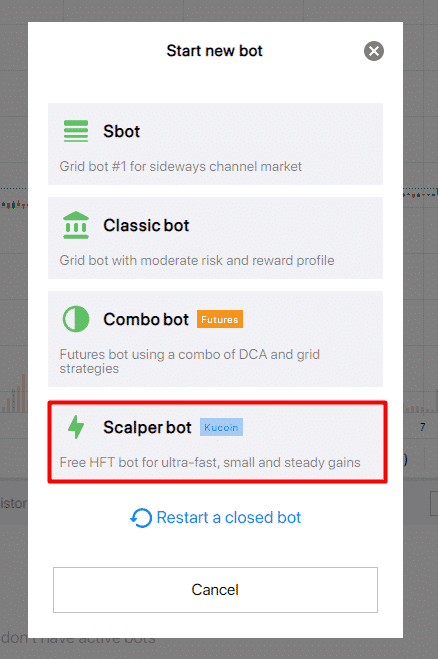

A pop-up window will show all the available bots that can be used to trade cryptocurrencies. Click on the Scalper Bot in this case.

Once you select the bot, simply select a cryptocurrency pair you would like to trade.

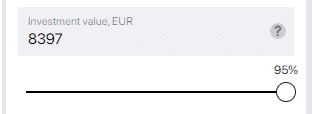

Next, specify the amount you want to invest and then choose the percentage of the amount you will use.

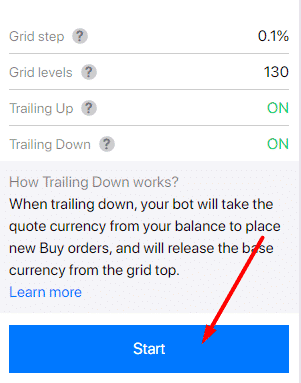

The scalper bot comes preset with all the instructions needed to execute trades and lock in profits. In addition, the bot leverages the grid step trailing feature to execute trades based on prevailing market conditions.

Once you click on the start button, you will be taken to the preview tab, where you can check all the settings before the scalping bot starts executing trades.

Upon clicking start, the scalping bot will initiate the launching process, and you will be able to see the whole process.

Crypto scalping strategies

Most of the readily available crypto scalping bots come programmed with various strategies that allow them to open and close positions within the shortest period. Therefore, it is important to settle on an automated system that leverages a strategy that one is familiar with.

Below are some of the popular crypto scalping strategies.

Crypto range trading

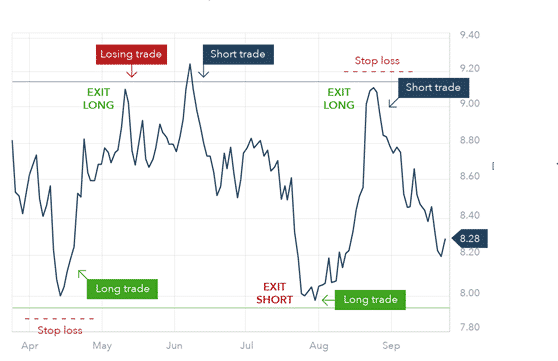

In this case, a bot will be programmed to identify whether the cryptocurrency market is moving sideways. The oscillation that comes into play makes it easy to buy and sell within well-defined ranges. Conversely, the bot will be able to identify the upper limit of the range whereby sell positions would be triggered in anticipation of the price getting rejected and moving lower.

Similarly, the bot will identify the lower limit acting as support where the price bounces back and starts moving up. This will be the level where buy positions would be triggered in anticipation of price edging higher.

The bot will open sell positions at any given time as long as the price moves close to the upper limit and close the positions whenever the price tanks to the lower limit, therefore, locking in profits. Similarly, it will open buy positions when the price tanks to the lower limit and close it upon moving to the upper limit.

The buying and selling process will continue throughout the day as long as the price does not break out of the defined range. However, as soon as the price breaks above the upper limit or below the lower limit, the bot will cease to open any trades as the price is no more extended range-bound.

Bid-ask spread

It is a scalping strategy whereby bots try to take advantage of the difference between the ask and the bid price. In this case, a bot would be programmed to open a position at the ask price. Once the price moves slightly lower, the trader would lock in the profit that comes into play.

Similarly, a trader could open a position at the bid price; once the price moves slightly higher and results in a small profit, the trader will lock in the profit that comes into play. The buying and selling at the bid and ask price level will continue, locking in the profits throughout the day.

Arbitrage

It is a strategy that allows traders to take advantage of extreme volatility and pricing inefficiencies in the market. The heightened volatility makes it possible to take advantage of the minor price changes. However, volatility causes price inefficiencies in various exchanges.

For instance, a bot could buy a cryptocurrency in one exchange if its price is undervalued due to heightened volatility in anticipation of it bouncing back to its fair value. At the same time, the bot will enter a sell position in another market whereby it is overpriced in anticipation of its tanking to fair value.

Final thoughts

Scalping is a unique trading strategy that makes it possible to generate small profits, which can be compounded to amount to big gains. In addition, the opening and closing of positions within minutes and seconds reduce risk exposure in volatile markets.

Consequently, the strategy works best with markets that are moving sideways as it becomes easy to open and close positions within well-defined ranges. The use of trading bots enhances scalping in volatile markets by following strict commands for opening and closing positions. Scalping bots can be secure, efficient, and profitable when appropriately programmed.