Automation is the new order as the race to gain an edge and squeeze a fortune while trading various cryptocurrencies heats up. Heightened volatility gives rise to unique investment opportunities in the burgeoning sector. However, keeping in touch with the opportunities that crop up every second in the nascent industry can be challenging. Here is where trading bots can be of great assistance.

Bots are changing the game by taking advantage of all the opportunities that crop up with little or no effort. They are automated computer programs that scan the entire market for opportunities with minimal human intervention. The tools can identify the best risk-reward opportunities, execute orders, lock in profit, and deploy risk management tools affirming their edge for pursuing fortunes in the cryptocurrency sector.

Below are the top 5 trading bots for anyone looking to spend a little amount of time scanning for opportunities in the cryptocurrency market.

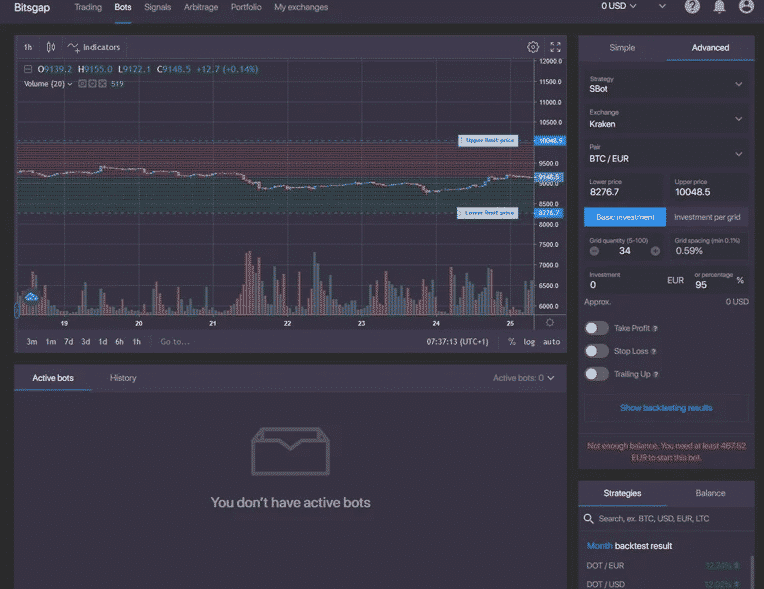

Bitsgap

Arguably one of the best operating as an all-in-one trading automation platform. It offers an exciting and unique way of trading across multiple exchanges under one roof. Advanced tools on offer automate the entire trading process right from scanning the market from all the popular exchanges to executing orders.

Bitsgap comes with unique features that enable easy comparison of rates from various digital markets. It also enhances the process of trading and switching between different exchanges. You can always take advantage of the price difference between exchanges using arbitrage. Its trading platform comes with a sleek interface that is fully functional. The interface comes with TradingView charts with over 100 technical indicators and customizable chart types.

Additionally, it comes with a trading bot that automates the entire trading process, from scanning the market for specific chart patterns to executing orders and locking in profits. It ensures all investments are distributed within the chosen range. It also specializes in making small but frequent profits in every market.

The Bitsgap trading automated tool executes orders based on current prices, automatically adjusting buy and sell orders to find the best opportunities. Therefore, traders can profit from the smallest of price movements in the market. Investments are usually distributed based on the grid strategy, dividing prices into multiple levels or grids.

Pionex

It is a cryptocurrency exchange that also comes with 18 in-built bots designed to enhance automated cryptocurrency trading. The automated trading systems are perfectly suited for people who are just getting started trading using such tools. It is free to access all the trading bots on the platform, which also come with some of the lowest fees at only 0.05% per trade.

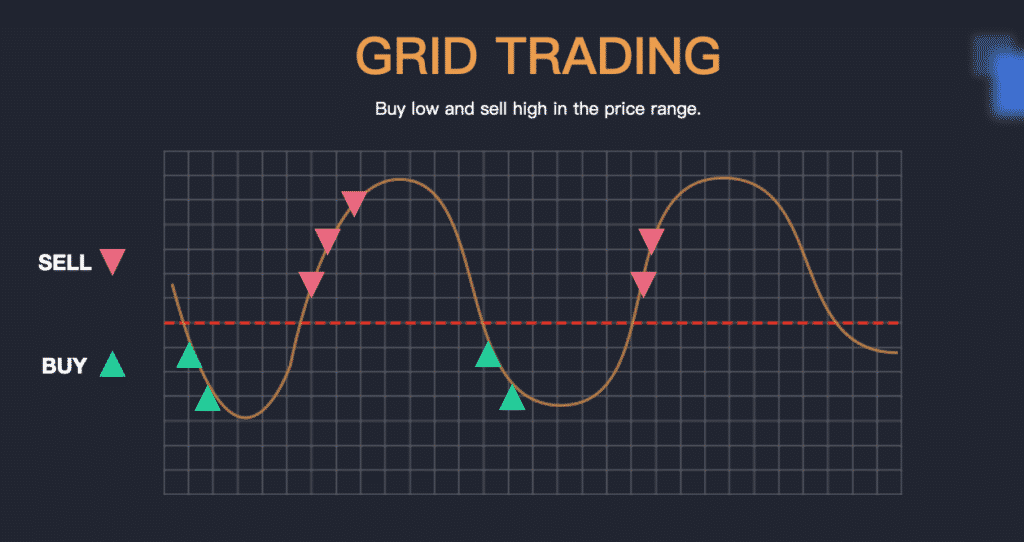

One of the stand-out bots in the exchange includes a grid trading bot programmed to buy low and sell high.

In addition, each of the Pionex cryptocurrency trading bots comes with a detailed tutorial that explains everything one needs to know. The trading bots allow people to access and trade over 120 plus cryptocurrencies. The support team is also on the dial to handle any issue one might have via a live chat feature.

While Pionex tools come programmed with various trading strategies capable of scanning opportunities, it is possible to set specific parameters. The tools are also integrated into various exchanges, thus enhancing the process of trading once opportunities come about.

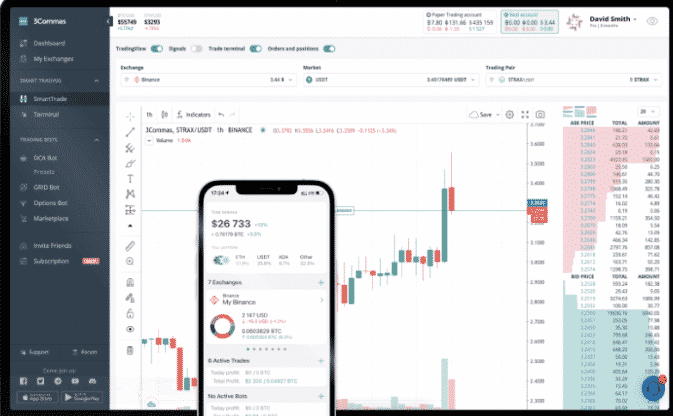

3Commas

It is the best platform for people who wish to automate their trading strategies into trading bots. For beginners new to the business, it also comes with bots integrated with various trading strategies, therefore able to execute trades and generate profits with little or no human intervention.

It comes with a Smart Trade feature whereby you can buy and sell various virtual currencies using essential risk management tools. With the feature, one can set up trailing buy and sell orders that repeatedly execute orders based on pre-defined rules.

Two of the three 3commas trading bots leverage the dollar-cost averaging strategy. With one of the bots, you can commit a certain amount of money used in trading. It leverages the QFL trading strategy that looks for potential dead cat bounces setups to execute trades.

It also comes with an advancement that leverages a more customizable dollar-cost averaging strategy. It is also suited for scalping as it can execute and close trades for small profits over a prolonged period. With the tool, you can always set the take profit and stop-loss levels while specifying the minimum daily volume for opening trades.

3commas offers trading bots with four main pricing plans, from a free junior plan to a top tier month Pro plan that costs $75 a month.

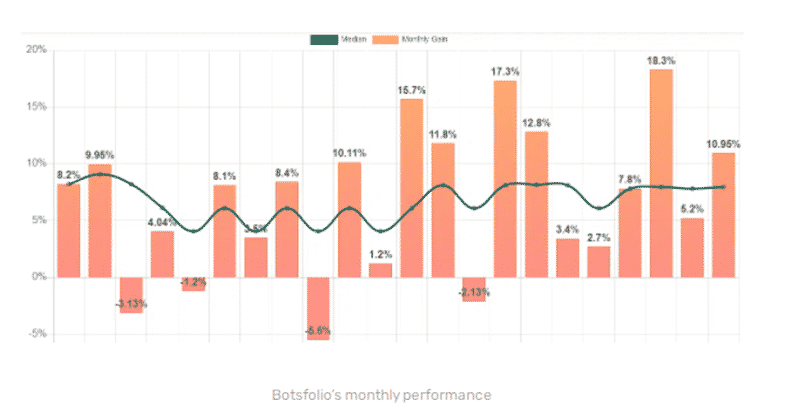

Botsfolio

It stands out as one of the best as it does not require any coding skills to operate. It comes with readymade trading strategies, therefore able to open and close trades automatically, which you can simply monitor the progress, profits, and losses on the platform. It is programmed to scan the market 24/7 and trades whenever high-risk-reward opportunities crop up.

Currently, Botsfolio works with 3 different exchanges. It also leverages short-term and long-term strategies to diversify investments in the exchanges. Some of the popular strategies that the bot leverages to squeeze profits for users include hedged trading and scalping futures trading. It also deploys value investing.

It also comes with 4-pricing plans that depend on the portfolio value. A portfolio with $1k to $3K will incur a charge of $4.75 to manage, while a portfolio of $3k to $10K will incur $9.50. However, Botsfolio can be expensive as it charges a 15% fee on profits every quarter

CryptoHopper

It is a cloud-based crypto trading bot that deploys an algorithmic programmed trading approach. It allows users to leverage external signals to execute trades. In addition, users can connect with up to 9 different changes, therefore able to execute arbitrage whenever there is pricing disparity in the various exchanges.

CryptoHopper executes orders based on underlying conditions that the bot has been instructed to implement. However, the semi-automated trading system does not guarantee profits. Instead, it allows users to make more intelligent trades based on programmed strategies and external signals.

Trading strategies for automated systems can be derived from various technical indicators. In addition, they can follow the actions of third-party experts. The bot comes with a range of trading tools and features, such as bot backtesting tools. While there are three pricing plans, CryptoHopper also offers a free trial for seven days.