One of the main ways to succeed in forex trading is to have the necessary tools to capitalize on all market conditions. In this article, we will introduce the basics and how to trade using the scalping strategy.

What is scalping?

Scalping involves profiting off small changes in price in a short period. Usually, this consists of opening a significant size position to make several pips – generally within the 1,5 or 15-minute candles.

How to use scalping when trading

There are two ways you might want to implement this strategy: as your main source of profitability or in combination with another trading method.

Primary trading style

If you want to use this strategy as your primary trading style, you will need to make many trades during the day. One minute candles will be your friend. You will need to be quick and execute trades with discipline to make the most of your gains. Therefore, it is advisable to employ a direct-access broker that will help you instantaneously execute your orders.

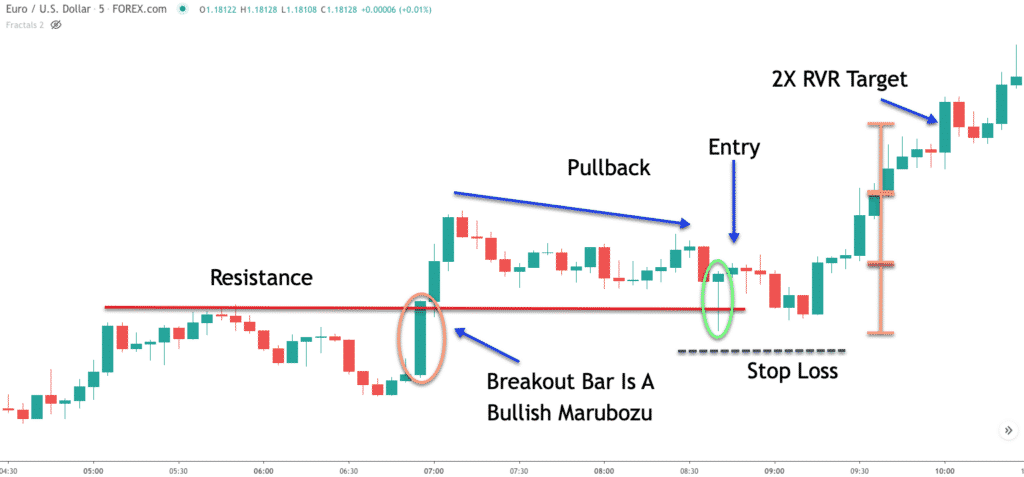

Chart 1. A typical day of Scalping with Candle Charts

Supplementary trading style

As mentioned before, diversity of strategies is essential in trading. If you have another preferred trading method, you can still use scalping when markets are volatile.

Furthermore, you can make extra income by scalping while waiting on your longer-term trades. These will help you increase revenue and generate more volume to put into your other positions.

Tips to succeed using scalping

To succeed using this approach, you will need to have a clear exit plan. As most positions have high volumes, one losing trade can eliminate all the gains accumulated throughout the day. You will also need to make a lot of trades and be aware of the news that could swing the market one way or another.

Final remarks

Scalping is a short-term approach that thrives in a turbulent market. In order to succeed, you will need to be disciplined with your trades. Make sure you have access to the relevant market information before trading and keep up with the live feed. Have a solid exit plan before opening your position and slowly accumulate your gains.