When decentralized finance was taking form, most DEX platforms were slow, buggy, and straight-up frustrating to use. Nowadays, these platforms are giving centralized exchanges a run for their money, thanks to their intuitive interfaces and breadth of features. A recent survey found that the DEXs account for approximately 12% of the trading volume across the mainstream CEXs. Some of these DEXs also stand out among the most popular dApps in their respective blockchains. Among other features, they allow permissionless transactions and storage of user funds in non-custodial wallets. That being said, let’s look at some of the top contenders in the industry.

Uniswap

This is the largest DEX in the market today by volume and among the earliest to launch. It is built on Ethereum and runs on the automated market maker (AMM) model. Instead of using a market maker, it utilizes liquidity pools to match orders between traders. The peer-to-peer trades are executed by means of smart contracts, allowing a trustless transaction. These smart contracts also set prices of the different assets in liquidity pools, depending on their demand and supply dynamics.

Users who stake their coins in liquidity pools provide the liquidity needed to complete transactions, and in return, they receive crypto rewards. The platform is powered by its native token, UNI, which doubles as a governance token.

SushiSwap

This is a fork of the famous Uniswap platform. To that end, it closely resembles its predecessor, except it introduced community ownership features such as a governance token named SUSHI and staking rewards. In fact, this is what inspired Uniswap to launch their UNI token. What’s more, on SushiSwap, users can trade assets from several blockchains and layer 2 networks. Some of these include Avalanche, Fantom, Harmony, and Celo.

Again, like its predecessor, it runs the AMM model. Users can earn rewards from contributing to liquidity pools and yield farming. It also includes a lending feature and a launchpad called MISO.

PancakeSwap

This was the first DEX to launch on Binance Smart Chain. As an AMM, it allows for the trade of various assets, as well as staking and yield farming. Liquidity providers earn LP tokens which they can then stake in yield farms to earn rewards in CAKE, the platform’s native currency. CAKE also works as a governance token.

What’s more, PancakeSwap also features an NFT marketplace, a lottery, a prediction market, and an initial farm offering. Built on BSC, it primarily supports BEP-20 tokens. However, it enables interoperability by supporting wrapped tokens from other blockchains.

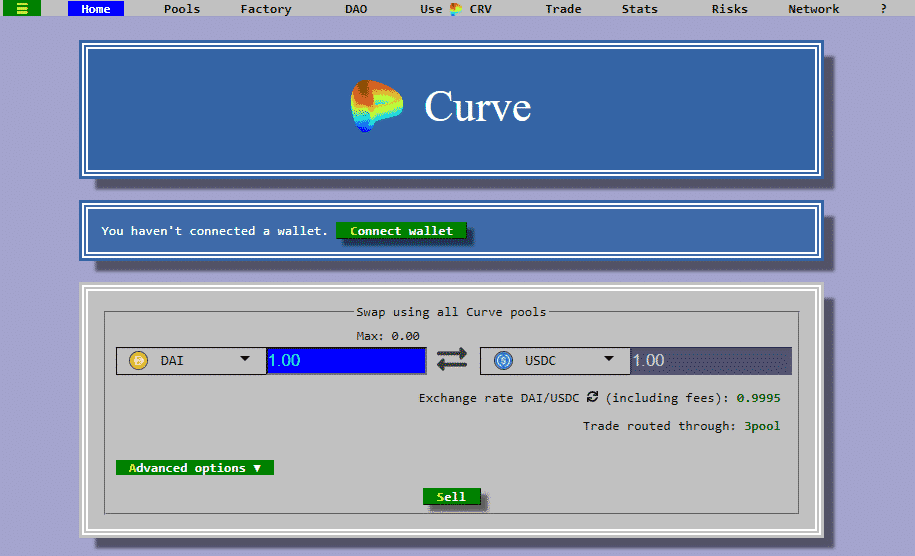

Curve

Launched in 2017, this was a DEX built on Ethereum but soon spread out to other blockchain and layer 2 networks, such as Avalanche, Polygon, and Fantom. Today, it is among the biggest DEXs by trade volume, clocking billions of dollars in monthly volumes.

Running the AMM model, Curve only accommodates liquidity pools comprising similar assets such as stablecoins or wrapped tokens. This allows it to charge record low fees of 0.04%, half of which is rewarded to liquidity providers while the other half is doled out to those who stake its native CRV token. The CRV token acts as a governance token on the Curve DAO. Notably, the platform avoids volatile assets in favor of more stable ones.

SpookySwap

This is a popular DEX built on the Fantom Opera chain. It differs from other DEXs in that it allows market orders as well as limit orders. This means users can swap tokens instantly, or place their bids and wait for them to be filled. The platform boasts a total value locked (TVL) of approximately $1.5 billion and regularly hits $300 million in daily trading volume. Other than trading, it allows yield farming, NFTs called Magicats and has its own governance token, BOO.

1Inch

This is a DEX aggregator that allows its users to obtain the best prices and lowest slippage for their trades. As of November 2020, the platform enabled swaps across 21 DEXs, aggregating liquidity from all those platforms. This enables it to reduce price volatility by increasing liquidity across the crypto market.

Liquidity providers are rewarded in 1INCH tokens. Holders of this token can also vote on governance decisions regarding the platform.

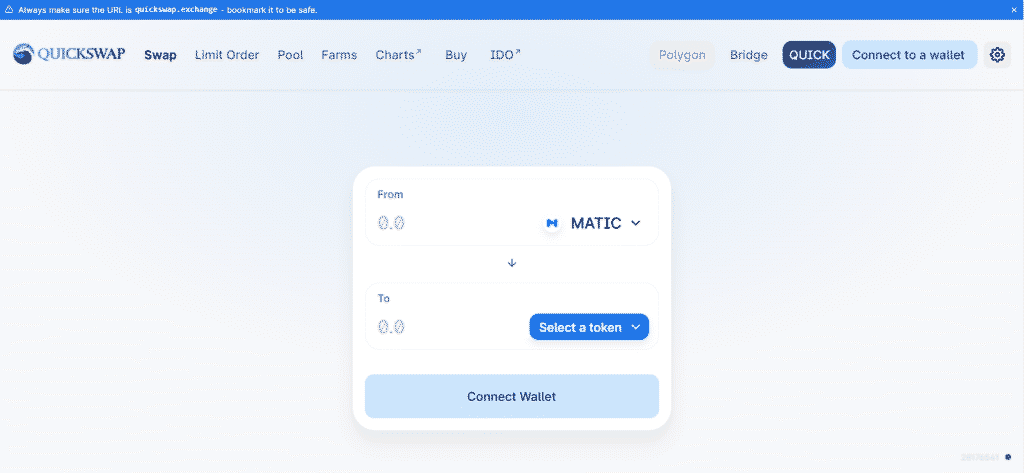

QuickSwap

This is a popular DEX hosted on Polygon. To that end, it allows the swapping of ERC-20 tokens, whether through market orders or limit orders. As one of the top dApps on Polygon, QuickSwap boasts a TVL of $700 million and clocks highs of $100 million in daily trading volume.

Thanks to the speed and efficiency of Polygon, this platform is known for its quick-swap speeds. However, users have to first bridge their assets to Polygon to utilize the service. It also features yield farming and dual mining that allows miners to earn MATIC and QUICK rewards.

TraderJoe

Built on Avalanche, this platform is touted as a one-stop-shop for all your trading needs. It features swapping functionality, yield farms, a launchpad, as well as DeFi lending. Its interface is very user-friendly, and you can access most features in a few simple clicks. It is compatible with more than 100 Avalanche assets and boasts daily transaction volumes north of $100 million. Its native token, $JOE, also carries governance rights. Another unique feature of TraderJoe is Zap, through which users can easily convert a token into LP tokens for yield farming.

Conclusion

Decentralized exchanges are blockchain-based platforms that allow the trustless swapping of crypto assets. Most of them also allow users to earn passive rewards from providing liquidity and yield farming. They operate the AMM model, which uses smart contracts to facilitate transactions. Nowadays, they have become popular destinations for crypto traders.