- Nvidia stock up 129% ahead of Q3 results.

- Wall Street projecting double-digit revenue and earnings growth.

- Focus will be on computer gaming and data center segments.

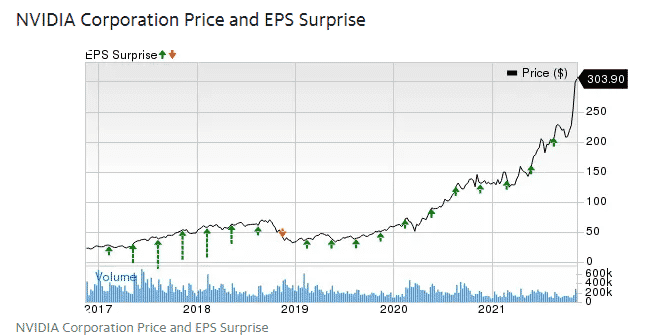

NVIDIA Corporation (NASDAQ: NVDA) is scheduled to deliver its Fiscal Q3 2022 results after the market closes on November 17, 2021. The company heads into the earning session, having posted better-than-expected results in the past five consecutive quarters. Additionally, the company has emerged as a big player in the virtual world backed by powerful products in the visual computing space.

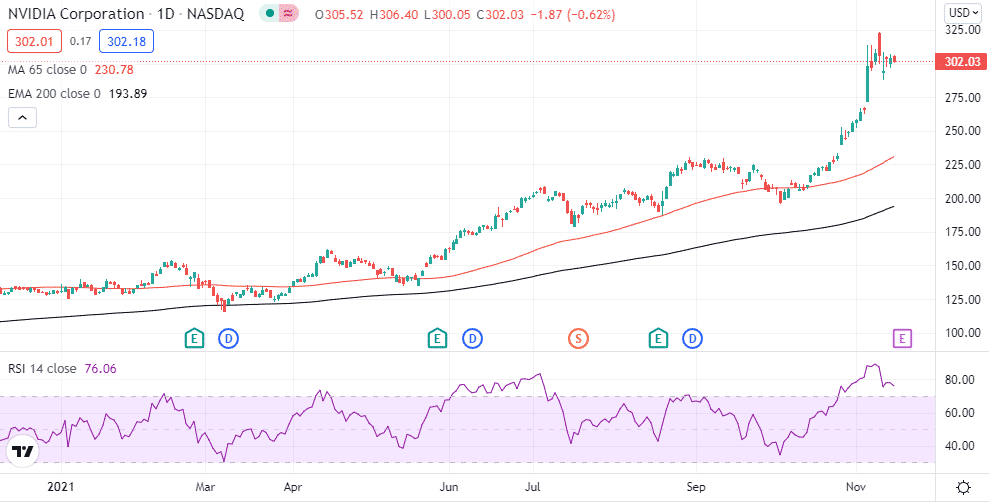

Its stock has outperformed the market on investors taking note of the company’s growth metrics and long-term prospects. The stock has more than doubled in value year to date after a 129% rally and currently trading near all-time highs. In contrast, the S&P 500 has returned about 25% year to date.

In the third quarter, Nvidia is believed to have benefited from the working and learning from home trend. It also looks to have benefited from strong demand for GPUs used in powering desktops and gaming consoles.

The prospects of Nvidia gaining a greater market share with cloud service providers all but increase the prospects of it generating better than expected Fiscal Q3 results.

Q3 earnings expectations

Wall Street expects the chip giant to deliver revenue of $6.82 billion for fiscal Q3 2022 representing a 44% year-over-year growth. Management is projecting revenue of $6.80 billion. In contrast, the company posted revenue of $4.73 billion the same quarter last year.

In the second quarter, Nvidia registered a 68% year-over-year increase in revenue that landed at $6.51 billion. Growth in the quarter was mostly driven by record revenue in gaming, data center, and professional visualization sectors.

Adjusted earnings per share is expected to land at $1.11 a share, representing a 52% year-over-year increase. Management, on the other hand, expects EPS of $1.10. In the second quarter, EPS was up 89% to $1.04.

In addition to Q3 results, Wall Street anticipates Nvidia will provide a guidance revenue of $6.81 billion and EPS of $1.08 for Q4.

What to look out for when Nvidia reports

When Nvidia reports, the focus will be on the two largest platforms; computer gaming and data center. In the first and second quarter, the two accounted for 85% and 83% of total revenue waiting to see their growth rate in Q3.

In the second quarter, management attributed the growth in the gaming platform to strong sales of the GeForce RTX 30 Series, waiting to see if the momentum continued in Q3. Additionally, the company registered solid growth in the professional visualization segment due to strong demand for the GPUs, powering desktop workstations in line with the working from the home trend.

Continued growth in the data center business amid the growing adoption of cloud-based solutions should also attract interest when the company reports. The work-from-home trend has bolstered Nvidia revenue in the past year. Hence, investors are waiting to see if the growth is accelerating or decelerating with the opening of the economy.

In addition, the focus will be on the pending acquisition of mobile chip designer Arm. The $40 billion deal was expected to close in March of 2022. However, the company has run into regulatory hurdles, and given the impact the deal is likely to have on competition in the industry.

Consequently, it will be uninteresting to see what management intends to do to address the competition hurdles standing in the way of the deal closing. The deal is allowed to go through and will strengthen the company’s competitive edge.

Bottom line

Nvidia is in a phase of robust growth if Q1 and Q2 results are anything to go by. Strong demand for the company’s products and solutions point to yet another upbeat report for Q3. A report that affirms underlying growth should strengthen investor sentiments which could see the stock edging higher. Disappointing results could spook the market, which could see the stock pulling back after the 129% rally.