- Microsoft stock up 40% ahead of Q1 results.

- Revenue and earnings are expected above estimates.

- The intelligent cloud unit will be the center of attention.

Microsoft is scheduled to deliver its first-quarter Fiscal 2022 results after the market closes on October 26, 2021. The tech giant is poised to report at a time it is firing on all angels depicted by growth in key business segments.

The company boasts of presence in several high-growth industries and an arsenal of products and services that affirm its growth metrics and long-term prospects. After years of stagnation, CEO Satya Nadella has turned the tide, and Microsoft has emerged as a $2.3 trillion company.

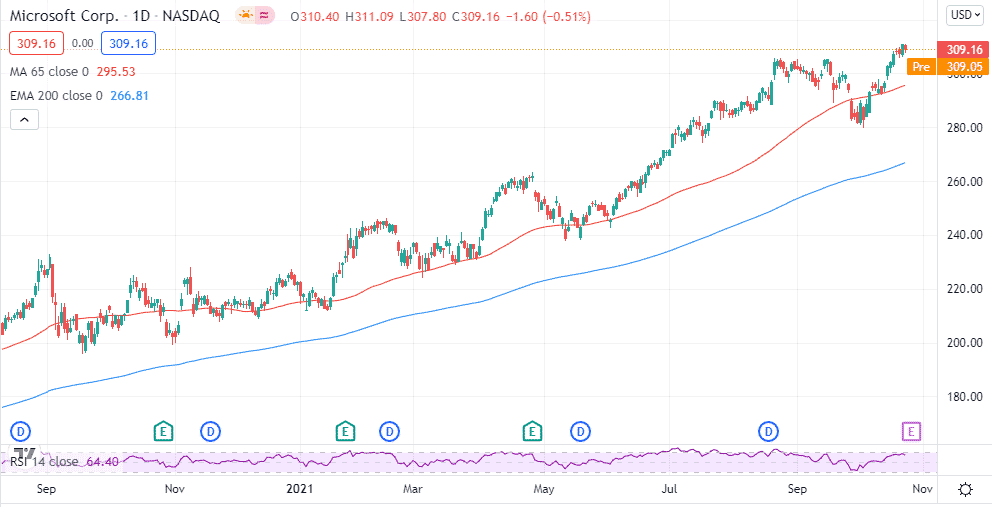

The stock is up by more than 40% for the year, having skyrocketed to all-time highs compared to a 21% gain for the S&P 500. Solid underlying fundamentals have been the main catalyst behind strengthened investors’ confidence in the company. Expectation is high that the software giant will deliver solid revenue and earnings numbers driven by growth in key business segments.

Q1 earnings expectations

Wall Street expects Microsoft to deliver earnings of $2.07 a share compared to earnings of $1.82 a share delivered the same quarter last year and in line with management expectations. In contrast, the company delivered diluted earnings per share of $2.17 in Q4 F2021, up 49% year-over-year.

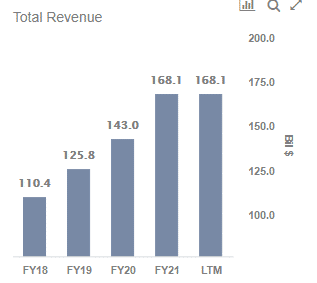

Revenue, on the other hand, is expected at $43.97 billion compared to $35.72 billion delivered the same quarter last year. In the fourth quarter of Fiscal 2021, revenue was up 21% year-over-year to $46.2 billion. Management on its part expects revenue of $44 billion, representing an 18% year-over-year increase.

The sequential decline in earnings and revenue signals a period of slow growth as Microsoft enters a period of tough comparison.

What to look out for

Microsoft Azure has emerged as a key driver of the tech giant’s bottom line thanks to the growing demand for cloud solutions. Additionally, it is currently ranked as the second largest in the cloud business, with 22% behind Amazon’s 31% market share.

When Microsoft reports, the focus should be on the learn from home trends believed to have fuelled demand for the company’s services, particularly in the Intelligent Cloud segment. With most people working and learning from home, the company’s cloud solutions attracted big business.

Revenue in the intelligent cloud unit was up 30% year-over-year in the fourth quarter to $17.4 billion, waiting to see if the momentum continued in the first quarter.

The productivity and Businesses process unit, which comprises Microsoft 365 with about 90% market share in Office Suite software, will also be the center of attention when the company reports. The segment delivered a 25% increase in revenue in Q4 F2021 to $14.7 billion. It will be interesting to see if the growth momentum is picking up pace.

The Personal Computing segment made up of Windows, Advertising, and Xbox has been the soft spot registering low growth in recent quarters. Revenue in the fourth quarter was up 9% in the quarter with Windows OEM revenue declining 3%.

However, the big question is whether Microsoft can maintain the strong growth momentum registered the past year, heading into a period of difficult comparisons.

Bottom line

Continued strength in the cloud computing platform Azure should see Microsoft deliver better than expected Fiscal 2022 first-quarter results. However, the personal computing unit could fail to excite the markets, the unit having experienced supply chain disruptions in the quarter that might have affected the development of key products.

A solid F2022 Q1 results should strengthen MSFT sentiments in the quarter and are likely to fuel further price gains in the market. Similarly, revenue and earnings falling short of Wall Street expectations could send jitters, given that the company is in a period of tough comparison.