- EURUSD under pressure after dovish ECB sentiments

- Oil prices above $70 amid growing demand optimism

- US indices rally to record highs on Q2 earning boost

- Bitcoin bottoms out on Musk rhetoric

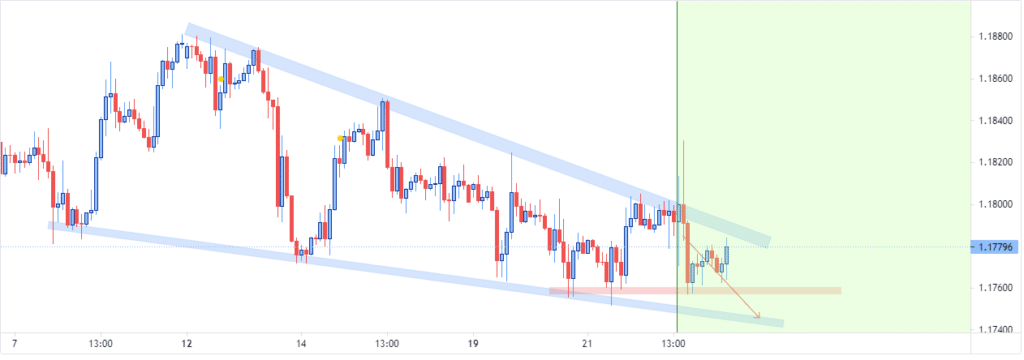

The euro remains under pressure against the majors following a bearish bias by the European Central Bank. The EURUSD has since slid below the 1.1770 level amid waning underlying fundamentals.

The pair is susceptible to further losses below the 1.1770 level and could plunge to the 1.1740, a critical support level.

A breach of the critical support level could result in the pair plunging to the 1.1700 level.

Euro strength has been weighed heavily by the ECB, reiterating it is not ready to ease the current monetary policies. The ECB met and decided to keep interest rates at record lows in the aftermath of the Federal Reserve hinting at the possibility of hiking rates soon. ECB president Christine Lagarde’s warning of the potential impact of a fresh wave of the coronavirus pandemic also continues to weigh heavily on the EURUSD pair.

Euro weakness against the yen

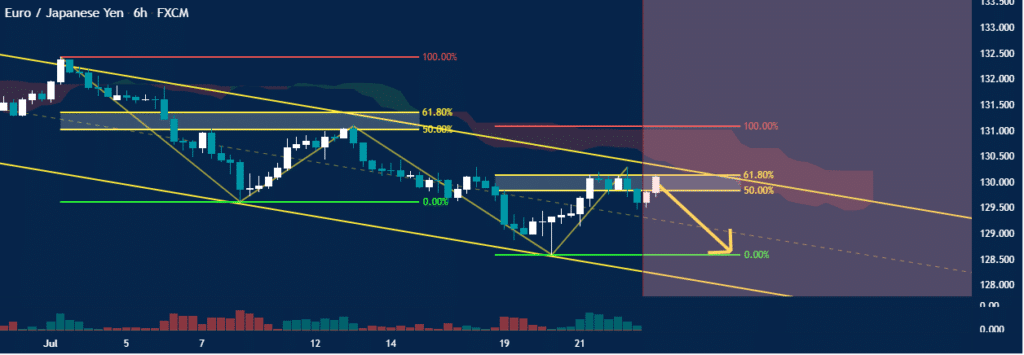

Additionally, the euro continues to lose ground against the Japanese yen. The EURJPY has bounced back from four-month lows. The pair bounce back is facing strong resistance near the 130.00 level.

A rally followed by a close above the 130.00 level should affirm the emerging uptrend.

The upside momentum on the EUR/JPY has mostly been fuelled by increased bid tone on the yen. The yen is attracting bids as a safe haven as traders adjust their positions amid the coronavirus pandemic concerns. The ECB dovish pivot on monetary policy at a time when other central banks are mulling exiting pandemic era stimulus also continues to weigh heavily on the euro against the yen.

Oil price bounces back

Oil prices continue to edge higher in the commodity markets, marking a third consecutive day of price gains. The advance has resulted in prices powering through the $71 a barrel level amid rising optimism about demand rising.

The oil price had initially dropped below the $70 barrel level amid growing concerns about a new wave of coronavirus infections. OPEC members reached an agreement to increase production but rattled the markets, resulting in a sell-off from three-year highs.

Data this week showing that gasoline demand is close to normal levels among the biggest oil-consuming countries continues to offer the much-needed support for the price jump. Lower crude holdings at the key Cushing hub have also had an impact on a spike in prices.

US indices rally

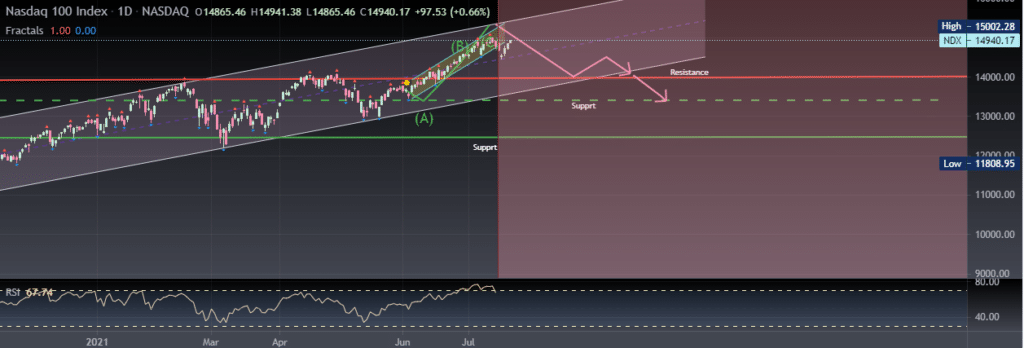

US stocks are poised to finish higher for the week on posting three consecutive days of gains and pushing all the major indices back to record highs. The rally in the equity markets comes amid an unexpected spike in jobless claims, a situation compounded by soaring Covid-19 fears.

The Dow Jones Industrial Average has retaken the 34,800 level, with the S&P 500 back to 4,300. Tech heavy NASDAQ composite continues to lead on the gains powering to highs of 14,600 levels.

The rally has come on the heels of impressive second-quarter results that continue to offset inflationary pressure and Covid-19 fears. Investors jumping into their favorite stocks ahead of earnings reports have also helped fuel the rally higher in the equity markets.

Bitcoin bottoms out

The upward momentum is once again building upon BTCUSD after the recent sell-off. After plunging below the $30,000 level, the flagship cryptocurrency has bounced back, taking out the $32,000 resistance level. The uptick in upside action comes on the heels of whale accounts that have remained dormant for years waking up with big transactions worth $841 million.

Additionally, BTCUSD has benefited from Elon Musk, reiterating he remains invested in the flagship cryptocurrency. He has also hinted at the possibility of Tesla resuming BTC payments on the amount of renewable energy used to mine it increasing.