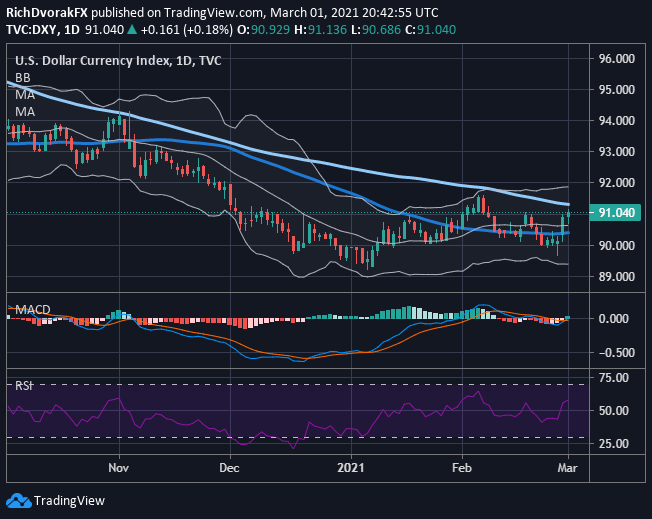

- The US dollar is up by more than 0.7% for the week, having turned bullish in response to Treasury yields rallying to one-year highs. The greenback rally has also received support from the positive commentary by the Federal Reserve Chair.

- The non-farm payroll report for February is the immediate economic release that could significantly impact dollar strength heading into the weekend. The outcome could determine whether the greenback strengthens or pulls back.

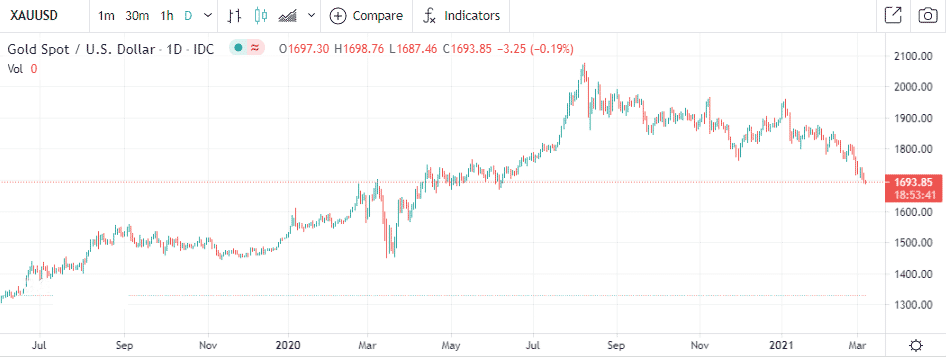

- Gold remains under pressure on dollar strength. The precious metal is looking increasingly bearish, having plunged below the $1,700 an ounce level.

The US dollar is headed to its biggest weekly gain as it continues to strengthen against other major currencies. The currency has been trending higher, hitting a four-week high. The rally has coincided with US Treasuries recording orderly gains, rallying to one-year highs.

Dollar strength

Growing optimism of economic recovery in the aftermath of the COVID-19 vaccine is one of the catalysts that has sent Treasury yields higher, conversely fueling dollar strength. Improving economic data has also strengthened trader’s sentiments about the US economy, leading to further strengthening of the greenback.

An aggressive fiscal stimulus deployment has helped boost US economic recovery growth prospects, conversely helping strengthen trader’s sentiments on the dollar. A spike in buying pressure has seen the dollar index, which measures the dollar’s strength against a basket of other currencies, eclipse its 100-day simple moving average.

The buying pressure has coincided with an upswing on both the relative strength index and MACD indicators. The currency powering through the upper Bollinger bands is already fuelling overvaluation concerns.

Major currencies weakness

In recent days, the greenback has registered substantial gains against the euro and yen, with the USD/JPY pair soaring to seven months highs. The greenback looks set to continue strengthening against the yen on Treasury yields continuing to rise.

The USD/JPY is looking bullish, having rallied to seven months high above the 107 level. A breach of the 108 resistance level could open the door for the pair to rally to the 110 level.

The EUR/USD pair has also come under pressure, plunging to four-week lows on the Federal Reserve Chair Jerome Powell, triggering a surge in Treasury yields with the ten-year yield surging past the 1.55% level.

The Australian and the New Zealand dollars have also not been spared either amid the broader US dollar strength. However, the gains could be short-lived given that the two economies appear to be doing exceedingly well on easing COVID-19 disruptions. With global trade expected to continue rising, the two currencies could receive a significant boost.

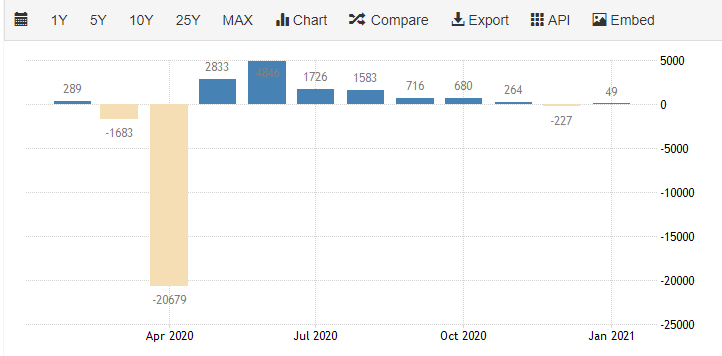

Non-farm payroll in focus

The Non-Farm Payroll is the latest economic release likely to influence trader’s sentiments on the dollar. The expected NFP results for February calls for the addition of 182,000 jobs. The NFP report topping estimates could trigger further dollar strength, especially on the unemployment rate tanking below the 6.3% level.

Markets would interpret a surge of over 200,000 jobs in February as robust economic recovery and a rapid return to normality. More people back to work would translate to more money to spend, which could see inflation edging higher. Similarly, given the realistically lower 182,000 jobs gain expected, a meager increase of less than 100,000 could lead to weakness in the dollar.

Gold sell-off

Gold is one of the commodities that has paid the ultimate price amid the broader dollar strength. The precious metal has since tanked to the eight months’ low and is looking increasingly bearish on tanking below the $1,700 an ounce level.

Gold is currently trading near a critical support level at the $1,690 level, below which it remains susceptible for further drops to the $1,500 level.

Gold sell-off has coincided with the Federal Reserve chair sending bond yields higher conversely, leading to dollar strength. Treasury yields have in recent days rallied past the 1.55% level on Powell, admitting that a recovering economy could create upward pressure on prices leading to higher inflation.

Powell’s sentiments have rattled the market, with the stock market pulling lower and gold following suit. Gold has been under pressure ever since it struggles to find support above the $2,000 an ounce level. Investors have continued to shrug off the metal despite its so-called inflation hedge.

Traders await the release of the February jobs report, which could weigh on the yellow metal. A better-than-expected jobs report could further strengthen the dollar, which could send gold lower below the $1,700 handle. Likewise, the report failing to excite the market could result in dollar weakness which could see a gold bounce back.