- Bitcoin and Ethereum retreat from four-month highs

- GBPUSD under pressure tanking to one-month lows

- Oil prices post longest losing streak since 2020

- US equities retreat from record highs of FOMC pressure

Bitcoin and Ethereum have been trading higher in recent weeks, following a string of supportive comments from Tesla CEO Elon Musk and Cathie Wood of Ark Investment Management. The positive chatter helped fuel a bounce back from five-month lows. However, the upward momentum appears to be losing steam.

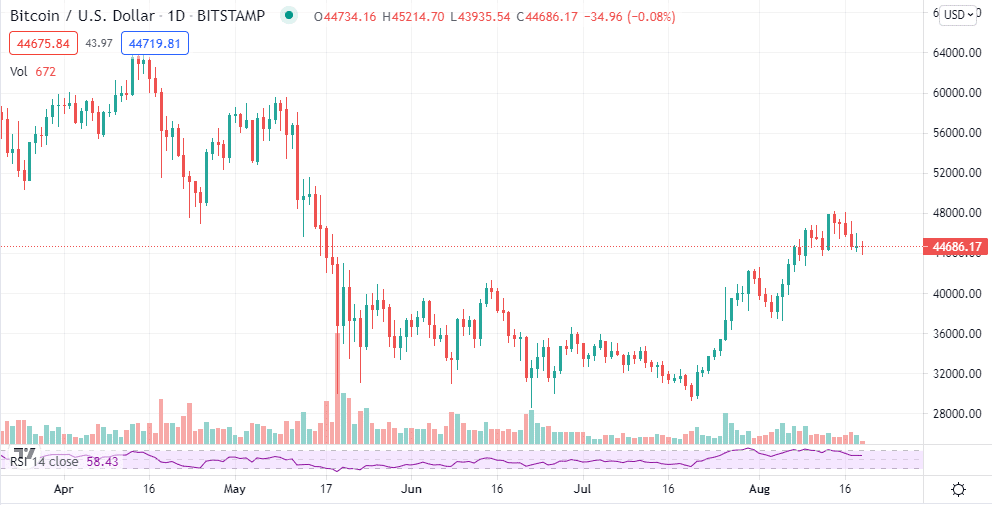

Bitcoin pullback

The two household names in the burgeoning cryptocurrency sectors have given up some of the early weekly gains as bears take the fight to the bulls. BTCUSD has been trading lower for the better part of the week, having struggled to power and find support above the $48,000 level.

A pullback to the $44,300 level leaves the flagship cryptocurrency susceptible to further losses to the $43,700 level.

A sell-off followed by a close below the $43,700 support level could pave the way for bears to push BTCUSD to the $40,900 mark, the next substantial support level. On the flip side, bulls need to defend the $43,700 support level to have any chance of pushing prices higher.

Bitcoin prices have been weighed heavily by a crackdown in China, targeting mining and trading operations. While the crackdown headwind has slowed in recent days, the crypto is in dire need of new catalysts to power through the $50,000 level.

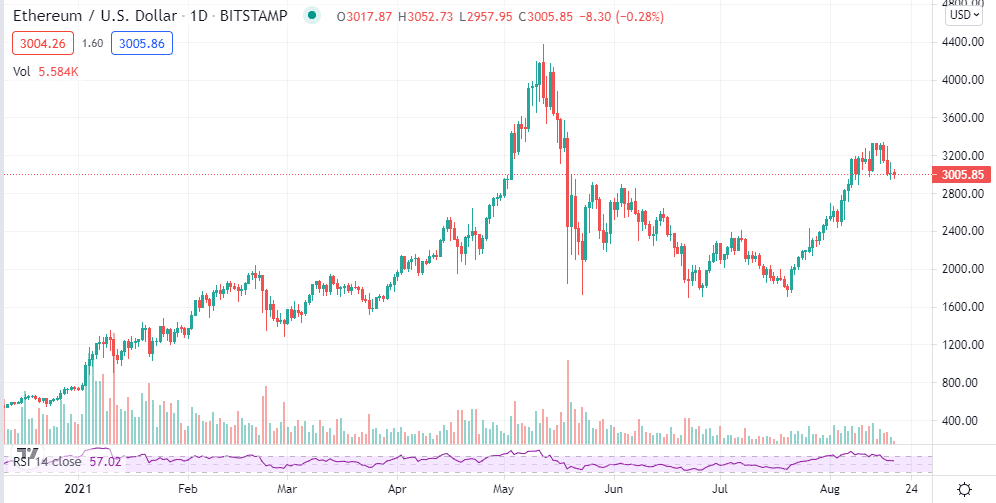

Ethereum at support

Ethereum is another cryptocurrency under pressure amid waning upward momentum in the industry. ETHUSD has posted four consecutive days of losses pulling back from four-month highs of $3,339. The pair is currently trading at a critical support level near the $3,000 mark.

A sell-off, followed by a close below the $3,000 level, could result in an influx of selling pressure that could see ETHUSD tanking to the $2,800 mark, the next substantial support level.

Bulls succeeding in defending the $3,000 level should pave the way for a bounce-back to four-month highs of $3,300.

One of the factors offering support to Ethereum is reports indicating that Microsoft, Alibaba, and Carnegie Mellon University are contemplating using the Ethereum blockchain to combat piracy.

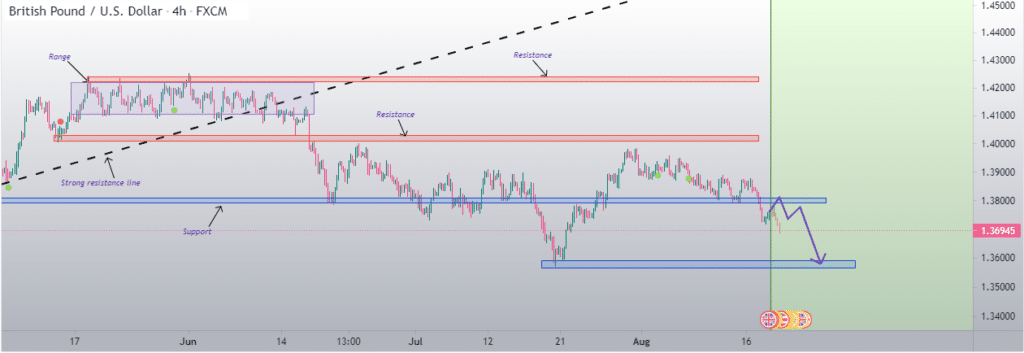

GBPUSD sell-off

In the forex market, the British pound is on the defensive, falling prey to dollar strength for the fourth consecutive day. With the dollar strengthening to four months highs, the majors are once again under immense pressure.

GBPUSD has since tanked to one-month lows after a recent breach of the 1.3800 support level. Bears are now attacking the 1.3700 support level on dollar strength themes across the board.

The cable is suffering from hawkish FOMC minutes that signaled tapering in the US could occur soon. Slowing inflationary pressures in the UK and flaring Brexit worries also continue to take a toll on pound strength, fuelling GBPUSD sell-off.

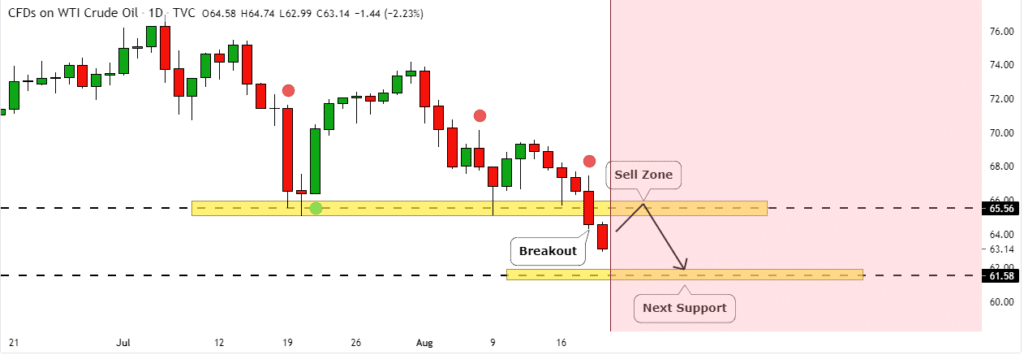

Oil prices longest losing streak

Oil prices are yet again on the receiving end, tanking for the sixth-consecutive day. US oil has slid to three-month lows at the back of the longest losing streak since February 2020. US oil was down by 1.7% on Thursday to $63.34 a barrel as Brent crude shed 1.3% to $67.36 a barrel.

Growing fears over skewer fuel demand are fueling the sell-off in the oil markets. A surprise build-up in US gasoline inventories has also added to the pressure. Oil prices are looking increasingly vulnerable amid a spike in COVID-19 infections that threaten lockdowns around the world.

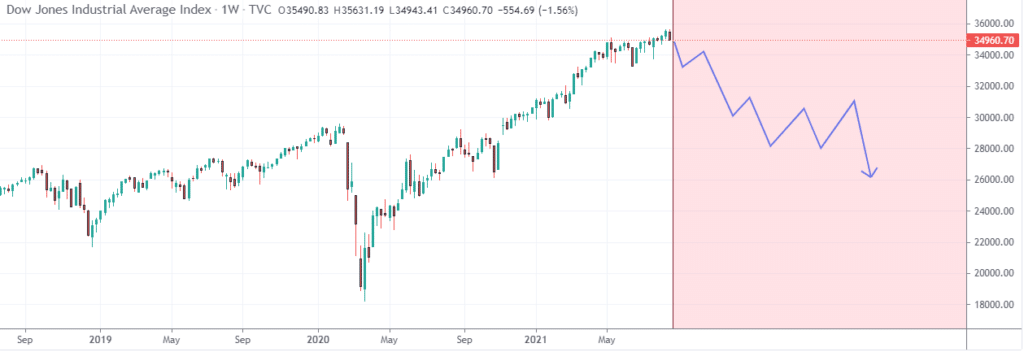

US stocks sell-off

US stocks closed lower on Wednesday following the FOMC minutes sending all the major indices lower. The S&P 500 and Dow Jones Industrial each fell 1%, and the NASDAQ closed 0.89% lower after the FOMC minutes showed the FED is closer to start tapering.

The minutes showing FED’s growing concerns about inflation fuelled suggestions that the central bank is ready to act. The prospects of the FED tapering bonds and hiking interest rates did not go well with equity investors.