- US dollar reamains on the defensive but near all-time highs.

- GBPUSD under pressure after interest rate disappointments.

- EURUSD is struggling for direction near one-month lows.

- Gold turns bullish on falling yields.

- US benchmark indices power to all-time highs.

- Cryptocurrencies rally persists.

The US dollar is on the defensive at the start of the week after it was rejected at its highest level in more than a year. The dollar index, which measures the greenback strength, powered to highs of 94.62 last week after a better than expected Non-Farm Payroll report.

The report showed that the US economy added 531,000 jobs in October, more than 450,000 jobs that analysts expected. The increase came as COVID-19 infections subsided, fueling the economy’s reopening. The index has since pulled back to 94.23

The better-than-expected jobs report triggered a decline in demand for safe-havens as risk appetite improved with investors betting on riskier currencies and stocks. Federal Reserve Chairman Jerome Powell reiterating they are not in any hurry to hike interest rates also weighed heavily on dollar strength against the majors

GBPUSD and EURUSD under pressure

Amid the dollar softness, the GBPUSD pair is trying to bounce back after plunging to five-week lows last week. The pound has come under immense pressure after the Bank of England opted to keep interest rates steady at 0.10%. Dovish remarks from the central bank continue to curtail any gains on the pair, which has since sunk below the 1.3500 level.

The EURUSD is another pair struggling for direction near one-month lows of 1.1561 after coming under pressure following dovish remarks by the European Central Bank. The bank failing to provide a clear path for rate hikes has continued to weigh heavily on the common currency against the dollar.

Consequently, the EURUSD has struggled to hold on to gains after a recent surge above the 1.1600 level. Above the critical resistance, level bears have come into the fold and pushed the pair lower.

The Australian dollar and the New Zealand dollar are some of the majors that have continued to hold firm, fending off dollar pressure in recent days. The AUDUSD is trying to consolidate above the 0.7400 level, the NZDUSD having found support above the 0.7100 level.

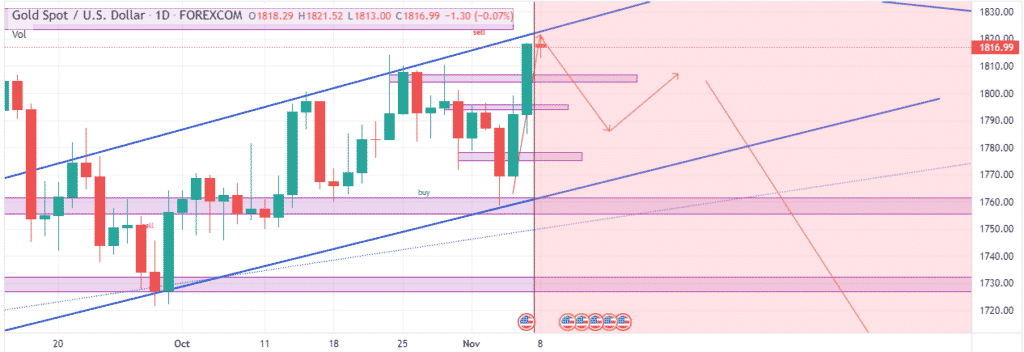

Gold bullish tone

Gold has regained its bullish momentum in the commodity markets taking advantage of the dollar softness across the board. The XAUUSD has since powered through the $1800 psychological level, with bulls eyeing the $1834 mark, which happens to be the next crucial resistance level.

The bullish momentum comes at the backdrop of US treasury yields coming under pressure and retreating from four-month highs to five-week lows. The spike in Gold prices also comes amid strong demand for the precious metal in India during the festival season last week.

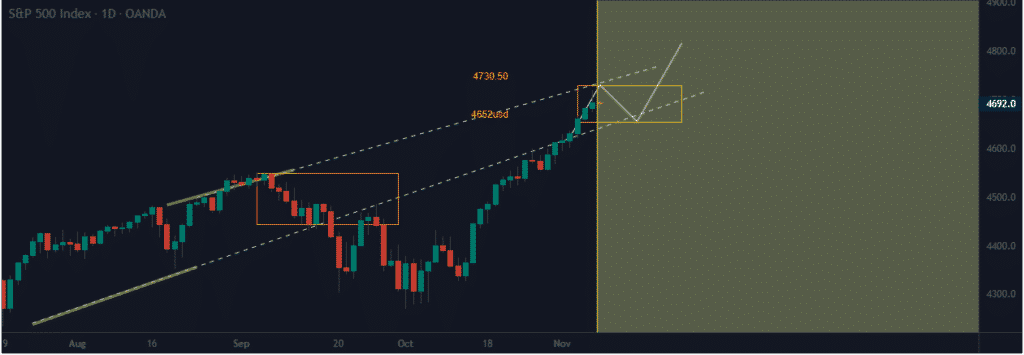

US indices rally

In the equity markets, all the major US benchmarks bounced back to record highs last week as signs of a resurgent US economy fuelled demand for stocks. The S&P 500 gained 2% last week as investors reacted to declining unemployment and a better than expected NFP report.

Tech heavy NASDAQ was also on a roll, gaining 0.45% on Friday to all-time highs of 16,456. The Dow Jones Industrial Average gained 0.5% on Friday. The rally in the equity benchmarks remains well supported by stocks powering to record highs at the back of blockbuster earning reports.

Meanwhile, US stock mutual funds and exchange-traded funds recorded their best monthly gain in October. The gains came as investors shrugged off virus and inflation concerns to continue betting on stocks. Data by Refinitiv indicates that an average US stock fund rose by 5.7%, boosting the year-to-date advance by 21.1 %.

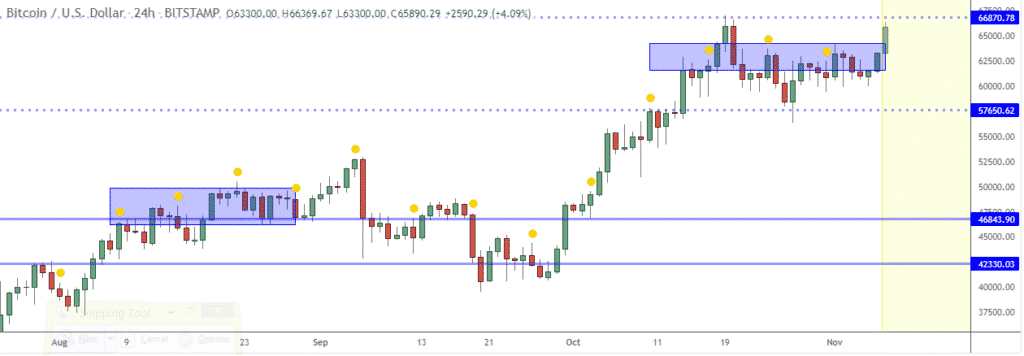

Cryptocurrencies rally persists

Separately, cryptocurrencies remain on the front foot at the start of the week powering to near-record highs on Monday, well supported by bullish momentum that started a few weeks back. BTCUSD touched highs of $66,045 on Monday, with bulls well poised to steer a rally to an all-time bight of $66,936.

Ethereum, which is up by more than 50% for the year, has already hit new all-time highs after powering to highs of $4,749 at the time of writing. The rally in the cryptocurrency market comes at the backdrop of the launch of the US future-based bitcoin exchange-traded fund. Falling real yields worldwide also continues to fuel demand for digital assets as a hedge against rising inflation.