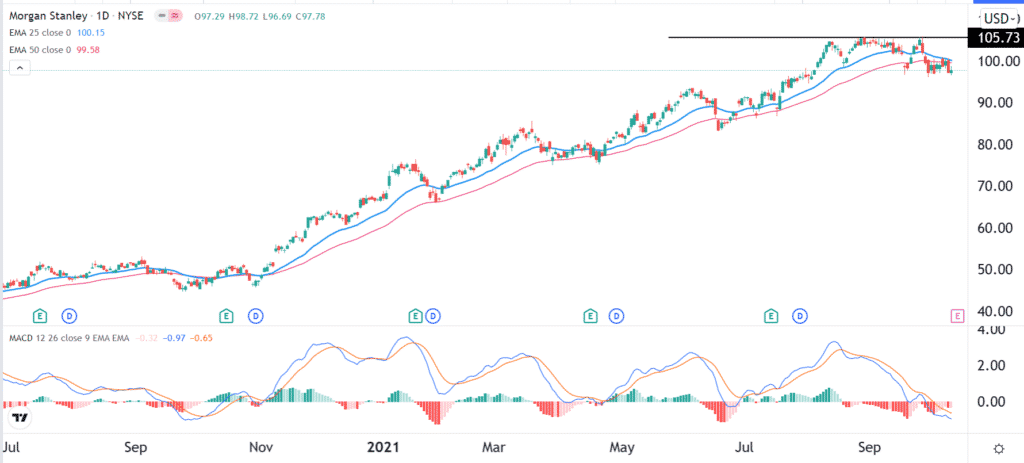

The Morgan Stanley stock price is hovering near its all-time high as investors wait for the company’s third-quarter earnings scheduled on Thursday. The stock is trading at $97.78, which is slightly below its all-time high of $106. It has jumped by more than 50% this year and outperformed the likes of JP Morgan and Citigroup.

Morgan Stanley earnings preview

Morgan Stanley is one of the biggest banks in the United States, with more than $178 billion in market capitalization. The company offers multiple services, including investment banking, brokerage, wealth management, and Institutional Securities.

Data compiled by SeekingAlpha shows that the company’s revenue is expected to drop from $14.76 billion in the second quarter to more than $13.65 billion in the third quarter. This revenue will still be higher than the $11.66 billion that it generated in the same quarter in 2020.

At the same time, analysts expect that the data will show that the company’s earnings per share rose to $1.68 in the third quarter. Still, the company has a good track record of beating Wall Street earnings. It has outperformed them in the past five consecutive quarters.

For example, in the second quarter, Morgan Stanley recorded stronger than expected results, boosted by its investment solutions. Its wealth and investment management division saw record inflows of more than $120 billion, helped by its recent acquisitions of Eaton Vance and E*Trade. Its total assets under management zoomed to more than $1.5 trillion.

Shareholder returns and costs

In this quarter’s release, analysts will be looking at several key details in Morgan Stanley’s performance. First, they will look at whether the company will boost its shareholder returns.

In the second quarter, the company doubled its dividend payout to investors and announced that it would return more than $12 billion to investors through share buybacks. This happened after the Federal Reserve gave banks the go-ahead to return funds to shareholders.

The Morgan Stanley stock price will also react to the company’s cost structure. In the past few weeks, several Wall Street banks have warned about escalating costs of doing business as they boost employee pay. This could affect the company’s profitability in the third quarter. In Q2, the company’s expense efficiency ratio was about 69%.

Most importantly, the market will look at the FICC growth. FICC stands for Fixed Income Commodities and Currencies and is one of the most important segments of the company.

Is Morgan Stanley a good investment

In general, Morgan Stanley stock price has done well over the years. Excluding dividends and buybacks, the stock has jumped by more than 240% in the past five years. In the same period, the S&P 500 has jumped by about 120%. The stock has also outperformed its peers this year, and analysts expect that it will keep doing well.

Data compiled by Webull shows that all of the 28 analysts who track the company have a favorable rating on the company. 57% of them have a buy rating, while 14% of them have a strong buy rating. Similarly, about 28% of them have a hold rating.

Morgan Stanley stock price analysis

The daily chart shows that the Morgan Stanley stock price has done well in the past few months. However, a closer look shows that the stock has found a lot of resistance in the past few days. It has found strong resistance at the $100 level. It has moved below the 50-day and 25-day moving averages (MA), while the MACD has formed a bearish divergence pattern. Therefore, the stock will likely retreat after the company publishes its earnings.