- Apple stock up 12% ahead of Q4 Results.

- Q4 revenue and earnings are expected to top estimates.

- Focus on iPhone 13 demand.

- Service segment growth in focus

Apple Inc. (NASDAQ: AAPL) is scheduled to cap a busy week on the earnings front when it reports its Fiscal Q4 results after the market closes on October 28, 2021. While the company blew expectations when it delivered Q3 results, that is not expected to be the case this time around, going by the supply chain issues that hurt its operations in the quarter.

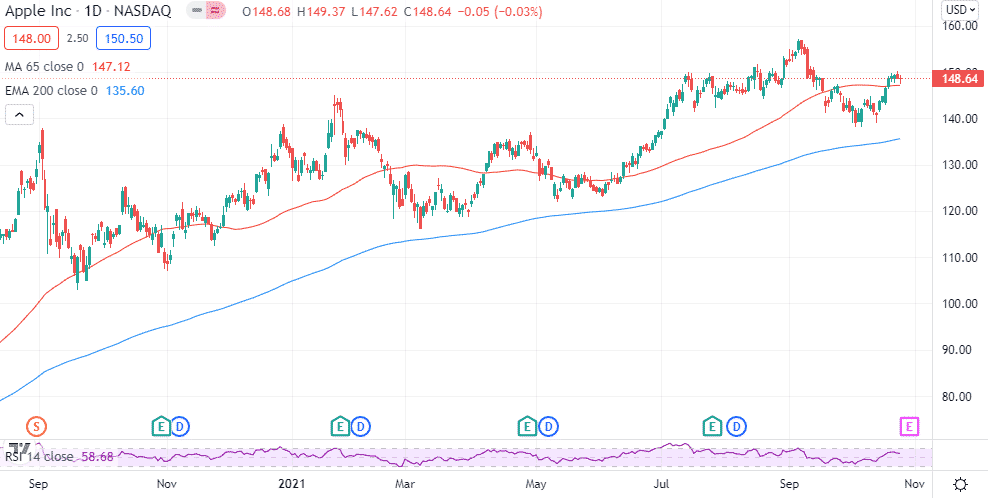

While the stock is up by about 12% year to date, it has underperformed the overall market, given that the S&P 500 is up by about 20%. Additionally, the stock is down by about 6% from all-time highs as it continues to edge lower.

Amid the supply chain issues, Apple is expected to finish a record-breaking year on a roll thanks to strong 5G iPhone sales.

Q4 earning expectations

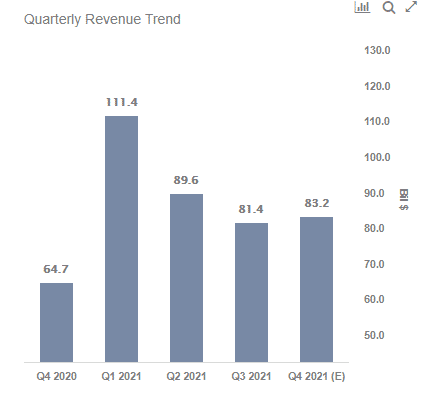

Wall Street expects the iPhone maker to deliver revenue of $83 billion, representing a 28.5% year-over-year increase. The increase will mostly be attributed to strong sales of the iPhone 12 and higher demand for iPads and Macs. Additionally, strong growth in the services segment is also believed to have significantly impacted revenue growth.

In the third quarter, revenue was up 36% year-over-year to $81.4 billion. Consequently, deceleration in revenue growth rate might as well indicate the impact of a tough comparison.

EPS, on the other hand, is expected at $1.18 a share, a 57% year-over-year increase. However, it will be a decline considering the company delivered earnings of $1.30 in the third quarter, double $0.65 delivered the same quarter last year.

iPhone 13 is not expected to significantly impact Apple’s Q4 results as it was launched in September and is available for sale for just a week in the quarter. Margins are expected to edge higher, mostly driven by a growing mix of services revenues and higher revenues for iPhones, among other devices.

What to look out for when Apple reports

When Apple reports Q4, the focus will be on the iPhone 13 demand, which is expected to be a key driver of the bottom line over the next year. CEO Tim Cook and his team are likely to talk about the ordering pattern, which should offer a clear indication of the underlying demand.

Amid the supply chain issues, investors should be wary of a difficult upgrade cycle going forward. There are concerns that the premium iPhone 13 could see some pressure due to saturation concerns. Additionally, production problems due to semiconductor shortages could significantly hurt Apple’s ability to ramp up production and meet any demand in the market.

In addition to iPhone sales, the focus will also be on other devices with Macs and refreshed iPads expected to elicit interest from the investment community. The iPads had seen an upswing in sales in Q3, waiting to see if the growth momentum continued in Q4. Apple indicating that a new series of Apple watch is on the pipeline should also evoke interest.

The services sector is expected to be a key driver of the bottom line in the years to come. Consequently, it will be interesting to see the kind of numbers the segment delivers. The segment is made up of the likes of Apple TV Plus, Music, Fitness plus, and iOS games.

While Apple did allocate $29 billion to shareholders in the last quarter, it will be interesting to see what it plans to do with the $72 billion it had at the start of the first quarter.

Bottom line

While Apple stock has gained about 12% year to date, its underperformance is a point of concern. The underperformance has come on investors roaring out of pandemic winners into more cyclical plays. Consequently, a better than expected Q4 report affirming underlying growth in key businesses should strengthen investors’ confidence in the stock.

A strong earnings beat could be the catalyst to take Apple stock higher after a 6% pullback from all-time highs.