- US dollar steadies near 1-month highs.

- USDJPY eyes further gains above 109.50.

- AUDUSD bounces back on dollar softness.

- US equity indices under pressure as back bounce stalls.

- Oil prices edge higher as stockpiles fall the most.

- Bitcoin and Ethereum sell-off persists.

The US dollar was holding steady slightly below one-month highs as global markets formed following the risk-off mood on Monday. The softness suggests the greenback could struggle as an improved pandemic backdrop continues to fuel demand for riskier bets in the forex market.

In addition, all eyes are on the Federal Reserve scheduled to post its policy decision later in the day. A plan by the US central bank to tighten monetary policy sooner than later is likely to favor the greenback. The FED pushing back on tapering could, in return, trigger renewed weakness that could see the buck weaken across the board.

USDJPY trying to bounce back

The USDJPY is yet to take advantage of the greenback softness, with the pair staying firm near the 109.50. The pair has bounced back from weekly lows as the Japanese yen remains under pressure as demand for safe-havens wanes amid improving the COVID-19 situation.

The pair is currently trading near a critical support level at 109.50. A breakthrough of the support level could fuel a move to the 110.00 level. Conversely, the pair struggling to hold on to gains above 109.50 could result in a pullback to the 109.00 level.

The Japanese yen remains on the back foot on the Bank of Japan, raising the economic outlook downwards citing virus woes. The bank also kept the benchmark rate at -0.10% and held the 10-year government bond at around 0%.

AUDUSD double bottom bounce back

Meanwhile, the AUDUSD pair appears to have hit strong support near the 0.7220 level from where it is trying to bounce back. The formation of a double bottom at the crucial support level is already offering support for further upside action.

The pair is staring at strong resistance near the 0.7290 level above, which could turn bullish after coming under immense pressure in recent days owing to dollar strength. Australian dollar sentiments have improved on the International Monetary Fund’s Chief Economist Gita Gopinath sounding optimistic about China’s Real estate sector.

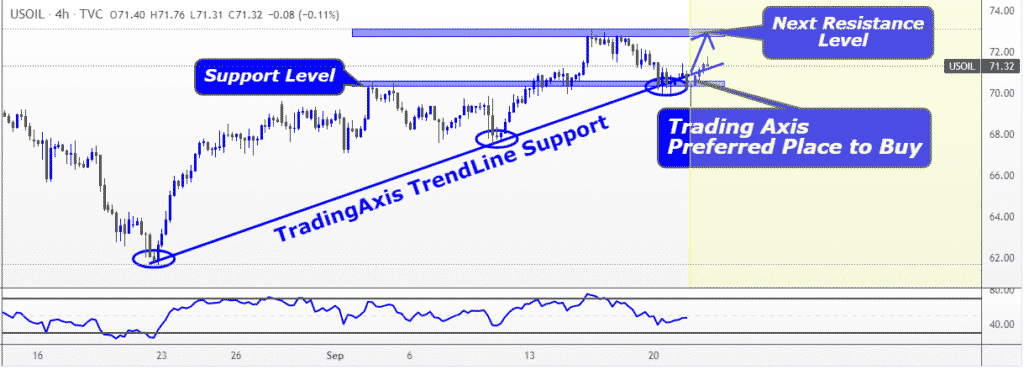

Oil price rise

In the commodity markets, oil prices are edging higher for the second day running after data showed US crude stocks fell the most last week by 6.1 million barrels in the wake of two hurricanes. US West Texas oil appears to have found support above the $70 a barrel level after rising 1.5% to $71.57 a barrel. Brent Crude was also up 1.4% to $75.39 a barrel.

Oil prices are still in recovery mode ahead of the release of the EIA weekly report later in the day. Additionally, the US Federal Reserve monetary policy decision could have a significant impact on the US dollar, which could influence oil prices.

The Royal Dutch Shell stating that production at the Gulf Mexico would be limited due to recent damages also continues to offer support for higher prices. Reports that OPEC members are struggling to increase output to targeted levels also continue to trigger bullishness on oil prices.

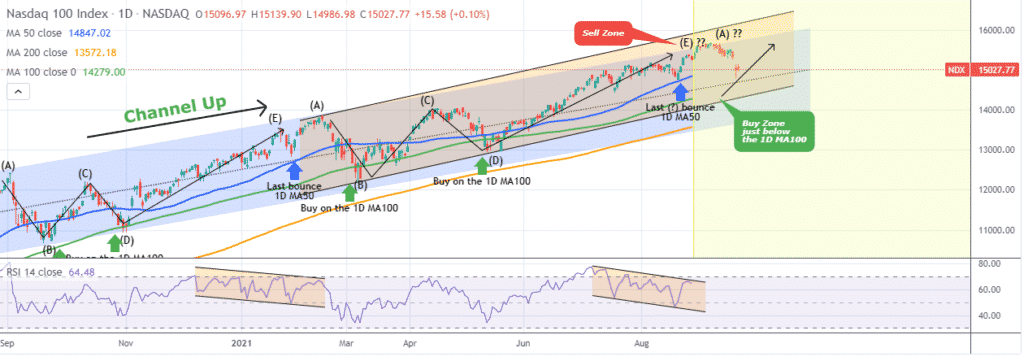

US equity woes persists

A rebound in the US equity markets struggled to gather steam, with major US indices closing lower on Tuesday after a massive sell-off on Monday. The Dow Jones Industrial Average fell 0.2% as S&P 500 fell 0.1% and Nasdaq Composite closed 0.2% higher.

The uncertainty in the equity markets has forced investors to rush into safe havens, with the 10-year US Treasury bond yield inching higher to 1.32%. The jitters in the equity markets come amid growing concerns that should Chinese property developer Evergrande go under, it could ripple across the financial markets.

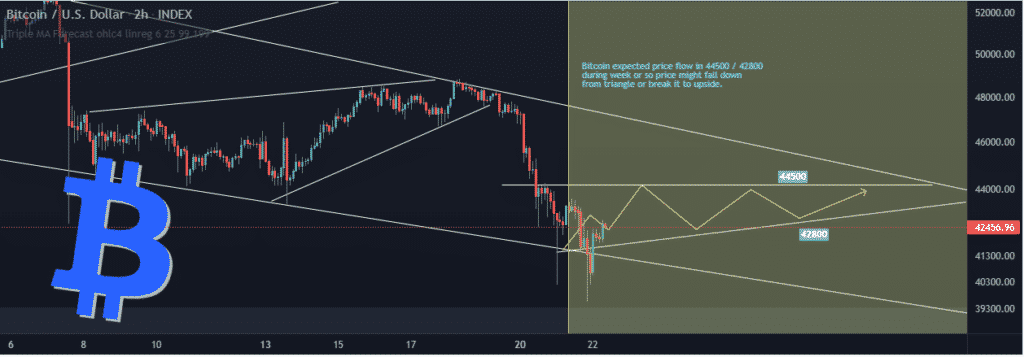

Bitcoin and Ethereum under pressure

In the crypto market Bitcoin and Ethereum remain under pressure for the third day running after tanking below key support levels. After tanking below the $40,000 level, BTCUSD is trying to bounce back on powering to the $42,200 level.

However, BTCUSD remains susceptible to further losses on failing to rise and find support above the $43,000 level. ETHUSD also remains under pressure after tanking below the $30,000 psychological level.