- US dollar bullish despite a pullback from one-month highs.

- EURUSD trying to bounce back after sell-off.

- EURGBP in consolidation mode ahead of key releases.

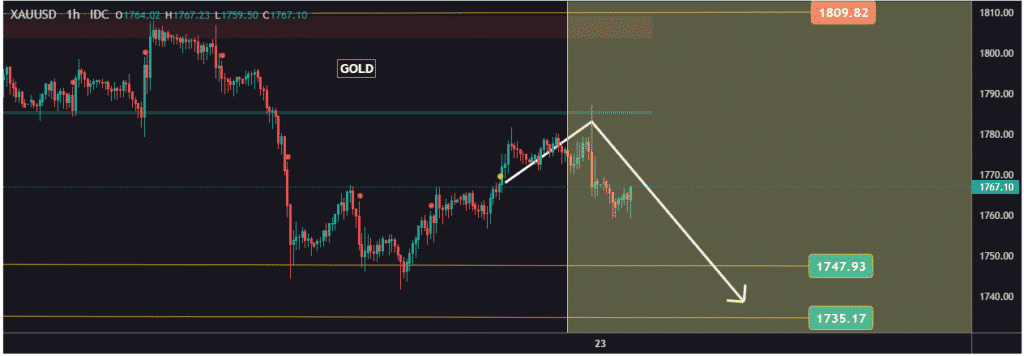

- Gold under pressure near crucial support level.

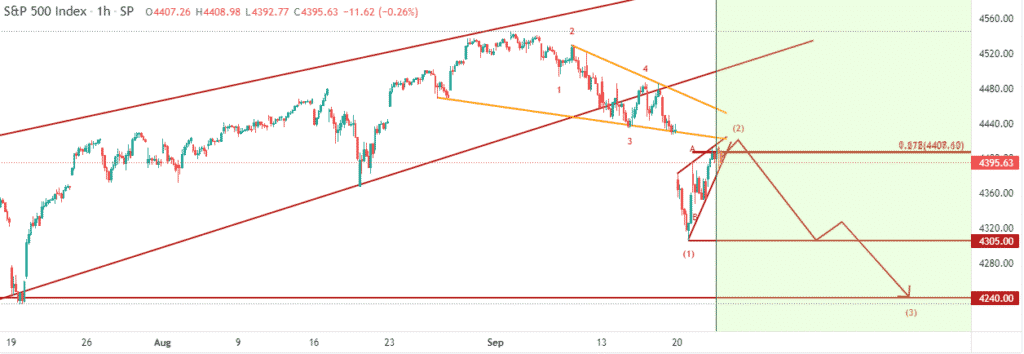

- US equities bounce back after FED report.

The US dollar pulled back Thursday morning after powering to the highest level in a month as the Federal Reserve affirmed plans to begin asset tapering. The FED also hinting that rate hikes could come a lot sooner also helped fuel dollar strength.

The dollar index, which measures greenback strength against the majors, touched highs of 93.51 before pulling back. The softness in the dollar after a dovish Federal Reserve report comes on a spike in demand for risk in the market. Risk-sensitive currencies are attracting bids on Chinese property developer Evergrande, reiterating that it will make a bond coupon payment.

EURUSD retakes 1.1700

EURUSD is one of the pairs on the defensive, trying to bounce back amid dollar softness. The pair plunged to one-month lows of 1.1681 on Wednesday as the dollar strengthened on the FED clearing the path to reduce monthly bond purchases.

EURUSD has since powered through the 1.1700 psychological level waiting to see if bulls have what it takes to fuel a bounce back. On the flip side, a breakthrough in the 1.1700 support could trigger losses to the 1.1650 area.

FED chair Jerome Powell sounding Hawkish more than ever, looks set to continue fuelling dollar strength, likely to pile pressure on the common currency. Looking forward, focus is on economic releases with the Germany PMI on dial later in the day. US PMI data later in the day is also likely to influence dollar strength.

EURGBP in consolidation

Meanwhile, EURGBP continues to trade in a tight trading range as the euro and the British pound remain under pressure across the board. The pair has struggled to power through the 0.8600 level, with 0.8520 emerging as a crucial support level, curtailing further losses.

The consolidation mode could be sorted out later in the day, given the plethora of economic data in the pipeline. Germany’s PMI would be the center of attention as it is likely to influence euro strength against the pound. Additionally, the focus will be on the Bank of England expected to issue its policy meeting report and interest rate decision.

Gold under pressure after bounce back

Gold remains susceptible to further losses after rejection above the $1780 an ounce level in the commodities market. The FED-sounding hawkish continues to work in favor of the greenback, consequently sending XAUUSD lower.

The precious metal remains well supported for a potential bounce back on finding support above the $1762 level. A sell-off resulting in price tanking below the support level could trigger renewed sell-off to the $1742 area.

As it stands, gold is trying to make a minor recovery above the $1760 level amid easing risk-on trades in the market that has resulted in yields edging lower. Lower yields tend to fuel dollar weakness which works in favor of the precious metal.

US equities recover

Losses in the US equity markets eased as major indices bounced back on the Federal Reserve, reiterating it is not ready to roll back monetary stimulus and hike interest rates. The Dow Jones Industrial Average gained 1% ending a four-day losing streak. The Dow was also up 520 points as tech-heavy NASDAQ also gained 1%.

The FED not giving a specific timeline on when it will taper or hike rates favors equities, thus the renewed buying pressure. While tapering could start in November, failure to do so now is seen as dovish, which favors equities.

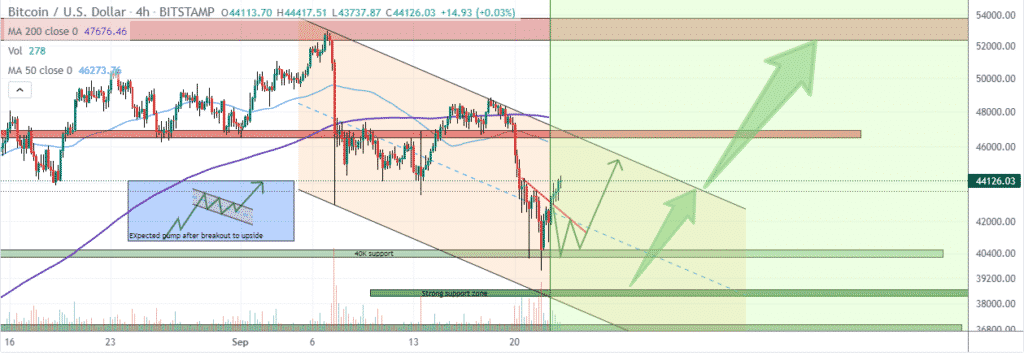

Bitcoin and Ethereum recover

Bitcoin and Ethereum are again trying to bounce back after plunging to one-month lows on Wednesday in the cryptocurrency market. BTCUSD has since powered through the $43,000 level after sliding to one-month lows of $39,400 on Tuesday.

ETHUSD is also in recovery mode powering through the $3,000 psychological level after sellers fuelled a sell-off to lows of $2,655. Amid the bounce back, the two are still trading near key support levels that could be threatened by renewed dollar strength.