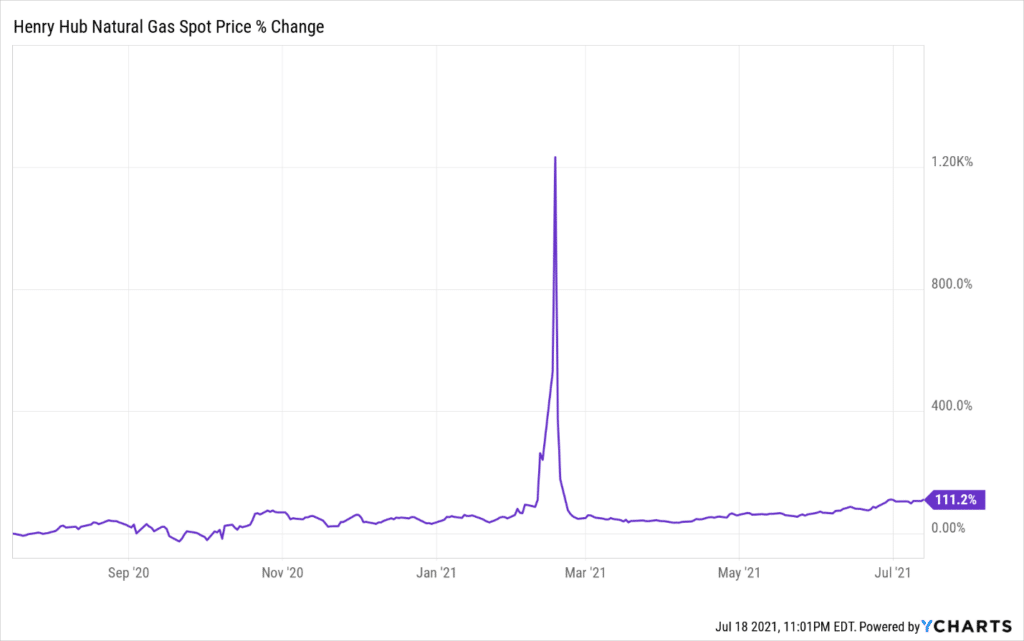

- Henry Hub Natural gas traded at 3.78 USD/MMBtu as of July 13, 2021, adding 111.2% in its 1-year change.

- Areas around the Pacific Northwest experienced a heatwave that limited hydroelectricity output.

- Global trade of LNG grew 45% between 2015 to 2019, attributed to the expansive liquefaction capacities in Australia, the US, and Russia.

The August 2021 natural gas contract added 0.63% to trade at 3.702 as of 10:43 pm GMT on July 18, 2021. The contract had traded at a high of 3.679 in the previous day, gaining 1.89%. If we look at the spot prices, the Henry Hub Natural gas traded at 3.78 USD/MMBtu as of July 13, 2021, adding 111.2% yearly.

Natural gas 1-year change (Henry Hub)

The US NYMEX natural gas futures rose more than 65% annually as gas prices hit a 2.5-year high (from December 2018). The past 52 weeks have seen natural gas prices gain 115.95% since the pandemic introduced sell-offs in 2020.

Weather and inventory levels

Extreme weather patterns influenced market dynamics favoring the rise of natural gas prices. Many parts of the US experienced hot weather that increased demand for electricity generation through the gas. Areas around the Pacific Northwest experienced a heatwave that limited hydroelectricity output.

Brazil, known for its large offshore natural gas reserves, with an average of 897 billion cubic feet (Bcf) as of 2019, is currently facing an acute drought situation. The national grid operator (ONS) for electricity has requested generators to postpone maintenance, and technical developments over the drought fear indefinitely. Low output from hydro-dams has increased Brazil’s inflation levels, including the price of alternative energy sources such as natural gas.

The heat-off situation in Canada also caused a decline in natural gas inventory levels and subsequently led to a commodity price hike. The main gas-producing areas of northern British Columbia (faced a 400C increase in temperature), while Alberta’s temperature rose to 350C.

Alberta’s electricity demand between June 28 and June 29, 2021, rose above its peak levels at 11,712 MW. Natural gas accounts for 50% of Alberta’s power generation, replacing coal now relegated to 31% of the electricity share. The AECO natural gas benchmark was trading at $4.16 per 1000 cf into July 2021. Up to 2.1 billion cubic feet (Bcf) of natural gas was withdrawn in Western Canada to cater to the high demand.

Low LNG output levels

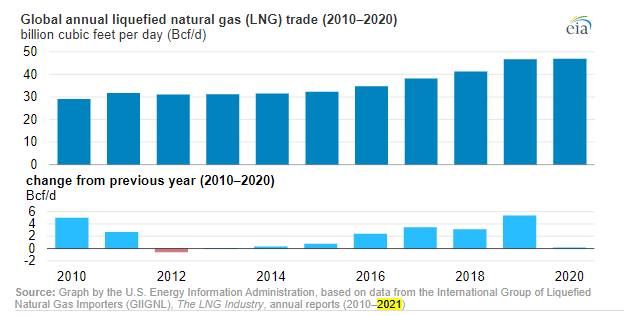

According to the Energy Information Administration (EIA) of the US, liquefied natural gas (LNG) levels in 2020 stayed flat at an average production of 46.9 Bcf per day.

LNG production levels

Global trade of LNG grew 45% between 2015 to 2019. This growth is attributed to the expansive liquefaction capacities in Australia, the US, and Russia. Demand destruction from Covid-19 caused annual LNG trade to increase 0.4% into 2021. However, liquefaction capacity is expected to expand beyond 90% in 2022 as natural gas demand peaks.

Australia, the world’s second-largest LNG exporter (behind Qatar), has grown its exports from 7.1 million tons (MT) in 2004 to 80 MT in 2021. The commodity accounts for annual revenue of A$50 billion.

Exporters of LNG got a reprieve after the commodity was excluded from the carbon tax in the EU. Since 2017, US LNG export to the EU has increased tenfold, hitting 26 Bcf in 2020.

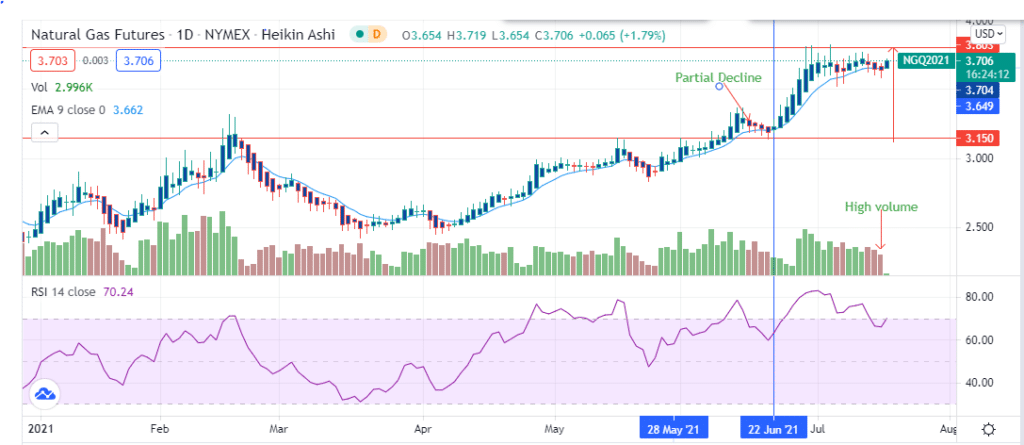

Technical analysis

The NYMEX natural gas futures indicate a potential upside after the partial decline on June 22, 2021.

At 3.706, the futures were higher than the 9-day EMA, further supporting the uptrend. A direct push above 3.803 may propel the NYMEX futures above 4.000. The 14-day RSI shows that the price is staying in the overbought zone at 70.24. If a price reversal occurs, the likely target of the decline is the support zone at 3.150.