- US dollar firms near one-year highs.

- USDJPY rises to seven-month highs on dollar’s strength.

- NZDUSD under pressure at one-month lows.

- Oil prices pressured amid concerns over supplies buildup.

- US equity benchmarks stabilize after coming under pressure.

- Bitcoin and Ethereum bottom out, eye further gains.

The US dollar was down Thursday morning but still near one-year highs after seeing renewed bids over growing concerns that the Federal Reserve could start tapering in a period of slowing economic growth. Additionally, traders flocked the safe-haven to hedge against the persistently high inflation.

The dollar index, which measures the greenback strength against a basket of other major currencies, has already risen to ten-month highs affirming the buck strength across the board. The index hitting highs of 94.43 continue to pile pressure on the major currencies.

USDJPY rally continues

The Japanese yen is one of the hardest hits amid the greenback strength. The USDJPY pair has since risen to seven-month highs. The pair continues to grind higher as it closes in on the 112.00 level. At just 111.91, the pair looks set to take out the crucial psychological level.

On the flip side, support on any pullback is seen at the 111.60 level, below which USDJPY could retrace to the 111.17 level. The bullish bias on the greenback means the pair could continue to grind higher. Investors are increasingly betting on US treasury yields, pushing the ten-year yield to three-month highs and the dollar higher against the yen.

The yen also remains under pressure from Bank of Japan Governor Haruhiko Kuroda, warning that weak consumption and lower inflation pose a significant danger to Japan’s economic growth.

NZDUSD pressured at 1-month lows

Meanwhile, NZDUSD remains pressured while trying to bounce back after plunging to one-month lows on dollar strength. A slide to the 0.6870 level leaves the pair susceptible to further sell-offs to the 0.6810 level.

On the other hand, bulls will have to steer the pair above the 0.6900 handle to have any chance of regaining control from bears that remain in control. The New Zealand dollar remains pressured on mixed economic data out of China raising concerns about global economic recovery.

The latest data shows that China’s NBS PMI for August slid below the 50 for the first time since February of last year. The Caixin PMI, on the other hand, rose to 49.5 but remained below the 50 level. Mixed concerns over the spike in COVID numbers in Auckland, New Zealand also continue to pile pressure on the NZD against the dollar.

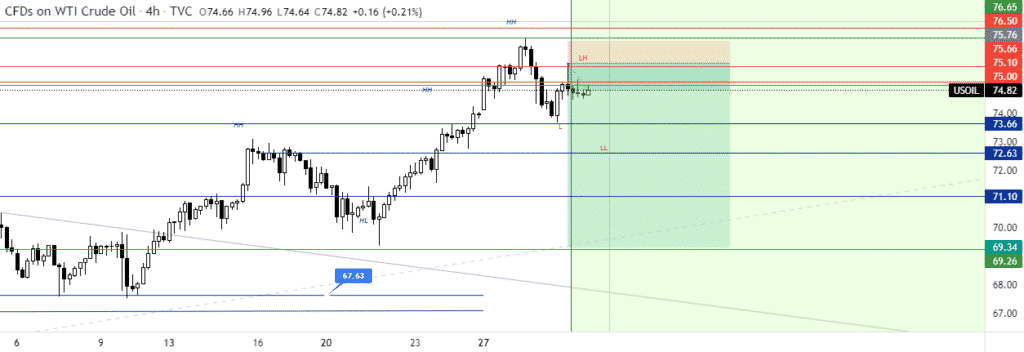

Oil prices under pressure

In the commodity markets, oil prices remain pressured at two-month highs as official US data confirmed a buildup in crude supplies. Data released by the EIA indicates a buildup of 4.578 million barrels a week against a predicted draw of 1.652 barrels for the week ended September 24. The buildup comes after production in the Gulf of Mexico returned, with output rising to 11.1 million arrears per day last week.

Brent crude futures slid 0.18% on Thursday as WTI Futures fell 0.03%. The pullback comes at the backdrop of two days of price losses in the oil markets. Despite the pullbacks, oil price remains at a touching distance to the elusive $80 a barrel level.

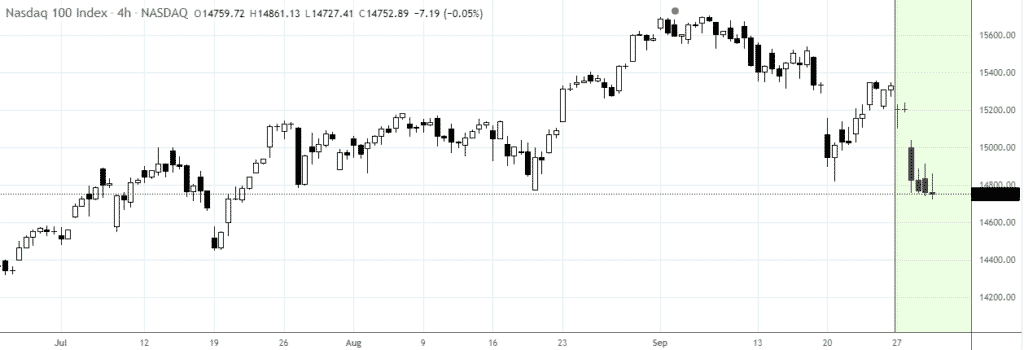

US indices stabilize

In the stock market, stock futures edged higher on Thursday morning ahead of the final session of September and the third quarter. Major equity benchmarks have come under immense pressure shedding about 4% from all-time highs.

Tech-heavy NASDAQ finished in the red on Wednesday after sliding 0.2%. The Dow was down 0.3%, and the S&P 500 rose 0.2%. Stocks have underperformed the past month on focus shifting from technology stocks owing to growing concerns that the Federal Reserve will hike interest rates. High technology stocks have also been hit hard by rising treasury yields that have fuelled chatter for tapering and rate hikes.

Bitcoin and Ethereum rally

In the cryptocurrency market, Bitcoin and Ethereum continue to climb the ladder after the recent pullback below key support levels. BTCUSD has since retaken the $43,000 handle powering to the $43,660 level. The next stop could be the $45,000 level.

Ethereum upward momentum is also gathering steam, with the ETHUSD bouncing above the critical $3,000 level. The pair could be headed to the $3,170 area going by the strength of the upward momentum.